- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Booking Holdings (BKNG): Evaluating Valuation Following €1.5 Billion Debt Raise and Strong Earnings Guidance

Reviewed by Simply Wall St

Booking Holdings (BKNG) just completed a €1.5 billion senior note offering, with the goal of bolstering its financial position and flexibility. This news followed the company’s report of both strong earnings growth and an encouraging outlook for the year.

See our latest analysis for Booking Holdings.

Booking Holdings’ €1.5 billion debt sale arrives following another robust earnings report and upbeat guidance. The company's share price has remained steady near $4,958 in 2025. Over the past year, total shareholder return has dipped slightly. However, the company’s strong three- and five-year total shareholder returns of 154% and 138% respectively show that long-term momentum remains intact. Recent share buybacks and institutional interest continue to support positive sentiment, even as the market adjusts to short-term volatility and changing risk perceptions.

If you’re curious about what other fast-moving companies are catching investor attention, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below analysts’ target prices and earnings momentum continuing, investors now face a critical decision: is Booking Holdings undervalued after recent market dips, or is future growth already factored into the share price?

Most Popular Narrative: 19.2% Undervalued

According to the most popular narrative, Booking Holdings’ fair value is estimated at $6,140, which stands notably above its recent close of $4,958. The narrative’s underlying assumptions and catalysts present an ambitious growth path based on innovation and powerful partnerships.

Booking Holdings is incorporating AI technology across its platforms to improve operations, streamline traveler experiences, and enhance supplier partnerships. This approach is expected to drive future revenue growth and margin improvement. The company's focus on increasing alternative accommodations and expanding its Genius loyalty program aims to strengthen customer retention and capture a broader market, which could potentially boost revenue and net margins.

Want the full story behind this ambitious price target? The core assumptions include bold projections about the next wave of profit margins and customer retention, fueled by new technology strategies. Curious how these bets on innovation could transform future earnings? Explore the details that justify this substantial fair value call.

Result: Fair Value of $6,140 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, region-specific travel challenges or rising acquisition costs could undermine both demand and margins. This could put pressure on Booking Holdings’ growth forecasts.

Find out about the key risks to this Booking Holdings narrative.

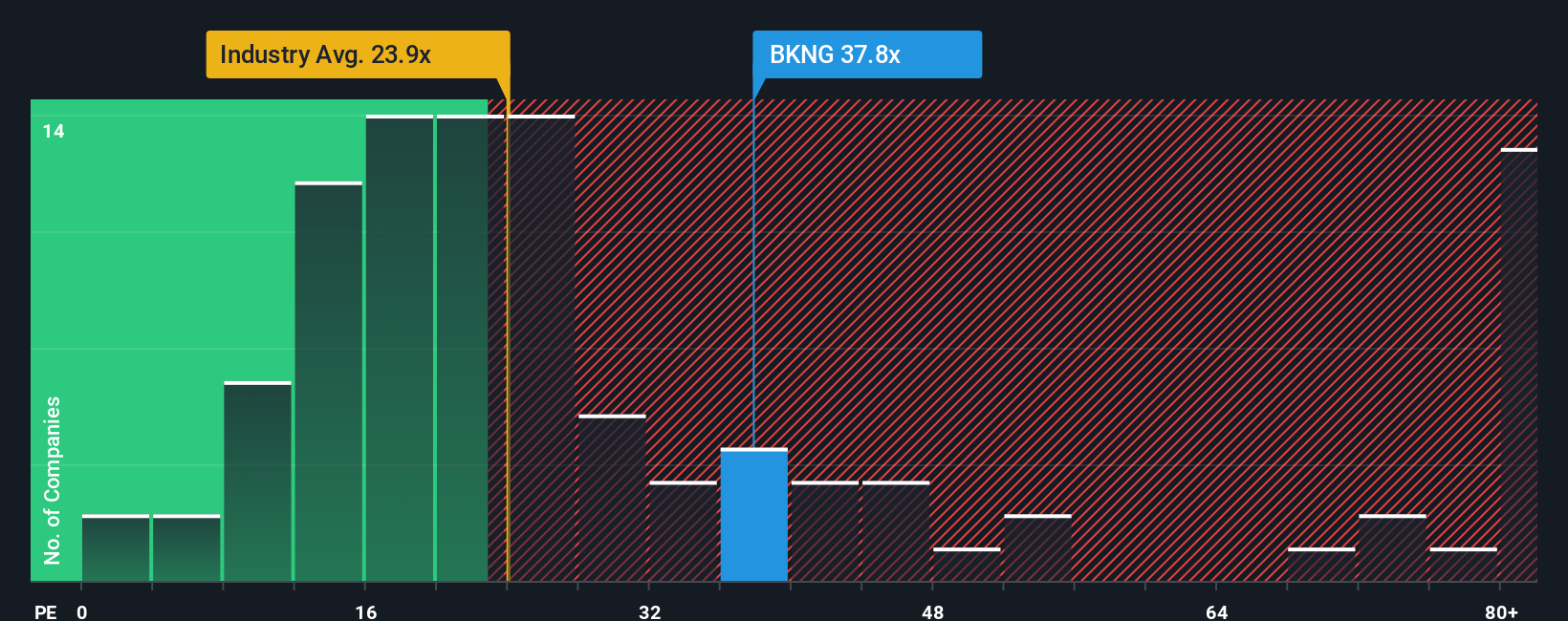

Another View: Comparing Price Ratios

Looking from another angle, the stock’s price-to-earnings ratio stands at 31.7x. This is higher than industry peers at 21.3x and also above the peer average of 28.4x, but still below its fair ratio of 37.1x. This suggests there may be potential for upside, but also indicates valuation risk if expectations are not met. It raises the question of whether the market is being cautious or simply waiting for a bigger payoff.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Booking Holdings Narrative

If you have your own perspective or want to dive deeper into the numbers, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your Booking Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one great pick. Make sure you’re not missing breakout opportunities or hidden gems by checking out these standout stock ideas below.

- Capture high yields as you target stable income streams by reviewing these 16 dividend stocks with yields > 3%, which is currently delivering impressive returns beyond 3%.

- Stay ahead of technology’s next wave and seize opportunity in artificial intelligence by browsing these 25 AI penny stocks, which are set to transform tomorrow’s industries.

- Capitalize on unique value opportunities and hunt for stocks trading at significant discounts with these 868 undervalued stocks based on cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives