- United States

- /

- Consumer Services

- /

- NasdaqGS:FTDR

Can Frontdoor's (FTDR) Growth and Buybacks Offset Uncertainty from a CFO Transition?

Reviewed by Sasha Jovanovic

- Frontdoor, Inc. recently reported third quarter 2025 earnings, announcing double-digit sales growth to US$618 million and upgraded full-year revenue guidance to a range of US$2.075 billion to US$2.085 billion, alongside a CFO transition as Jason Bailey succeeds Jessica Ross.

- Substantial share repurchases and sustained improvement across both non-warranty HVAC programs and real estate channels contributed to positive momentum, with the outgoing CFO remaining as an advisor through year-end to support a seamless leadership change.

- Let's explore how Frontdoor's upgraded 2025 guidance and robust quarterly results shape its investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Frontdoor Investment Narrative Recap

To be a shareholder in Frontdoor, you need confidence in the company's ability to drive both organic and diversified growth, especially as non-warranty HVAC and real estate channels gain traction. The recent CFO transition to Jason Bailey, with the outgoing CFO advising through year-end, is not expected to materially disrupt the company’s positive short-term momentum; however, the biggest near-term catalyst remains Frontdoor’s upgraded annual revenue guidance, while the main risk continues to be soft member growth in its core home warranty segment.

Frontdoor’s recent announcement of repurchasing nearly 1.3 million shares for US$80.8 million between July and October reflects ongoing execution of its buyback program. This commitment to returning capital to shareholders is particularly interesting in the context of positive quarterly results, as it underscores management’s confidence while member growth challenges persist.

In contrast, investors should be aware of the potential long-term headwinds if weakness in home warranty member count continues to...

Read the full narrative on Frontdoor (it's free!)

Frontdoor's narrative projects $2.4 billion revenue and $279.0 million earnings by 2028. This requires 7.2% yearly revenue growth and an $22.0 million earnings increase from $257.0 million today.

Uncover how Frontdoor's forecasts yield a $60.25 fair value, a 19% upside to its current price.

Exploring Other Perspectives

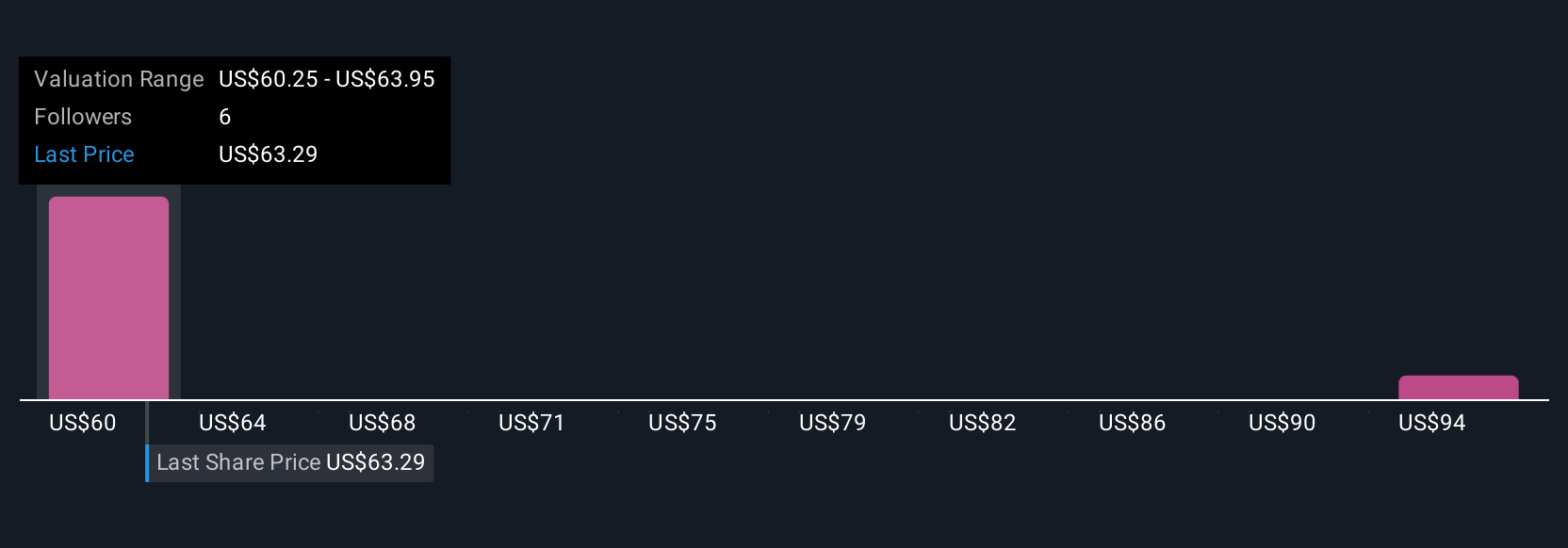

Two Simply Wall St Community contributors estimate a fair value for Frontdoor ranging from US$60.25 to US$94.06 per share. Yet, with ongoing member count softness posing a key risk to recurring revenue, you may want to compare these varied investor opinions and form your own view.

Explore 2 other fair value estimates on Frontdoor - why the stock might be worth just $60.25!

Build Your Own Frontdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Frontdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontdoor's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTDR

Frontdoor

Provides home and new home structural warranties in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives