- United States

- /

- Consumer Services

- /

- NasdaqCM:BODI

The Beachbody Company, Inc.'s (NASDAQ:BODI) Price Is Right But Growth Is Lacking After Shares Rocket 46%

The The Beachbody Company, Inc. (NASDAQ:BODI) share price has done very well over the last month, posting an excellent gain of 46%. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

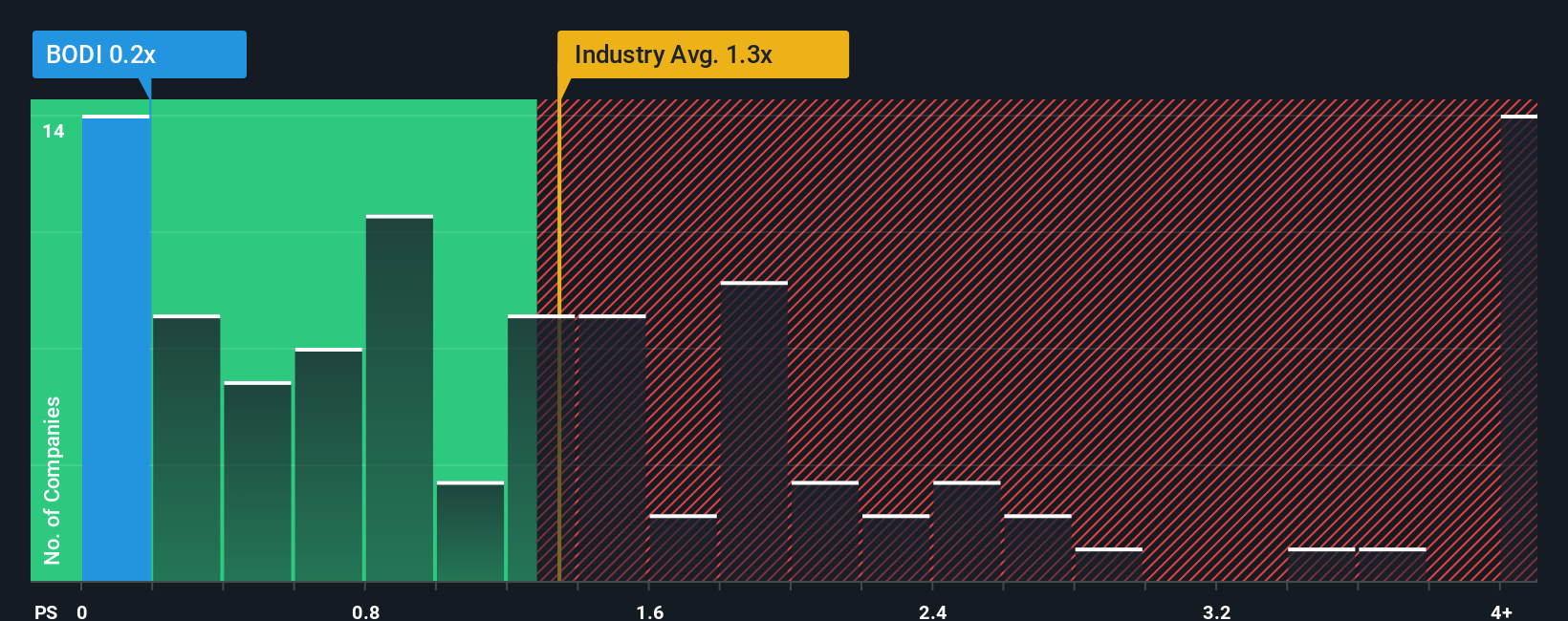

In spite of the firm bounce in price, when close to half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Beachbody Company as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Beachbody Company

How Has Beachbody Company Performed Recently?

While the industry has experienced revenue growth lately, Beachbody Company's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Beachbody Company's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beachbody Company's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's top line. As a result, revenue from three years ago have also fallen 63% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 16% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 10%.

With this information, we are not surprised that Beachbody Company is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Beachbody Company's P/S

The latest share price surge wasn't enough to lift Beachbody Company's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Beachbody Company maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Beachbody Company you should know about.

If you're unsure about the strength of Beachbody Company's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beachbody Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BODI

Beachbody Company

Operates as a fitness and nutrition company in the United States, Canada, the United Kingdom, and France.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives