- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (NasdaqGS:DASH) Expands Ad Capabilities with US$175 Million Symbiosys Acquisition

Reviewed by Simply Wall St

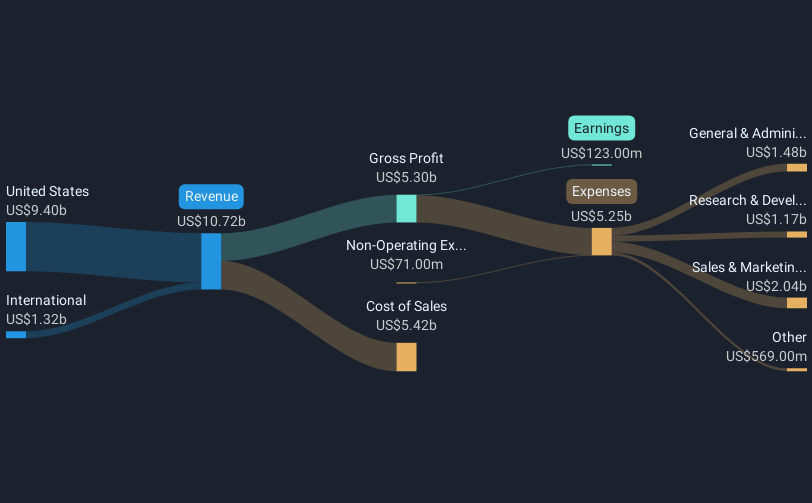

DoorDash (NasdaqGS:DASH) recently announced a significant update to its advertising platform and the acquisition of Symbiosys, enhancing its advertising capabilities. During the last quarter, the company's stock price rose by 22%, coinciding with these developments. Additionally, DoorDash reported strong Q1 2025 earnings, with a notable shift from a net loss to a $193 million profit. While the broader market also experienced gains, the combination of robust financial performance and strategic enhancements in advertising likely added momentum to DoorDash's climb, aligning with the market's broader 11% rise over the past year.

We've spotted 1 possible red flag for DoorDash you should be aware of.

The recent update to DoorDash's advertising platform and its acquisition of Symbiosys may boost the company’s growth trajectory by enhancing its advertising capabilities, potentially increasing revenue streams and profit margins. Over the longer term, DoorDash's stock has soared by 242.35% in the past three years, which provides a strong backdrop against the broader market's 11% one-year rise. This indicates a substantial outperformance relative to both the market and industry, with the US Hospitality industry returning 16% over the past year.

The developments highlighted in the introduction could lead to increased revenue and earnings, supporting forecasts that project a revenue increase to $18.5 billion and earnings of $2.6 billion by 2028. These catalysts may help align the company closer to the consensus analyst price target of US$216.25, especially given the current share price of US$190.11. Such a target is perceived 13.1% higher than today’s stock price, indicating potential upside should these growth initiatives bear fruit while aligning with expected financial performance improvements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives