- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Does the Recent Regulatory Buzz Signal Opportunity for DraftKings in 2025?

Reviewed by Bailey Pemberton

- Wondering if DraftKings is a hidden gem or a speculative bet? You are not alone, and it is time to dig into what the numbers are really saying about its value.

- After a wild ride, DraftKings' stock has climbed 1.4% in the past week but is still down more than 9% this month and over 30% in the past year. These changes hint at big shifts in how investors view its growth and risk.

- Recently, talk of tighter online betting regulations and shifting state-by-state approval processes have dominated headlines. This has put the spotlight squarely on DraftKings and its industry peers. Big fluctuations in regulatory news have influenced recent stock movements, creating both worry and fresh opportunities for the company.

- Right now, DraftKings scores a 3 out of 6 on our undervaluation checks. This gives us a numerical starting point but not the full story. Next, we will compare different approaches to valuing DraftKings. Stay with us until the end to see a smarter way to interpret these numbers with more context than a score alone can provide.

Find out why DraftKings's -30.4% return over the last year is lagging behind its peers.

Approach 1: DraftKings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. It takes into account both near-term forecasts from analysts and longer-term estimates, aiming to reflect the sum of all future cash the business can generate for shareholders.

For DraftKings, the most recent reported Free Cash Flow stands at $513.6 million. Based on both analysts’ predictions and extended projections, the company’s annual Free Cash Flow is expected to grow steadily, reaching an estimated $2.16 billion by 2029. Notably, forecasts for the next five years are rooted in analyst estimates. After that period, further growth is extrapolated using industry models provided by Simply Wall St.

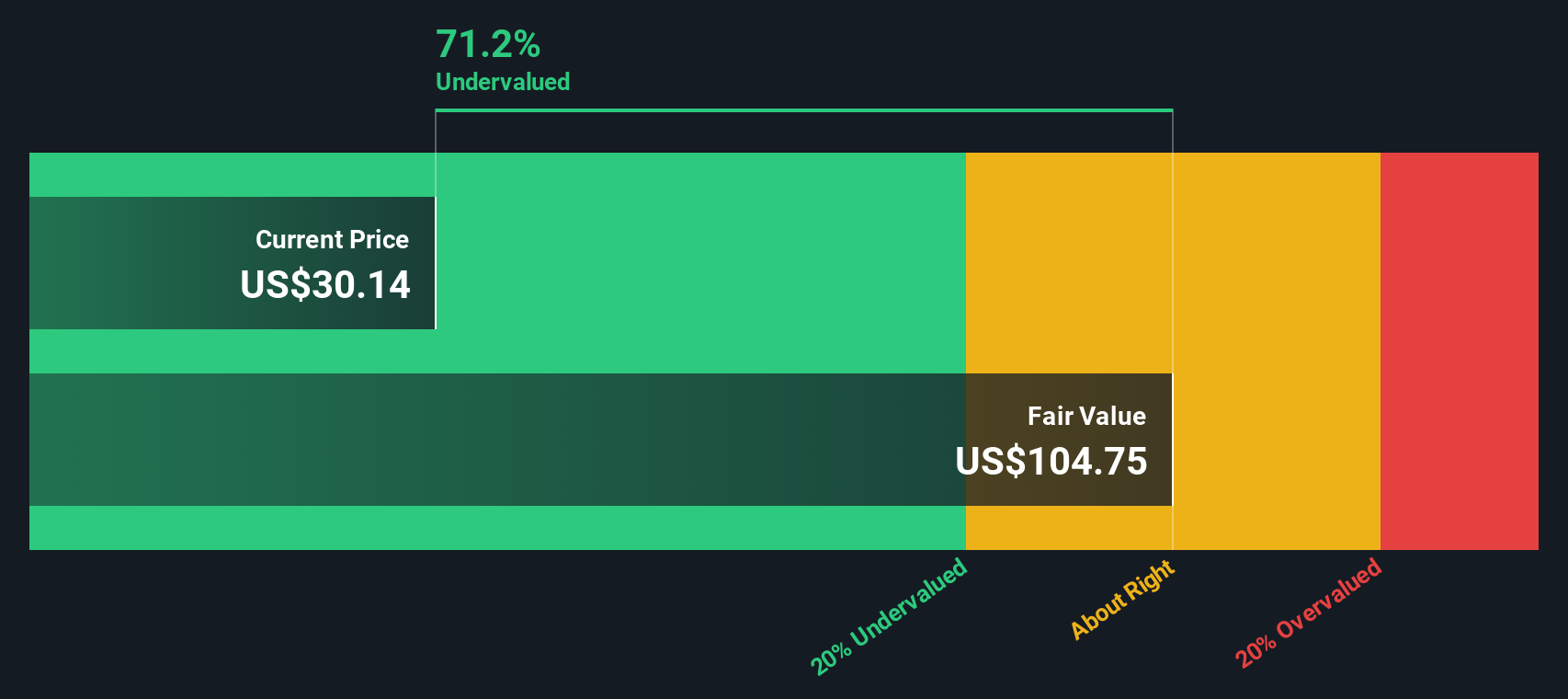

According to the DCF analysis, DraftKings' fair value comes out to approximately $96.19 per share. At current market prices, this suggests the stock is trading at a 68.8% discount to its estimated intrinsic value. This represents a significant margin that points toward undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DraftKings is undervalued by 68.8%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: DraftKings Price vs Sales

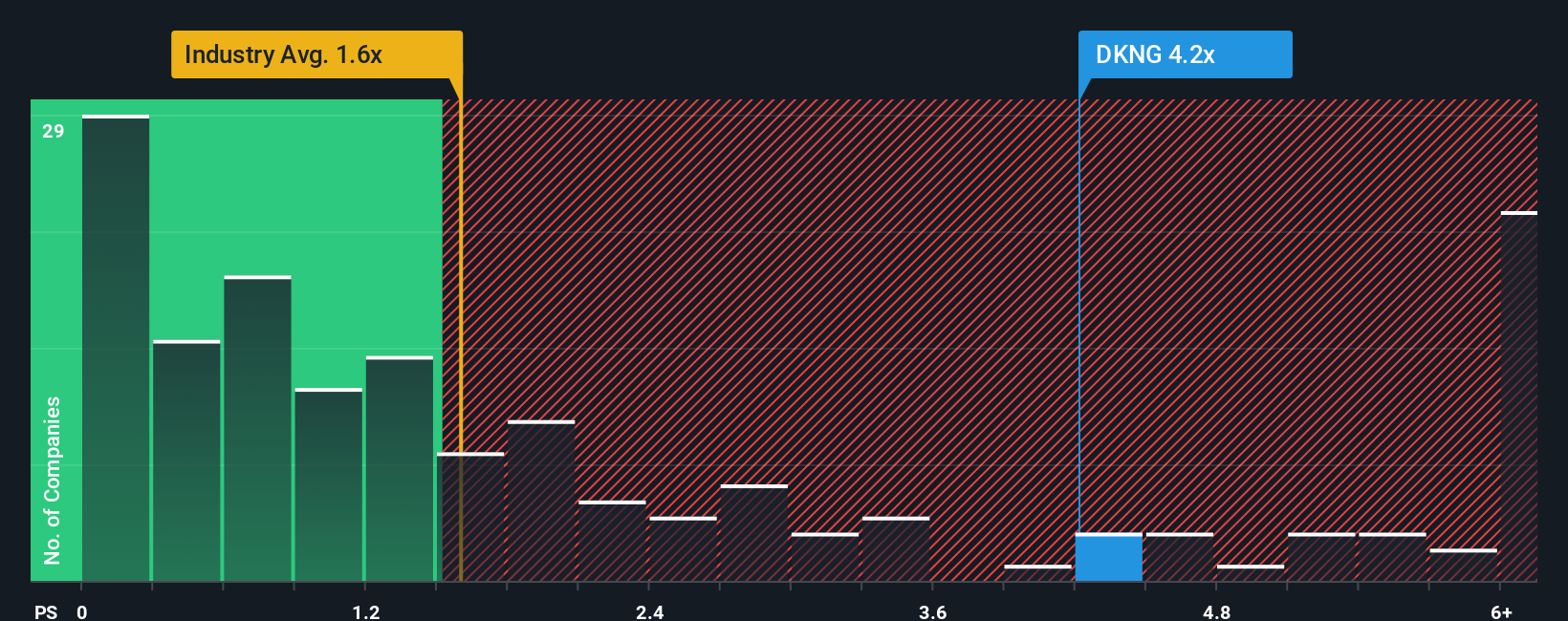

For companies like DraftKings that are not yet profitable but are generating significant revenue growth, the Price-to-Sales (P/S) ratio is often the most useful valuation tool. This metric helps investors understand how much they are paying for each dollar of revenue. It is particularly relevant for fast-growing firms in expansion phases where consistent earnings are not yet in place.

While the industry’s average P/S ratio is 1.6x and DraftKings’ closest peers trade at about 2.1x, DraftKings itself currently trades at 2.7x sales. It is important to remember that “fair” multiples vary depending on growth outlook and risk. Companies with higher growth prospects or lower risk profiles often trade at higher ratios, and vice versa.

Simply Wall St’s “Fair Ratio” calculation goes a step further by factoring in growth expectations, profit margins, market cap, industry trends, and company-specific risks. For DraftKings, the Fair Ratio comes in at 3.6x, higher than both its current P/S ratio and those of peers or the broader industry. This approach offers more tailored insight than a simple industry or peer comparison, allowing investors to weigh the company’s unique strengths and risks.

Since DraftKings’ actual P/S ratio of 2.7x is below its Fair Ratio, the stock appears to be undervalued based on this method.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DraftKings Narrative

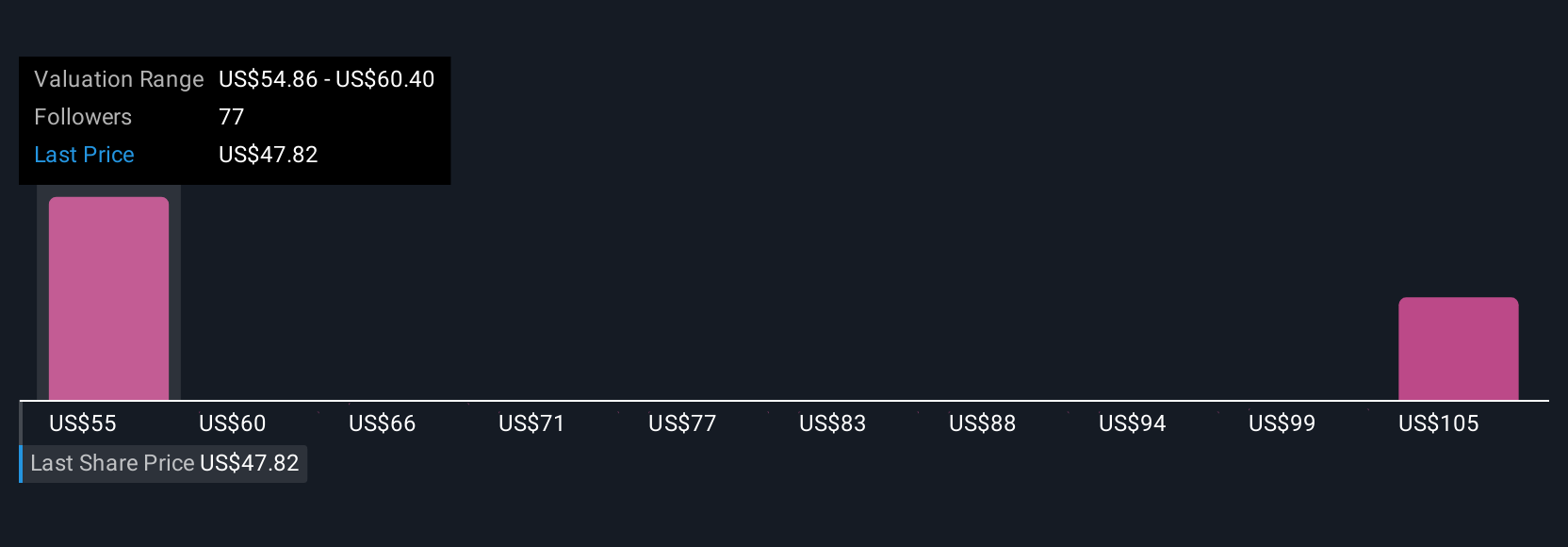

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a user-created story that explains why you believe a company like DraftKings is worth a certain amount, by joining your perspective on its future revenue, earnings, and margins to a fair value. This essentially connects the numbers to a big-picture outlook.

Narratives allow you to easily lay out your own assumptions and forecast what you think will happen, incorporating business shifts, industry events, or emerging risks. Think of it as a dynamic fusion of a company's story and its financial forecast, making valuation both personal and flexible, and available for everyone directly in the Simply Wall St Community.

This tool empowers you to decide when to buy or sell by comparing your Narrative’s fair value to DraftKings’ latest market price, while seamlessly updating your forecast as new earnings, news, or market data arrive. Your view adapts as the facts change.

For example, one DraftKings Narrative might expect bold expansion into new markets will counter competition, calling for a fair value near $78 per share. Another may see greater risk and competitive pressure, favoring a much lower $39.5. This demonstrates in real time how your outlook shapes your investment decision.

Do you think there's more to the story for DraftKings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives