- United States

- /

- Hospitality

- /

- NasdaqGS:JACK

Why Jack in the Box (JACK) Is Down 5.1% After Weak Sales and "Jack on Track" Turnaround Plan

Reviewed by Sasha Jovanovic

- Jack in the Box recently reported disappointing fourth quarter results, with revenue falling to US$326.19 million and net income dropping to US$5.8 million, alongside a 7.4% decline in same-store sales amid ongoing operational restructuring and restaurant closures.

- The company unveiled its "Jack on Track" turnaround plan, which includes retraining its workforce, reimaging restaurants, new product launches, and a focus on value-oriented menu items in an effort to regain customer traffic and stabilize sales.

- We’ll explore how this turnaround strategy and sharp drop in same-store sales could alter the company’s longer-term investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Jack in the Box Investment Narrative Recap

To be a shareholder in Jack in the Box today, you need to believe that operational improvements and the "Jack on Track" revitalization plan can reverse recent sales declines and lead to a sustainable turnaround. The latest weak fourth quarter results have put additional pressure on the company's chief short-term catalyst, a return to positive same-store sales growth, while underscoring the significant risk from ongoing pullbacks in core customer spending. The immediate impact of earnings disappointment increases uncertainty around both recovery timing and future sales momentum.

Against this backdrop, Jack in the Box’s decision to suspend its dividend and redirect capital toward financial recovery stands out. This move highlights management’s focus on stabilizing cash flow and signals a willingness to make tough, potentially unpopular changes in support of long-term recovery, even if it removes a traditional incentive for holding the stock during periods of underperformance.

Yet, with consumer demand under pressure and store closures ongoing, investors should be aware that while management is taking action, the risk remains that...

Read the full narrative on Jack in the Box (it's free!)

Jack in the Box's outlook anticipates $1.5 billion in revenue and $104.4 million in earnings by 2028. This assumes a 0.4% annual revenue decline and an increase of $169 million in earnings from the current level of -$64.6 million.

Uncover how Jack in the Box's forecasts yield a $23.06 fair value, a 60% upside to its current price.

Exploring Other Perspectives

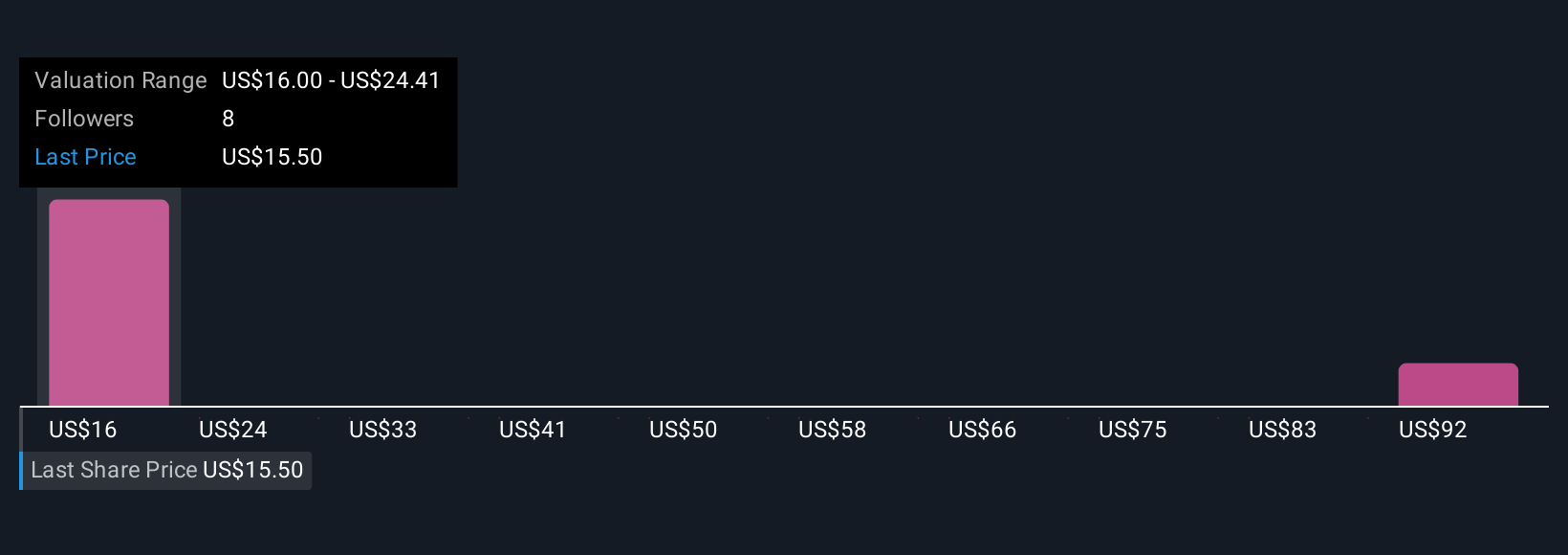

Simply Wall St Community members estimate Jack in the Box’s fair value anywhere from US$16 to as high as US$94.12, based on 3 distinct projections. While these opinions reflect significant disagreement on the company’s outlook, persistent sales declines and shifting customer demand remain central to future performance. Explore the range of views and assess which case resonates with your own expectations.

Explore 3 other fair value estimates on Jack in the Box - why the stock might be worth over 6x more than the current price!

Build Your Own Jack in the Box Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jack in the Box research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jack in the Box research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jack in the Box's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JACK

Jack in the Box

Develops, operates, and franchises quick-service restaurants (QSR) in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives