- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

First Watch (FWRG): Valuation Perspectives Following Strong Earnings Beat and Upgraded Growth Outlook

Reviewed by Simply Wall St

First Watch Restaurant Group (FWRG) reported quarterly results that outpaced Wall Street’s expectations, with a lift in revenue and same-restaurant sales. The company’s new unit growth and higher full-year guidance have caught investor attention.

See our latest analysis for First Watch Restaurant Group.

After a challenging start to the year, First Watch shares have clawed back recent losses. The stock rallied for a 13.6% 30-day share price return as upbeat earnings and higher guidance reignited optimism. Despite the short-term pop, one-year total shareholder return still sits at -18.4%. This suggests that momentum is building, but there is more ground to cover for long-term investors.

If this momentum shift has you scouting for other fast movers, it might be time to broaden your investing lens and discover fast growing stocks with high insider ownership

With shares still trading around 30% below analyst price targets and strong Q3 results fueling renewed optimism, investors now face a key question: is First Watch’s growth story undervalued at these levels, or is future upside already in the price?

Most Popular Narrative: 21.9% Undervalued

First Watch Restaurant Group's most widely followed narrative sets its fair value at $22, notably higher than the recent closing price of $17.19. Expectations for robust long-term growth, driven by expansion and targeted innovation, shape this perspective.

Accelerating unit expansion into new markets, especially in fast-growing Sun Belt and suburban areas, leverages broad demographic shifts and significant untapped real estate opportunities. This positions First Watch for sustained double-digit revenue growth and market share gains. The brand's alignment with increasing consumer demand for health-conscious, fresh, and made-to-order daytime dining, along with continued menu innovation and digital investments such as waitlist automation and nutrition filters, is likely to drive higher in-store traffic, check growth, and strong long-term same-restaurant sales.

Want to know what really propels this valuation higher? The narrative hinges on relentless new restaurant openings and bold earnings projections rarely seen in this sector. Curious which aggressive growth assumptions underpin the target price? Delve deeper to see the remarkable numbers behind the fair value call.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and First Watch’s limited daytime-only service could challenge margin growth and limit the company’s long-term revenue potential.

Find out about the key risks to this First Watch Restaurant Group narrative.

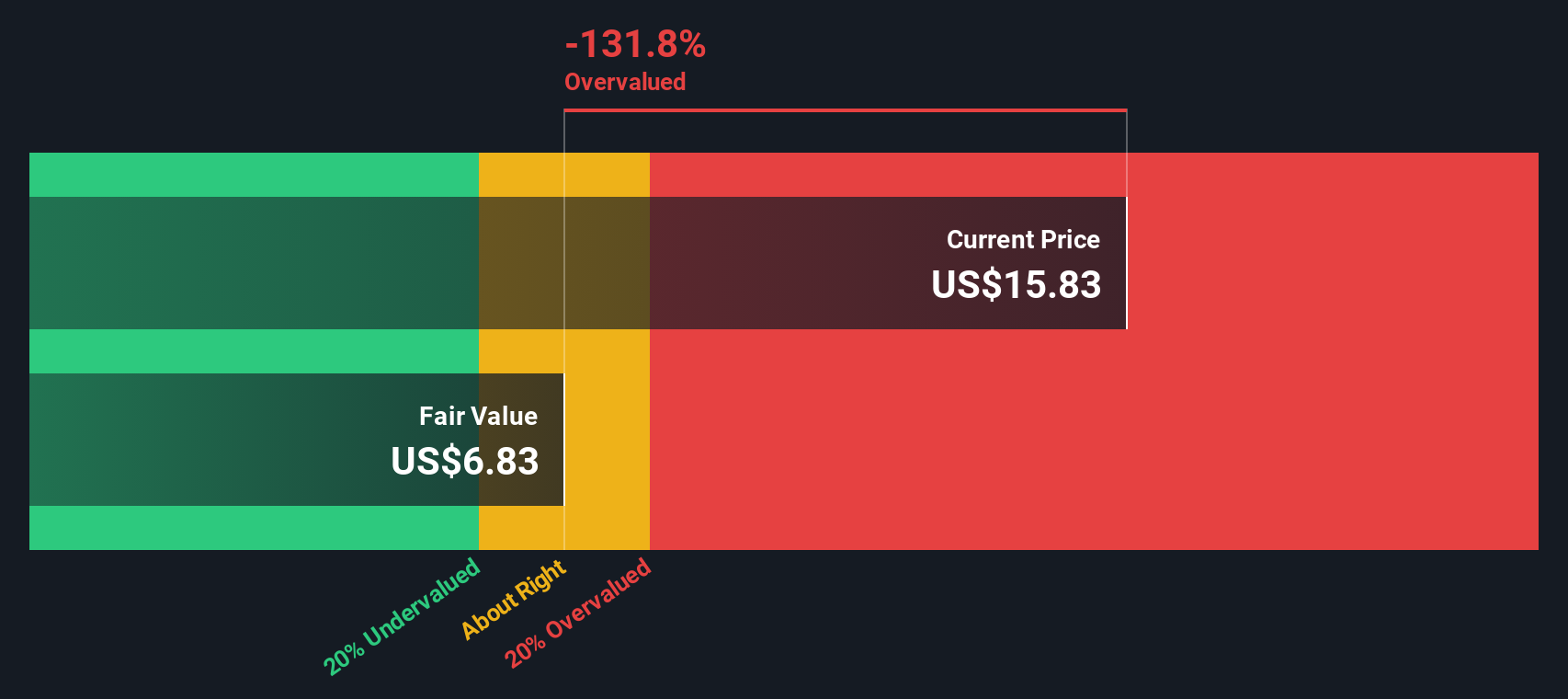

Another View: Discounted Cash Flow Model Raises Caution

While many see value in First Watch based on earnings potential and price targets, our DCF model points to a less optimistic outcome. According to this approach, the current share price actually sits above the SWS DCF estimate of fair value. This sharp difference poses an important question: which measure is leading you closer to the true opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you have your own perspective or want to dive deeper into the numbers, crafting your personal narrative takes just a few minutes. Do it your way

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave smart gains on the table. Turn today’s momentum into tomorrow’s opportunities by checking out these standout stock ideas waiting for you right now:

- Unlock reliable cash flow by targeting income potential with these 16 dividend stocks with yields > 3%, featuring companies with attractive yields exceeding 3% for steady portfolio growth.

- Seize the chance to ride the next innovation wave and spot trends before the crowd by browsing these 876 undervalued stocks based on cash flows, which is based on future cash flow expectations.

- Catalyze your portfolio’s advancement by tapping into rapid breakthroughs in medicine and technology with these 32 healthcare AI stocks stocks that are leading pivotal healthcare AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives