- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

DraftKings (DKNG): Valuation in Focus Following Analyst Downgrades and Regulatory Risk Concerns

Reviewed by Simply Wall St

DraftKings (DKNG) is drawing fresh scrutiny from investors as multiple analyst downgrades highlight issues such as choppy sports outcomes, softer iGaming performance, and the threat of higher state taxes.

See our latest analysis for DraftKings.

The string of analyst downgrades and legal headlines comes as DraftKings shares have struggled, with a 30-day share price return of -15.1% and a year-to-date drop of nearly 23%. Over the last year, total shareholder return has been a disappointing -28%. Investors who stuck with the company over three years still enjoy a healthy 105% gain, which shows that long-term momentum has not entirely faded even as current sentiment wobbles.

If this market reset in online gaming has you watching for leadership shifts, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below recent analyst price targets and major headwinds in focus, the question is whether DraftKings’ current price reflects all the near-term challenges or if a buying opportunity is emerging before growth resumes.

Most Popular Narrative: 44.9% Undervalued

DraftKings last closed at $27.98, yet the most popular narrative values its shares at a hefty premium. This sharp disconnect raises the stakes on what could be fueling the upside case.

Efficiency initiatives, including improved promotional spend, cost discipline, renegotiation of legacy access and tech contracts, and leveraging AI for operational optimization, are expanding gross and EBITDA margins. This supports higher net margins and profitability. DraftKings' proprietary technology, enhanced by the acquisition of Simplebet and in-house developments, is enabling unique betting formats and vertical integration. These factors should support higher gross margins and strengthen competitive positioning, positively impacting long-term earnings and operating leverage.

Curious how tech upgrades and deeper margin focus could be rewriting DraftKings' story? Find out which bold financial projections and an aggressive profit rebound drive this striking valuation. The most critical quantitative leap might not be what you expect. Ready to unpack the full narrative?

Result: Fair Value of $50.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory risks and intensifying competition from prediction markets could quickly challenge the bullish outlook that is currently driving DraftKings' valuation story.

Find out about the key risks to this DraftKings narrative.

Another View: What Do the Ratios Say?

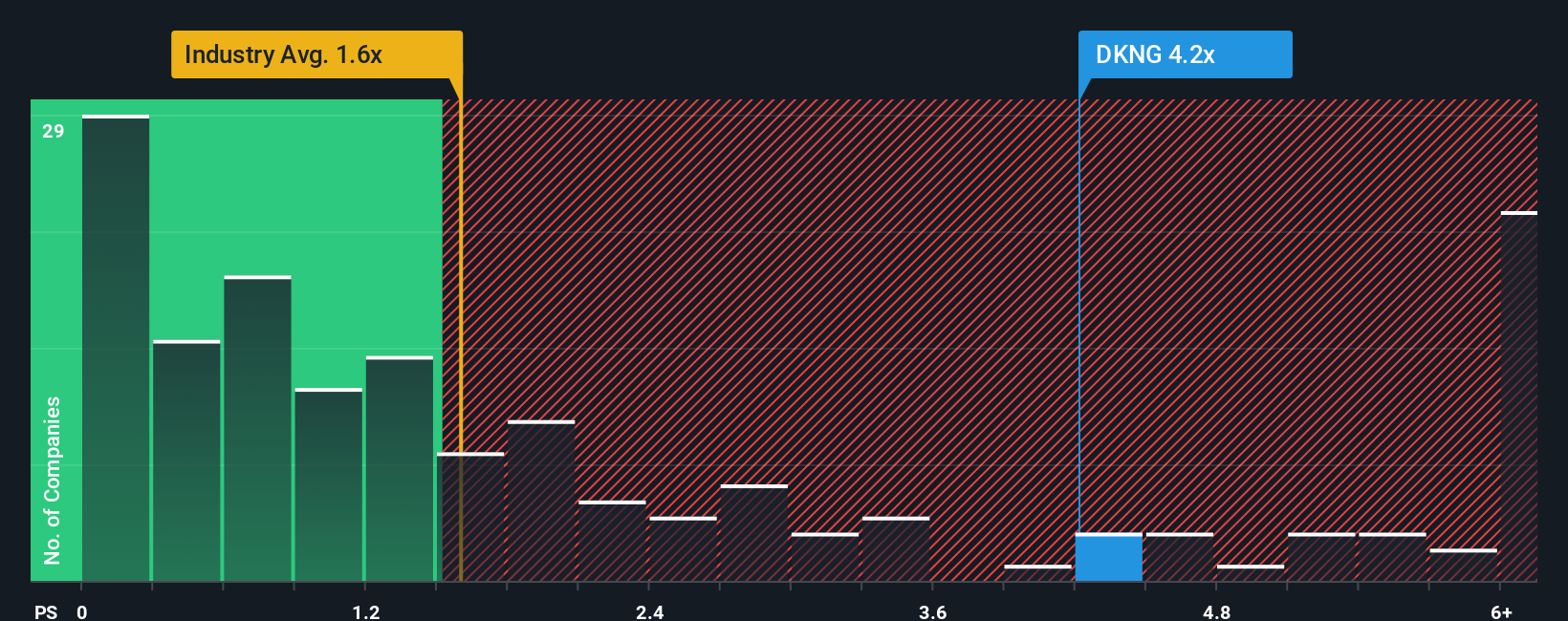

While the narrative-driven fair value points to upside, the current price-to-sales ratio of 2.6x makes DraftKings look expensive compared to the US Hospitality industry average of 1.6x. However, compared to peer averages and our fair ratio of 3.3x, the pricing appears more balanced. Does this gap highlight risk, or is it an opening for contrarian investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DraftKings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft a custom narrative in just a few minutes, your way. Do it your way

A great starting point for your DraftKings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Opportunity?

Smart investors never stop searching for fresh ideas. Widen your horizons and secure your edge by checking out these handpicked opportunities shaping tomorrow’s markets:

- Tap into rapid innovation by scanning these 25 AI penny stocks making real breakthroughs across machine learning and automation before Wall Street catches up.

- Get in early on serious upside with these 3601 penny stocks with strong financials that show strong fundamentals and the potential for game-changing growth.

- Lock in higher returns by targeting income potential among these 18 dividend stocks with yields > 3% that consistently deliver yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives