- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Does DraftKings’ Recent 21.5% Drop Signal a Hidden Opportunity in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if DraftKings is a bargain right now, or if you’ve missed your shot? Let’s dig into the numbers and see if there’s real value hiding behind the buzz.

- Despite some rollercoaster moments, DraftKings has dropped 21.5% over the last year and is down even more over the past month. Look closer and you’ll spot a massive 128.0% gain over three years, which signals that growth questions are still on the table.

- Recently, the stock has been moving in response to broader trends in online sports betting and gaming regulation, as states expand legal betting markets and major sports seasons kick off. Headlines around partnerships and market launches have fueled new waves of optimism, even as competition in the space intensifies.

- On our valuation checks, DraftKings scores a 4 out of 6 (see the full breakdown), which suggests it might be undervalued in several key metrics. Let’s review both classic and alternative approaches to valuation, and we’ll wrap up with a perspective you might not expect.

Find out why DraftKings's -21.5% return over the last year is lagging behind its peers.

Approach 1: DraftKings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach is widely used by analysts to get a sense of whether a stock is undervalued or overvalued based on assumptions about growth and profitability.

For DraftKings, the latest reported Free Cash Flow stands at $360 million. Over the next several years, analyst projections and model extrapolations anticipate substantial growth. By 2029, Free Cash Flow is expected to climb to just over $2.5 billion. Extended projections indicate steady increases into the next decade. These cash flows, all denominated in USD, are discounted back to present value using a two-stage model. This incorporates both near-term analyst forecasts and longer-term expectations from Simply Wall St.

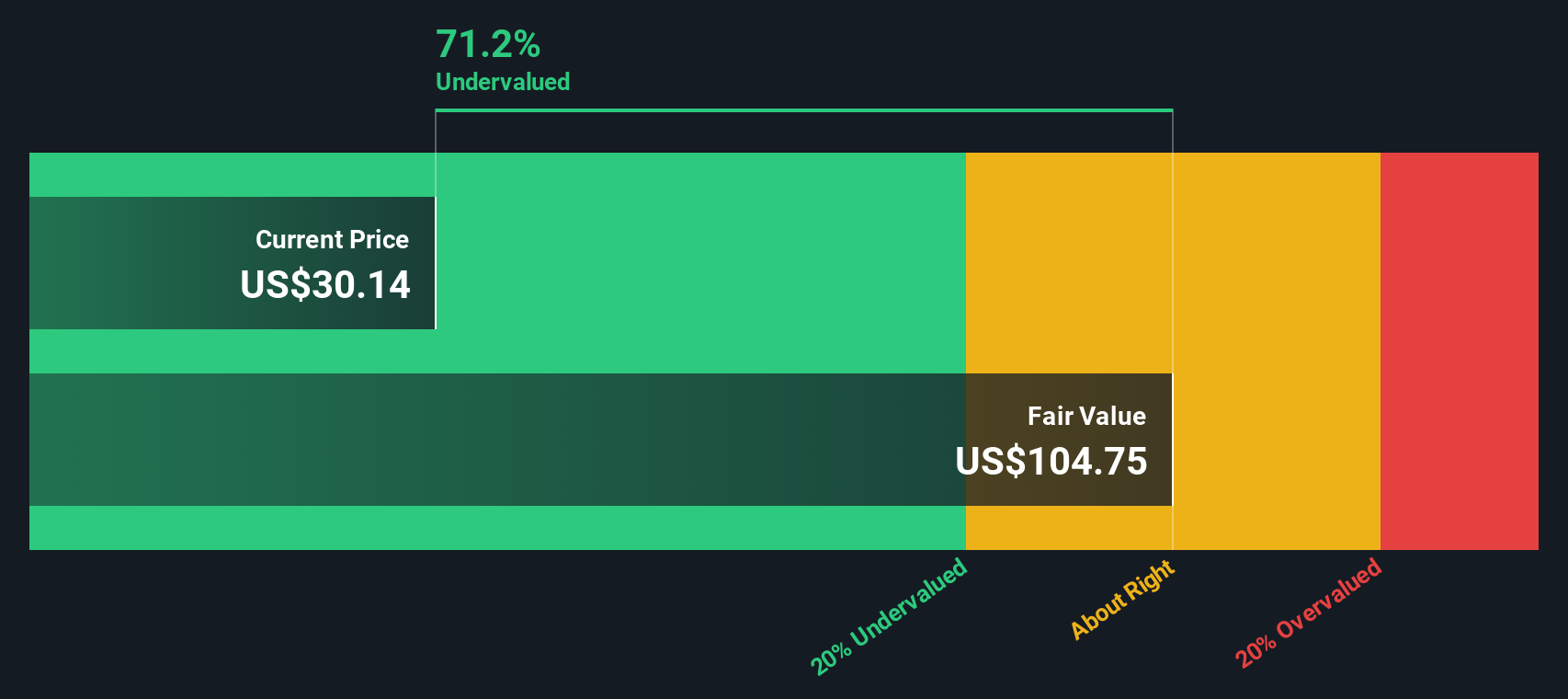

Based on these calculations, DraftKings' estimated fair value is $107.30 per share, which is roughly 73.3% above recent market pricing. According to the DCF model, the market may be significantly undervaluing the cash flow potential built into DraftKings' future prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DraftKings is undervalued by 73.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: DraftKings Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation metric for companies like DraftKings that are scaling rapidly but have yet to reach substantial profitability. It helps investors see how much they are paying for each dollar of revenue, which is particularly useful for businesses reinvesting heavily in growth and still progressing toward consistent profits.

Growth expectations and risk profiles influence what counts as a "normal" or "fair" P/S ratio. Companies expected to deliver above-average revenue growth or operate within expanding markets often justify higher multiples, while those in more mature, slower-growing industries tend to see lower ratios.

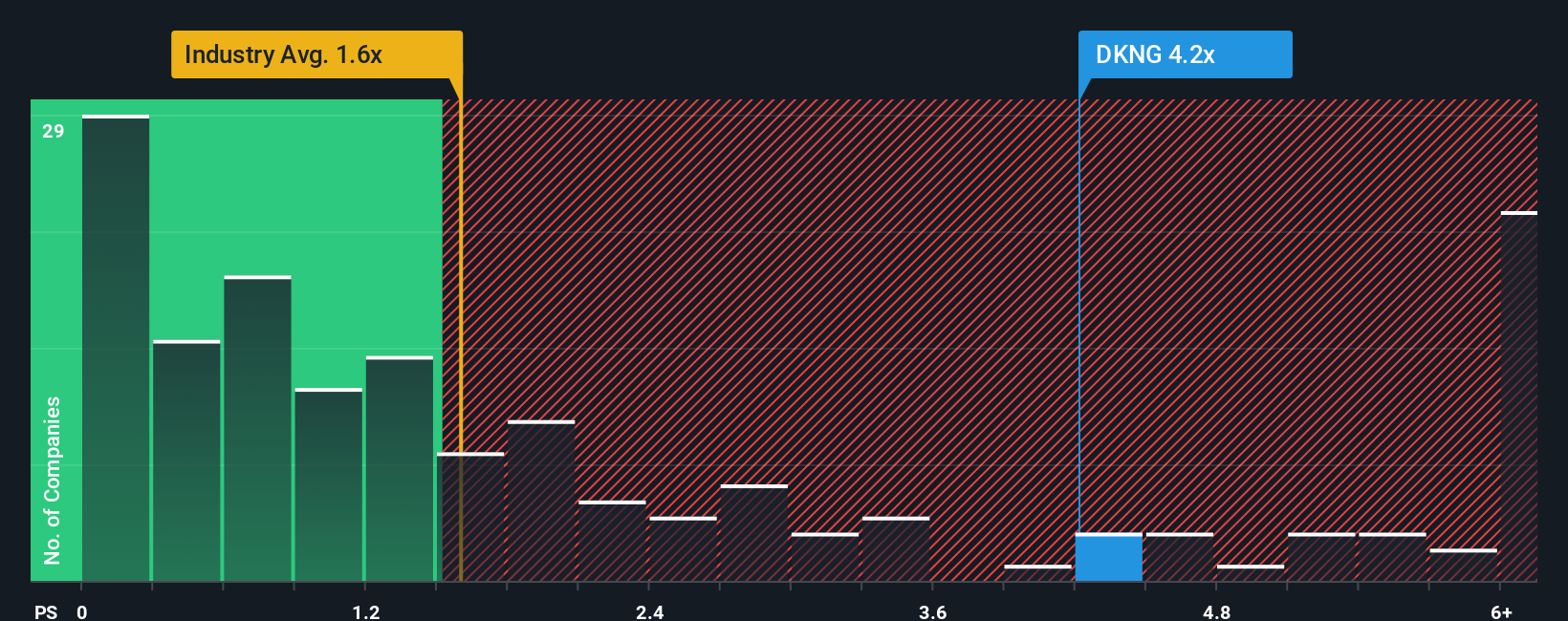

Currently, DraftKings trades at a P/S of 2.63x. This is above the broader hospitality industry average of 1.60x but slightly below the peer group average of 2.82x. Simply Wall St’s proprietary “Fair Ratio” for DraftKings is calculated at 3.42x. This figure reflects the company’s specific risk profile, market cap, fast-growing revenues, and evolving profit margins, providing investors with a more nuanced target than a simple industry or peer comparison.

The Fair Ratio is a more sophisticated benchmark because it combines growth prospects, earnings quality, and risk into a single valuation framework. In DraftKings' case, its actual P/S multiple sits meaningfully below the Fair Ratio, indicating the stock could be undervalued compared to what its business fundamentals might support.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DraftKings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story or perspective an investor has about a company. It is how you believe DraftKings will perform, what you think about its future markets, growth, and profitability, captured in numbers like fair value, revenue, and margins.

Narratives link a company's story directly to a financial forecast, and from there to a fair value, helping you visualize exactly how your view translates into actionable numbers. On Simply Wall St’s Community page, millions of investors easily create and update Narratives, using intuitive tools that incorporate the latest news and earnings automatically, so your view is always current.

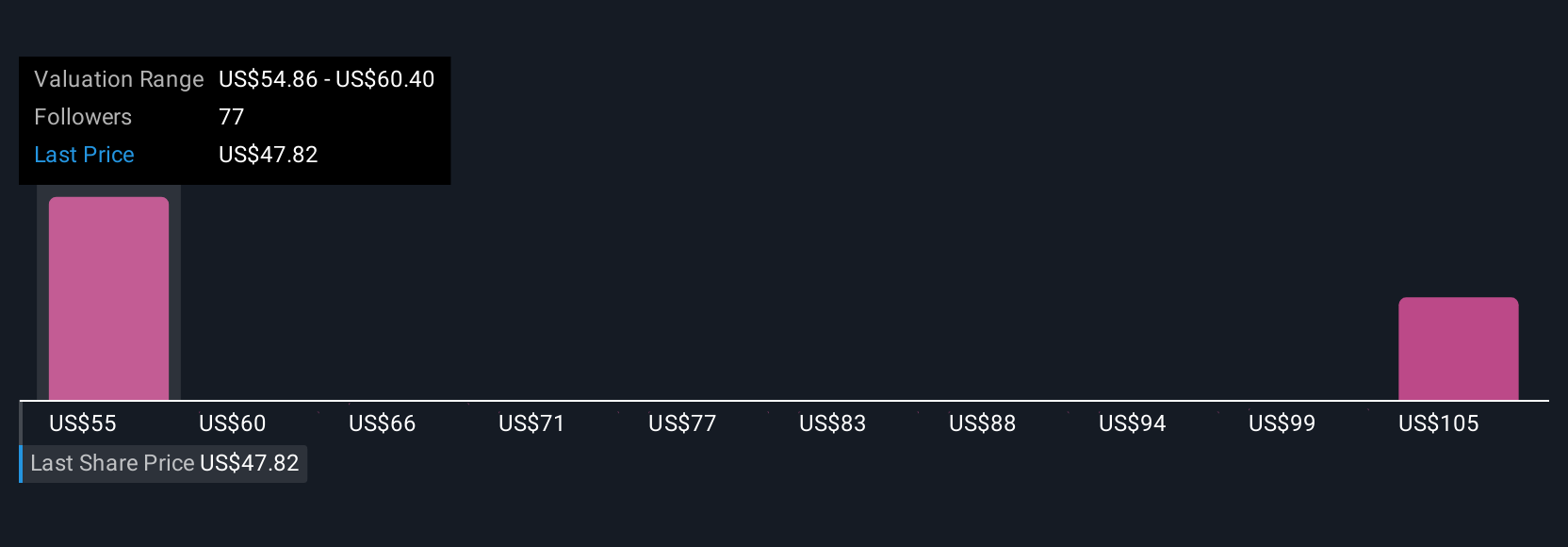

The real power of Narratives is that they enable you to compare your fair value to the current share price, making it far easier to decide when to buy or sell. For example, looking at DraftKings, some investors believe the business is set for massive growth, justifying a bullish Narrative and a fair value as high as $78 per share. Others take a more cautious view, landing on a bearish Narrative closer to $39.50. Narratives put you in control, making your investment process more dynamic, transparent, and personal.

Do you think there's more to the story for DraftKings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives