- United States

- /

- Hospitality

- /

- NasdaqGM:KRUS

Analysts Have Lowered Expectations For Kura Sushi USA, Inc. (NASDAQ:KRUS) After Its Latest Results

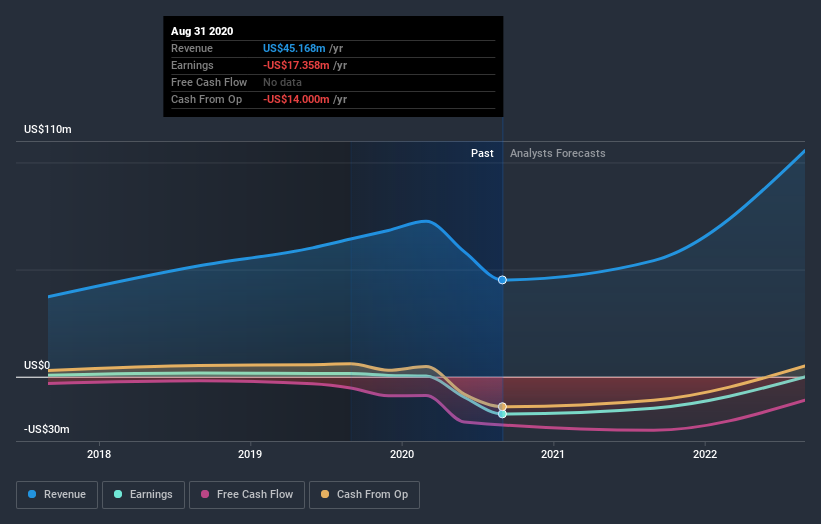

As you might know, Kura Sushi USA, Inc. (NASDAQ:KRUS) last week released its latest yearly, and things did not turn out so great for shareholders. It was a pretty negative result overall, with revenues of US$45m missing analyst predictions by 3.9%. Additionally, the business reported a statutory loss of US$2.08 per share, larger than the analysts had forecast prior to the result. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Kura Sushi USA after the latest results.

View our latest analysis for Kura Sushi USA

Taking into account the latest results, the most recent consensus for Kura Sushi USA from four analysts is for revenues of US$54.2m in 2021 which, if met, would be a solid 20% increase on its sales over the past 12 months. Losses are supposed to decline, shrinking 16% from last year to US$1.76. Before this earnings announcement, the analysts had been modelling revenues of US$72.5m and losses of US$0.65 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The analysts lifted their price target 21% to US$19.60, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Kura Sushi USA analyst has a price target of US$21.00 per share, while the most pessimistic values it at US$17.00. This is a very narrow spread of estimates, implying either that Kura Sushi USA is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Kura Sushi USA's rate of growth is expected to accelerate meaningfully, with the forecast 20% revenue growth noticeably faster than its historical growth of 11%p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 24% next year. Kura Sushi USA is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Kura Sushi USA. Sadly, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the industry itself. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Kura Sushi USA analysts - going out to 2022, and you can see them free on our platform here.

It is also worth noting that we have found 2 warning signs for Kura Sushi USA that you need to take into consideration.

If you’re looking to trade Kura Sushi USA, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kura Sushi USA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:KRUS

Kura Sushi USA

Operates technology-enabled Japanese restaurants in the United States.

Excellent balance sheet with concerning outlook.