- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Is Booking Holdings Still a Bargain After Recent Stock Dip and Strong 5-Year Growth?

Reviewed by Bailey Pemberton

- Wondering if Booking Holdings is a bargain or a splurge? You are not alone, especially with so many investors hunting for value in a high-flying sector.

- Although the stock dipped 2.7% over the past week and is down 4.9% for the month, Booking Holdings is still up 148.6% over the last 3 years and 144.1% across 5 years, hinting at long-term growth potential.

- Several analysts and outlets have recently spotlighted the company's ongoing global expansion and increasing travel demand, which may be helping to explain recent price swings. Regulatory developments and industry shifts in online booking trends are also shaping investor sentiment in real time.

- When it comes to valuation, Booking Holdings scores a solid 4 out of 6 across our standard undervaluation checks, but there is more nuance to uncover. Stick around as we break down the usual valuation methods and reveal an approach that makes sense of all the moving parts, especially for investors looking for an edge.

Approach 1: Booking Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is widely used to estimate a company’s intrinsic value by projecting future free cash flows and discounting them back to today’s dollars. Essentially, it helps investors answer the question, “What is this company truly worth, based on what it can earn in the future?”

For Booking Holdings, the DCF is based on a 2 Stage Free Cash Flow to Equity model. The company’s latest trailing twelve-month free cash flow stands at $8.23 billion, and analysts project continued growth over the coming decade. Projections show free cash flow reaching $13.38 billion by 2029, while Simply Wall St’s extrapolations suggest a steady climb into the $14 to $17 billion range by 2035. All cash flow estimates are measured in USD.

Based on these inputs, the model calculates an intrinsic fair value of $7,637 per share. With the DCF model indicating the stock trades at a 35.3% discount compared to this intrinsic value, Booking Holdings currently appears significantly undervalued by the market based on its cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booking Holdings is undervalued by 35.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Booking Holdings Price vs Earnings

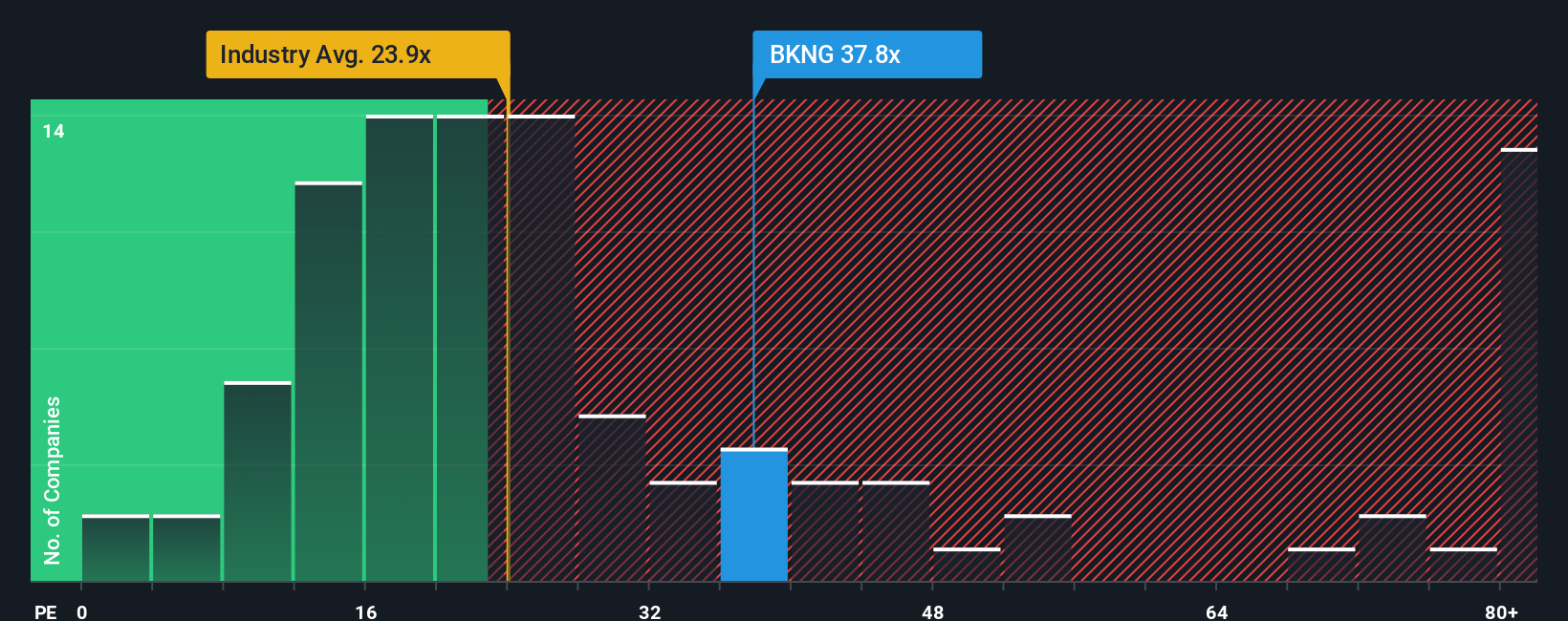

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Booking Holdings, because it puts the current share price in the context of how much profit the business actually generates. A higher PE ratio often suggests investors expect faster growth and are willing to pay a premium, but it can also reflect perceptions of lower risk or higher quality earnings.

"Normal" or fair PE ratios are heavily influenced by expectations around how quickly a company can grow its earnings in the future, as well as the level of risk compared to sector peers. Companies with dependable profits and robust growth prospects typically command higher PE ratios, while firms facing uncertainty or stagnating earnings tend to trade at lower levels.

As of now, Booking Holdings trades at a PE of 31.57x. This is noticeably above the Hospitality industry average of 21.85x and just above the peer group average of 28.28x. While these benchmarks offer useful context, they do not fully account for the specific strengths and risks tied to Booking Holdings.

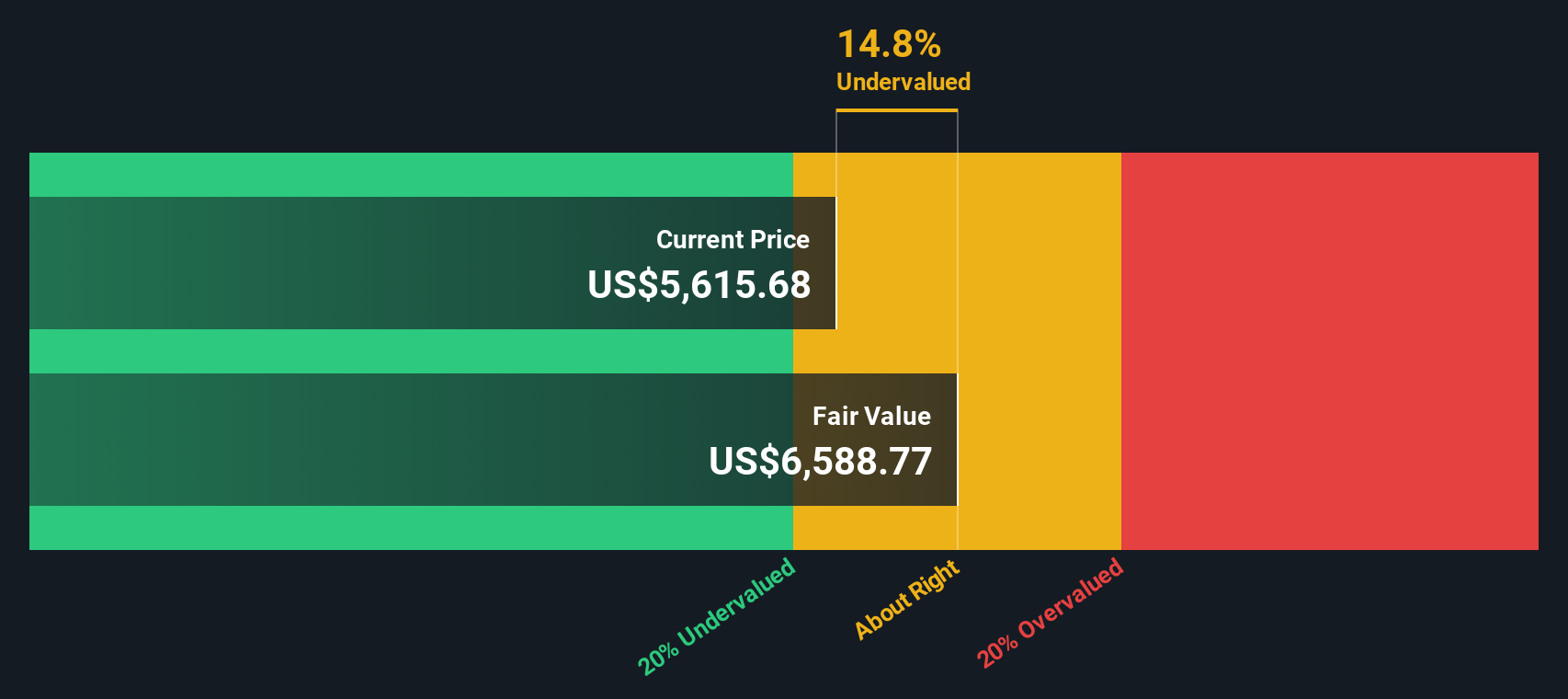

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio, at 37.08x for Booking Holdings, blends factors like historical and forecast earnings growth, profit margins, scale, industry positioning, and risk profile to calculate a company-specific benchmark. Unlike simple peer or sector averages, the Fair Ratio is designed to reflect Booking Holdings’ unique fundamentals and future outlook.

Comparing Booking Holdings’ actual PE (31.57x) to the Fair Ratio (37.08x), there is a meaningful gap. This suggests the market is currently undervaluing the company’s earnings power and strong fundamentals relative to what its tailored benchmark indicates.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, yet powerful, story that connects your perspective about a company, such as Booking Holdings, with the actual numbers behind its future revenue, earnings, and profit margins. All of these factors come together to form your unique fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives to bring together their views of where the business is heading, quantifying this outlook into a forecast and a fair value, and then comparing that to today’s share price. Narratives make investing more personal and actionable, empowering you to decide when to buy or sell based on whether your calculated fair value is above or below the current market price.

What sets Narratives apart is that they are updated automatically as new events, news, and earnings are released, ensuring your perspective stays informed and current. For example, some investors see Booking Holdings' rapid AI adoption driving sustained double-digit revenue growth, and may set their fair value at the highest analyst target of $7,218. More cautious investors cite macroeconomic headwinds and might opt for just $5,200. This illustrates how the Narrative approach helps you map your beliefs directly to decisions.

Do you think there's more to the story for Booking Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives