- United States

- /

- Consumer Services

- /

- NasdaqCM:EJH

Further Upside For E-Home Household Service Holdings Limited (NASDAQ:EJH) Shares Could Introduce Price Risks After 99% Bounce

E-Home Household Service Holdings Limited (NASDAQ:EJH) shareholders are no doubt pleased to see that the share price has bounced 99% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 92% share price decline over the last year.

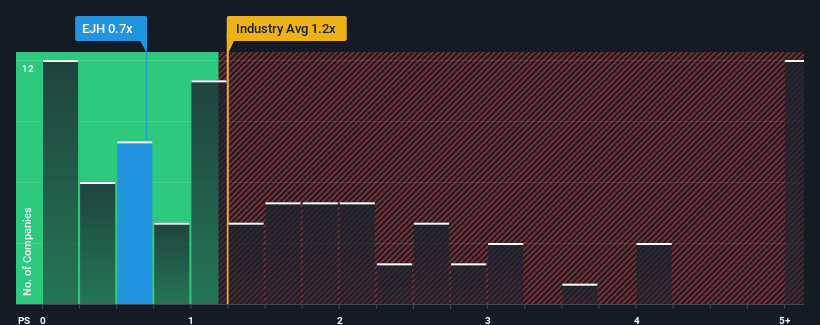

Even after such a large jump in price, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider E-Home Household Service Holdings as an attractive investment with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for E-Home Household Service Holdings

What Does E-Home Household Service Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for E-Home Household Service Holdings, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on E-Home Household Service Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

E-Home Household Service Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 16% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that E-Home Household Service Holdings' P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does E-Home Household Service Holdings' P/S Mean For Investors?

The latest share price surge wasn't enough to lift E-Home Household Service Holdings' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of E-Home Household Service Holdings revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

Before you take the next step, you should know about the 4 warning signs for E-Home Household Service Holdings (3 are a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if E-Home Household Service Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EJH

E-Home Household Service Holdings

Engages in the operation of household services in the People’s Republic of China.

Flawless balance sheet slight.

Market Insights

Community Narratives