- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH): Evaluating Current Valuation Following Recent Share Rally and Growth Momentum

Reviewed by Simply Wall St

DoorDash (DASH) has been making quiet yet interesting moves in the market lately, catching the attention of investors who are keen to understand how recent trends could shape its valuation. In the past year, shares have surged 72%.

See our latest analysis for DoorDash.

DoorDash’s recent run reflects more than just fleeting excitement. After some choppy weeks, the company is back in the spotlight as its 1-year total shareholder return approaches 72%, and its 3-year total return is an eye-catching 505%. Short-term momentum is building, suggesting that investors are revisiting its long-term growth story and showing renewed optimism about profitability.

If DoorDash’s surge has you thinking about where growth might pop up next, it could be worth taking a look at similar trends with fast growing stocks with high insider ownership

With shares rallying and forecasts still looking upbeat, the big question now is whether DoorDash is undervalued at these levels or if the market has already factored in all future gains, leaving little room for upside.

Most Popular Narrative: 12% Undervalued

DoorDash closed at $263.35, while the most widely followed narrative places its fair value at $300.72. This signals that, based on future prospects and risks, analysts see the potential for meaningful share price upside ahead.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This diversification is expected to accelerate topline revenue and support net margin expansion.

Want to uncover what’s fueling this gap between price and value? There’s more than just high revenue growth at work here. The real curveball is the projected shift in profitability and a bold valuation multiple that’s higher than most would expect. Find out how these future assumptions stack up against history and what twists analysts are betting on.

Result: Fair Value of $300.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if DoorDash struggles with operational complexity or faces stronger competition in new markets, which could limit growth and profitability.

Find out about the key risks to this DoorDash narrative.

Another View: What Do Multiples Indicate?

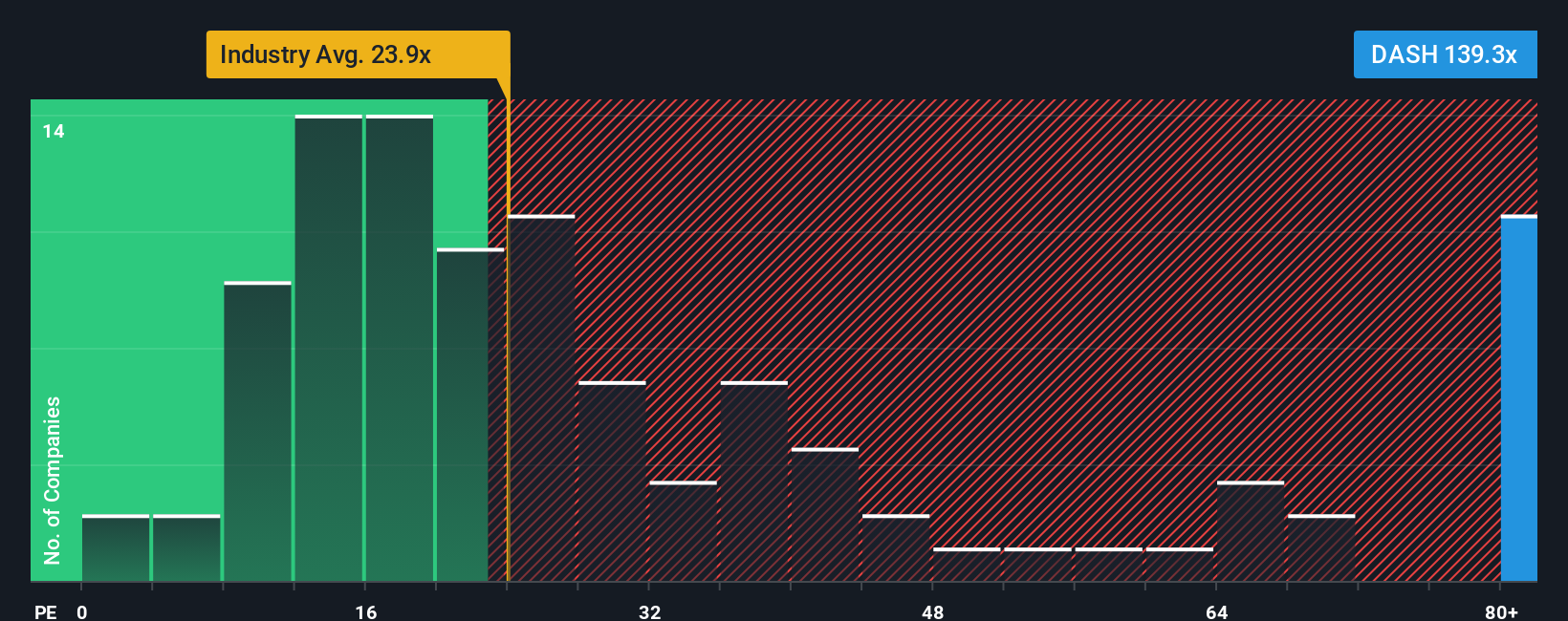

Looking beyond fair value narratives, DoorDash currently trades at a price-to-earnings ratio of 144x. This figure is significantly higher than both the US Hospitality industry average (24.1x) and the peer average (31.9x). The fair ratio sits at 57.9x, suggesting a wide gap that introduces elevated valuation risk if the market shifts toward more reasonable multiples. Is the premium justified, or does it signal future correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

Curious to see things from a different perspective or want to dig into the numbers yourself? You can craft your own narrative in under three minutes: Do it your way

A great starting point for your DoorDash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s momentum pass you by. Tap into hidden opportunities with the Simply Wall Street Screener and stay ahead of the crowd with smart, data-driven strategies.

- Target strong cash flows and undervalued potential by checking out these 870 undervalued stocks based on cash flows. This tool is built for investors seeking solid fundamental value.

- Secure steady income streams by reviewing these 19 dividend stocks with yields > 3%. This resource spotlights stocks with yields over 3% and a track record of rewarding shareholders.

- Get a head start on future tech breakthroughs by exploring opportunities in these 28 quantum computing stocks. Here, quantum computing innovation meets real market growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives