- United States

- /

- Consumer Services

- /

- NasdaqGS:LAUR

While shareholders of Laureate Education (NASDAQ:LAUR) are in the black over 1 year, those who bought a week ago aren't so fortunate

It's easy to feel disappointed if you buy a stock that goes down. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. So while the Laureate Education, Inc. (NASDAQ:LAUR) share price is down 38% in the last year, the total return to shareholders (which includes dividends) was 19%. And that total return actually beats the market decline of 22%. To make matters worse, the returns over three years have also been really disappointing (the share price is 32% lower than three years ago).

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Our analysis indicates that LAUR is potentially undervalued!

Laureate Education wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Laureate Education saw its revenue grow by 10%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 38% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

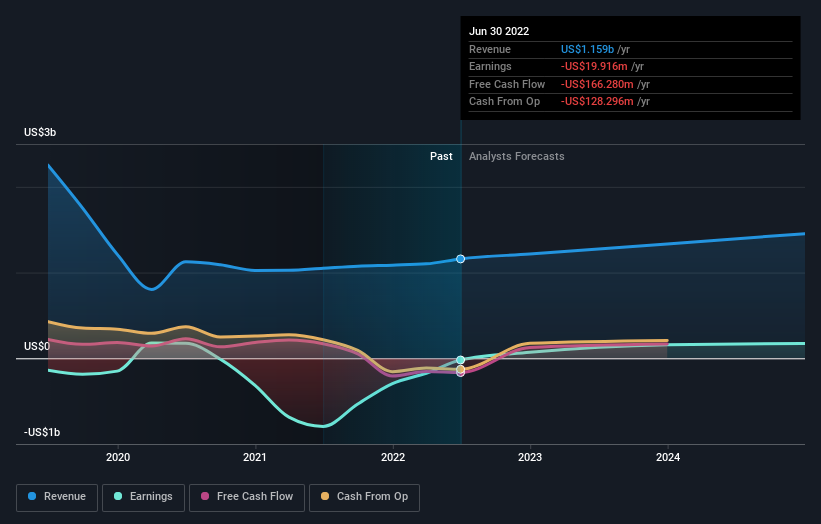

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Laureate Education stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Laureate Education's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Laureate Education hasn't been paying dividends, but its TSR of 19% exceeds its share price return of -38%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Laureate Education shareholders have received a total shareholder return of 19% over one year. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Laureate Education better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Laureate Education .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LAUR

Laureate Education

Offers higher education programs and services to students through a network of universities and higher education institutions.

Very undervalued with outstanding track record.