- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH): Evaluating Valuation After a 11% Share Price Pullback

Reviewed by Simply Wall St

DoorDash (DASH) shares have drifted downward in recent weeks, slipping around 11% over the past month. Investors seem to be weighing valuation after a year of strong gains, even as the company reported double-digit annual revenue and net income growth.

See our latest analysis for DoorDash.

Despite some recent softness, DoorDash’s momentum this past year is hard to ignore. While the share price has pulled back roughly 11% over the past month, its year-to-date share price return remains impressive at nearly 42%. Looking back even further, long-term holders have been rewarded with a 54% total shareholder return over the last year and a remarkable 365% total return over three years. After such a strong run, the current pullback feels more like a breather rather than a reversal of the broader growth story as investors reassess how much future upside is already priced in.

If you’re watching how growth stocks handle shifting sentiment, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether DoorDash’s stock still holds untapped value after such a run, or if the current price fully reflects its future potential. This could mean there is little room for outsized returns from here.

Most Popular Narrative: 20% Undervalued

At $242.05, DoorDash trades well below the fair value estimate of $302.53 set by the most popular narrative. This suggests meaningful upside from current levels if the assumptions hold true. This viewpoint depends on the company's success in capitalizing on ambitious growth catalysts and financial projections through 2028.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This diversification is expected to accelerate topline revenue while supporting net margin expansion.

Want to know the formula behind this bullish price target? The narrative relies on DoorDash driving growth in fresh markets and reshaping its profit base. Which aggressive projections and bold margin estimates make this fair value possible? Find out how future bets and high growth targets power the most optimistic predictions yet.

Result: Fair Value of $302.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs and the challenge of sustaining margin growth amid rapid expansion remain crucial risks that could quickly alter this optimistic outlook.

Find out about the key risks to this DoorDash narrative.

Another View: What Do Multiples Say?

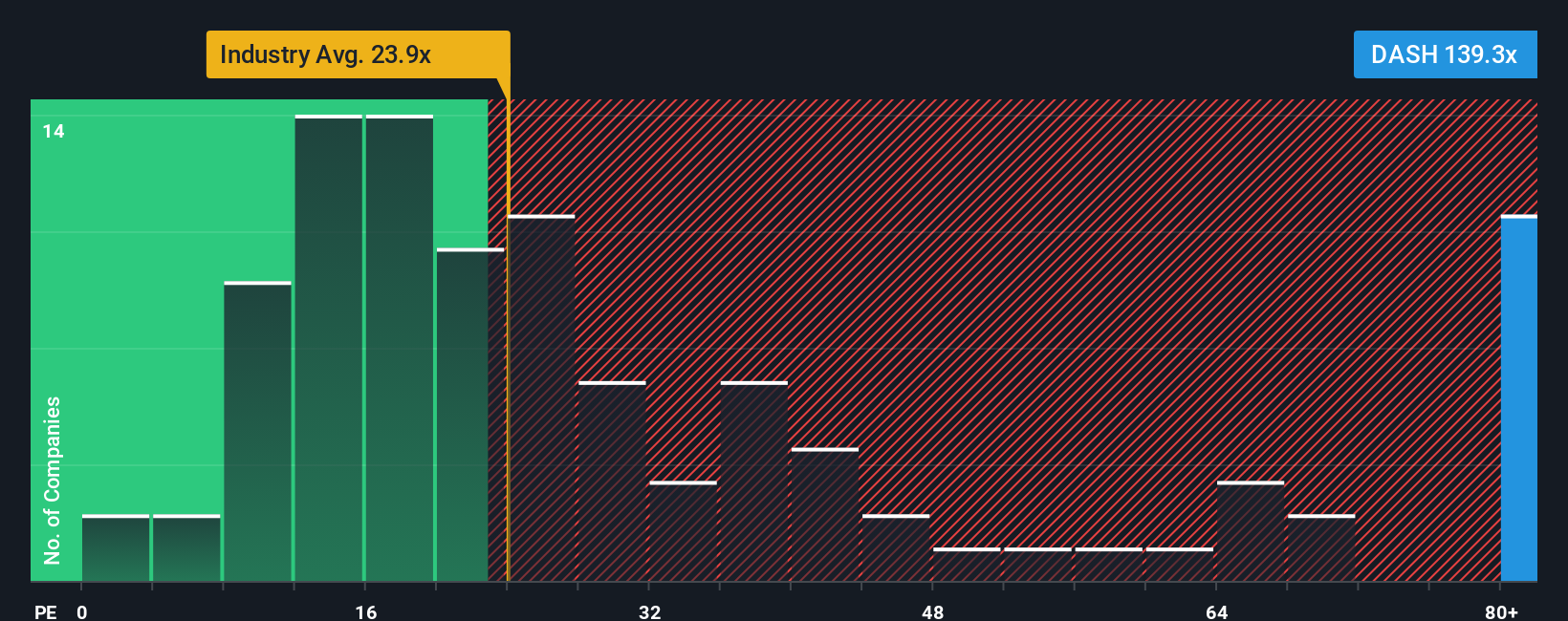

While some see DoorDash as undervalued based on projected growth, its current price-to-earnings ratio is sky-high at 132.4x. This is significantly above the US Hospitality industry average of 23.5x and the peer average of 28.6x. Even the fair ratio for DoorDash sits at just 53.2x, suggesting that valuation risk remains if growth expectations aren’t met. Will the market keep rewarding this premium, or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can shape your own view in just minutes with Do it your way.

A great starting point for your DoorDash research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Great investors never stop at a single story. Make your next smart move and uncover stocks that match your ambition. These screens can help you spot what others might miss, so you don’t let the next winning idea pass you by.

- Accelerate your portfolio’s growth by targeting high-yield opportunities with these 18 dividend stocks with yields > 3%, which offers attractive yields and reliable income potential.

- Ride the wave of technological progress and future possibilities through these 28 quantum computing stocks, where companies are pioneering breakthroughs in computational power and innovation.

- Diversify your strategy by tapping into the massive potential of transformative and unbeatable value found among these 843 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives