- United States

- /

- Consumer Services

- /

- NasdaqGS:LOPE

Assessing Grand Canyon Education (LOPE) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Grand Canyon Education (LOPE) has continued to capture investor attention as shares maintained stability over the past month, following a stretch of double-digit growth seen so far this year. Its recent performance puts a spotlight on long-term value considerations for the education services provider.

See our latest analysis for Grand Canyon Education.

Grand Canyon Education’s share price has cooled off following its earlier gains, sliding nearly 15% over the past month. However, momentum still feels strong when you zoom out. The stock’s year-to-date share price return sits at a solid 14%, with the total shareholder return over the last year reaching an impressive 32% and extending to nearly 120% over five years. This indicates that long-term holders have been well rewarded even as recent volatility refocuses attention on valuation and growth potential.

If you’re weighing your next move, now’s a perfect time to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares now trading well below recent peaks, the question facing investors is clear: is Grand Canyon Education overlooked and undervalued, or is the market simply reflecting all the future growth that is already expected?

Most Popular Narrative: 22.7% Undervalued

Compared to the last close price of $184.86, the most popular narrative assigns a fair value of $239. This suggests a substantial gap between the current price and perceived worth, fueled by upbeat profit and revenue forecasts.

Direct partnerships with over 5,500 employers and the rollout of 20+ new career-aligned programs annually position GCE to capture sustained demand for workforce reskilling and upskilling. This supports ongoing student pipeline growth and forms the basis for durable revenue and operating earnings expansion.

Want to find out what’s driving this valuation? See which growth assumptions, margin moves, and profit projections justify such a strong fair value. The full narrative spells out how bullish forecasts, sector trends, and analyst consensus figures combine to build this case. Dive in to unlock the numbers behind the headline.

Result: Fair Value of $239 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in traditional enrolments and shifting student preferences toward alternative credentials could present challenges to Grand Canyon Education’s long-term growth assumptions.

Find out about the key risks to this Grand Canyon Education narrative.

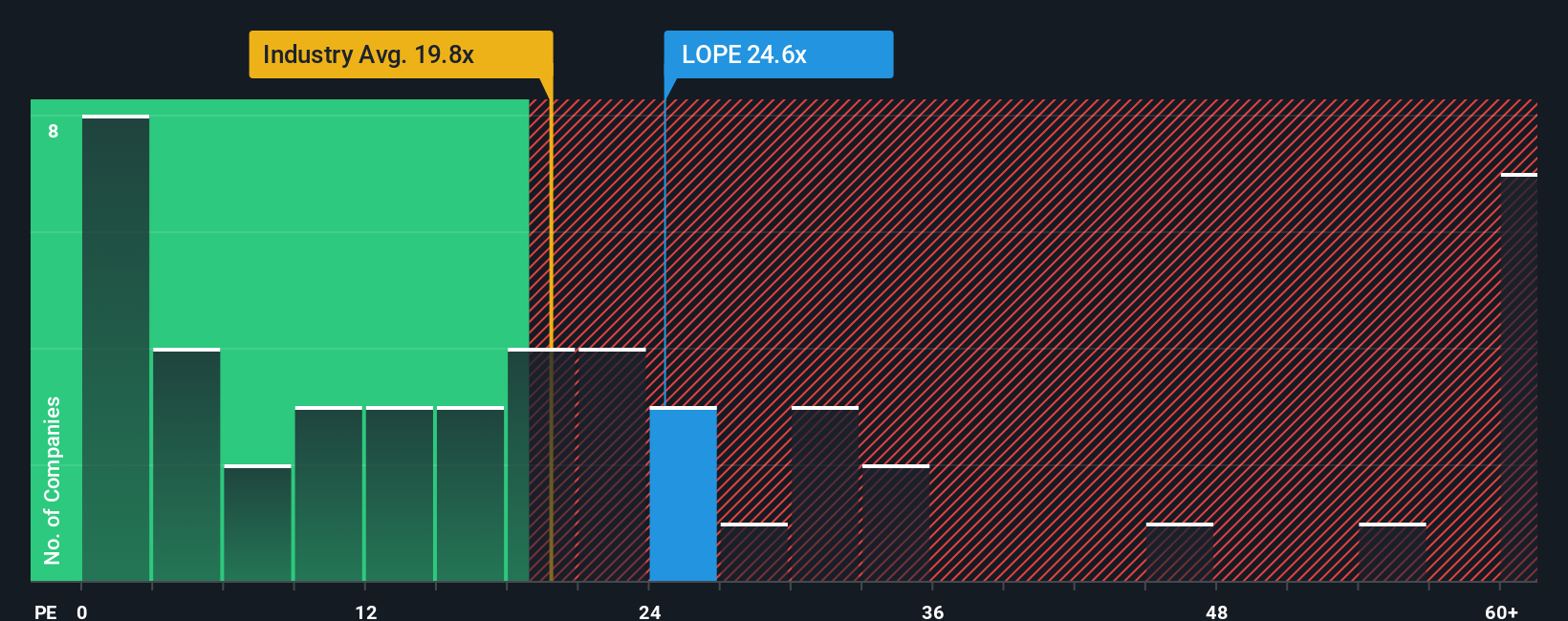

Another View: How Do the Multiples Stack Up?

While the narrative highlights a fair value well above today’s price, looking at valuation ratios tells a different story. Grand Canyon Education trades at a price-to-earnings ratio of 21.7x, higher than both its industry average of 18.4x and a fair ratio of 19.4x. This premium suggests the market is already baking in a lot of optimism, which could mean the margin for upside is slimmer if growth does not meet expectations. Are investors paying up for future growth, or is there genuine untapped value here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grand Canyon Education Narrative

If you have your own perspective or want to dive deeper into the numbers, you can build a complete narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grand Canyon Education.

Looking for more investment ideas?

Don’t let hidden gems slip past you. The smart move is to hand-pick fresh opportunities using the right filters. Use these powerful tools to give yourself an edge before others catch on.

- Start your search for market-beating yields by reviewing these 20 dividend stocks with yields > 3% with strong payout potential and healthy fundamentals.

- Spot exciting companies tackling tomorrow’s biggest challenges by checking out these 33 healthcare AI stocks in the rapidly evolving world of health technology.

- Pursue outsized upside with these 3614 penny stocks with strong financials that stand out for robust financials and serious growth credentials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOPE

Grand Canyon Education

Operates as an education services company in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives