- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Is Duolingo Worth a Second Look After a 3.7% Dip This Week?

Reviewed by Bailey Pemberton

If you’re eyeing Duolingo and wondering whether it’s time to jump in, hold steady for a minute. There’s definitely more to the story than just a glance at the latest ticker. While the past year handed shareholders a 7.0% gain, much of the action has been in the long-term, with a staggering 275.2% run over three years reminding everyone just how wild the ride can get. Still, recent weeks have delivered a dose of reality: the stock slid 3.7% this past week, even as it managed a modest 3.6% gain over the last month.

Beneath those numbers is a swirl of news that’s shaping investors’ thinking. Duolingo’s steady pace of rolling out new features and its continued expansion into new learning segments has drawn headlines, fueling conversations about how sticky and scalable its user base might be. Each of these moves nudges market perceptions, either boosting optimism about future growth or triggering debates on the risk side, depending on which angle you favor. For those tracking Duolingo’s value score, a quick, numerical gauge of undervaluation across six key tests, the company picks up a 2 out of 6. So, while not screamingly undervalued, there are pockets where the stock may be hiding value.

Ready to dig deeper? In the next sections, we’ll break down how Duolingo stacks up across the major valuation tools. And stick with us, because at the end, we’ll uncover an even smarter way to assess what the market might be missing.

Duolingo scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Duolingo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand what Duolingo could be worth based on how much cash it is expected to generate in the years ahead.

Currently, Duolingo produces $315 million in free cash flow (FCF), providing a solid foundation as the business scales. Analyst estimates foresee strong FCF expansion, with projections reaching about $640 million by 2027. Looking further ahead, extrapolations suggest FCF could climb even higher over the next decade as Duolingo continues its growth trajectory in new markets and segments.

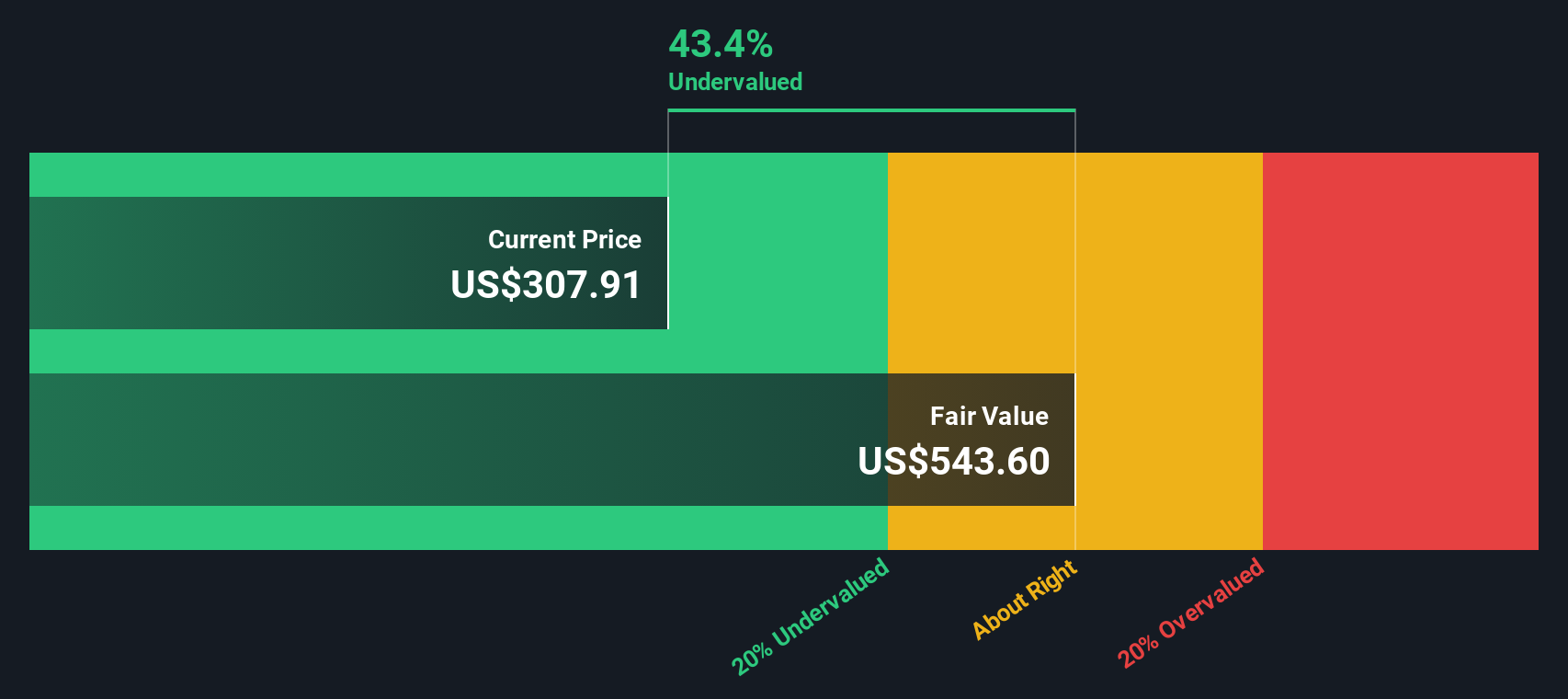

According to this DCF model, Duolingo's intrinsic value stands at $478 per share. With the market currently valuing the company at a 34.8% discount to this estimate, the stock appears significantly undervalued based on long-term cash generation prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Duolingo is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Duolingo Price vs Earnings

For companies like Duolingo that have become profitable, the price-to-earnings (PE) ratio is one of the most widely used methods for assessing valuation. This metric gives investors a quick sense of how much they are paying for each dollar of the company’s earnings. However, what counts as a “fair” PE ratio depends on growth prospects and business risks. A higher growth company often commands a higher multiple, while higher risks tend to drag the number lower.

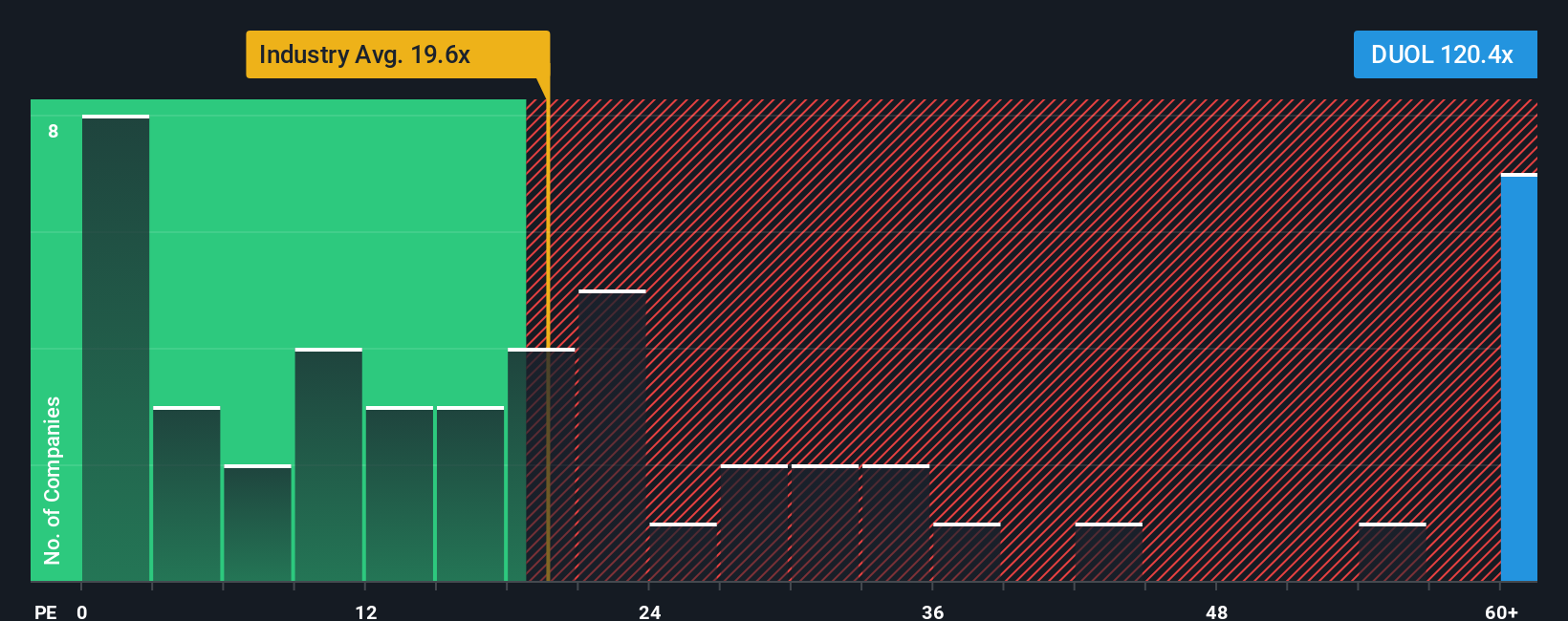

Duolingo trades at a current PE ratio of 122.0x, which is far above the Consumer Services industry average of 19.3x and its peer group average of 38.6x. This suggests that, at face value, the stock is priced at a significant premium to both its sector and comparable companies.

To get a more nuanced view, Simply Wall St’s Fair Ratio comes into play. Unlike a basic peer or industry comparison, this proprietary metric weighs Duolingo’s unique growth rate, profit margins, market cap, and risks and yields a Fair Ratio of 38.6x. This holistic measure takes into account why the company may deserve a higher (or lower) multiple given its specific strengths and challenges, rather than relying purely on the averages.

Since Duolingo’s actual PE ratio is 122.0x and the Fair Ratio is 38.6x, the current valuation looks significantly stretched by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duolingo Narrative

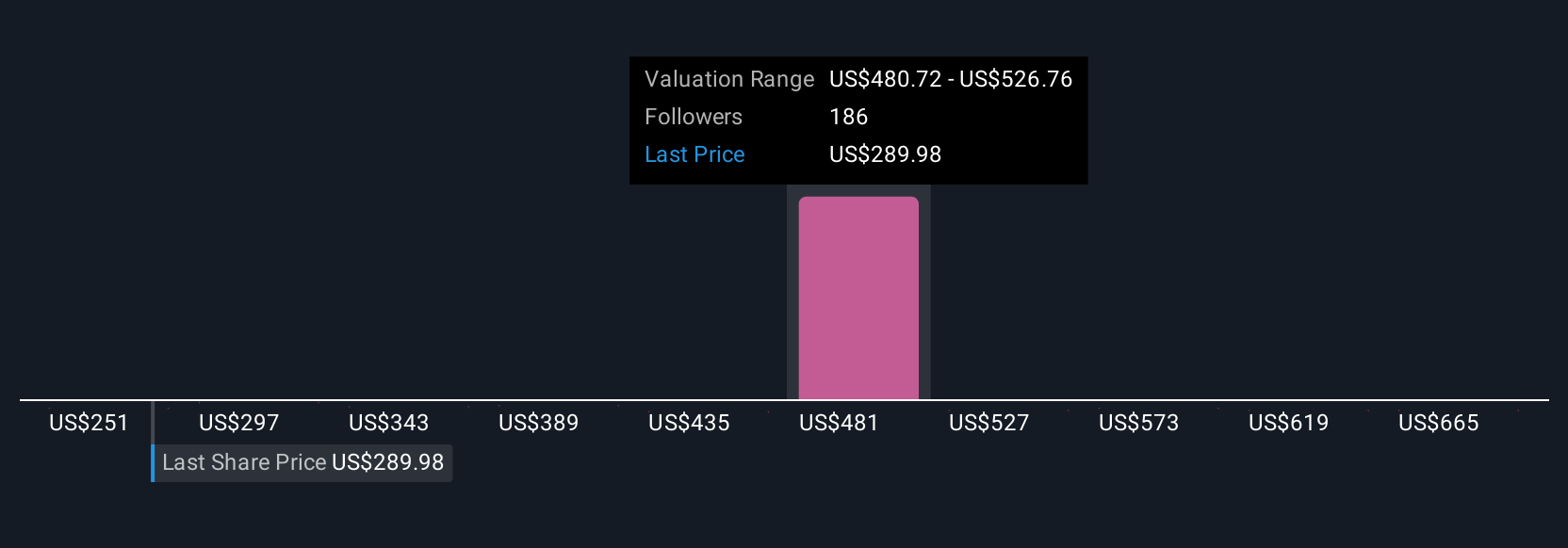

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story and reasoning about a company’s future, allowing you to link your expectations for Duolingo’s revenue, earnings, and margins to a fair value. Instead of relying solely on static numbers, Narratives let you spell out “why” behind your estimate, connecting the dots between business developments and their impact on value.

This approach is easy and accessible. Millions of investors use Narratives daily on Simply Wall St’s Community page. By crafting or following a Narrative, you can compare your fair value (derived from your assumptions) with the current market price, helping you decide whether to buy, hold, or sell based on your personal beliefs. Narratives automatically update in real time as new news, earnings, or analyst forecasts come in, so your investment story stays fresh and relevant.

For Duolingo, some investors are highly bullish, expecting international expansion, new learning categories, and AI-driven monetization to justify a fair value above $600 per share. Others see competitive risks and slowing user growth, putting fair value closer to $239. Narratives let you take control and choose the story, data, and valuation that make sense to you.

Do you think there's more to the story for Duolingo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives