- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

A Fresh Look at Booking Holdings (BKNG) Valuation After Recent Stock Declines

Reviewed by Simply Wall St

Booking Holdings (BKNG) has seen its stock under pressure this month, following a series of broader declines in the travel sector. Recent performance reflects shifting investor sentiment and has sparked questions about how resilient the company’s business model will prove amid changing market conditions.

See our latest analysis for Booking Holdings.

Despite a tough few weeks for Booking Holdings, with the share price down 9.4% over the past week and sliding nearly 18% in the last 90 days, longer-term investors are still sitting on substantial gains, with a total shareholder return of over 140% in the past three years. The recent pullback hints at fading short-term momentum and a market that is becoming more cautious, but the company’s strong performance over the years suggests it may yet have room to surprise on the upside.

If the shifts in Booking's momentum have you curious, now is a great moment to broaden your investing search and discover fast growing stocks with high insider ownership

But with the shares still trading at a notable discount to analyst price targets and Booking posting solid long-term gains, the real question is whether there is genuine upside left for investors or if the stock already reflects all anticipated future growth.

Most Popular Narrative: 24.5% Undervalued

At $4,690.77 per share, Booking Holdings trades well below its narrative-based fair value, suggesting room for further appreciation if the assumptions hold up.

Booking Holdings is incorporating AI technology across its platforms to improve operations, streamline traveler experiences, and enhance supplier partnerships. This is expected to drive future revenue growth and margin improvement. The company's focus on increasing alternative accommodations and expanding its Genius loyalty program aims to strengthen customer retention and capture a broader market, potentially boosting revenue and net margins.

What is fueling this narrative’s upbeat outlook? The secret driver is a bold set of growth and profitability forecasts that will surprise even seasoned investors. Want to see the ambitious numbers behind this undervaluation and what assumptions really power that fair value? Dive into the full narrative and decide for yourself.

Result: Fair Value of $6,210 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in alternative accommodations or rising customer acquisition costs could quickly challenge the bullish case and put pressure on Booking’s future growth trajectory.

Find out about the key risks to this Booking Holdings narrative.

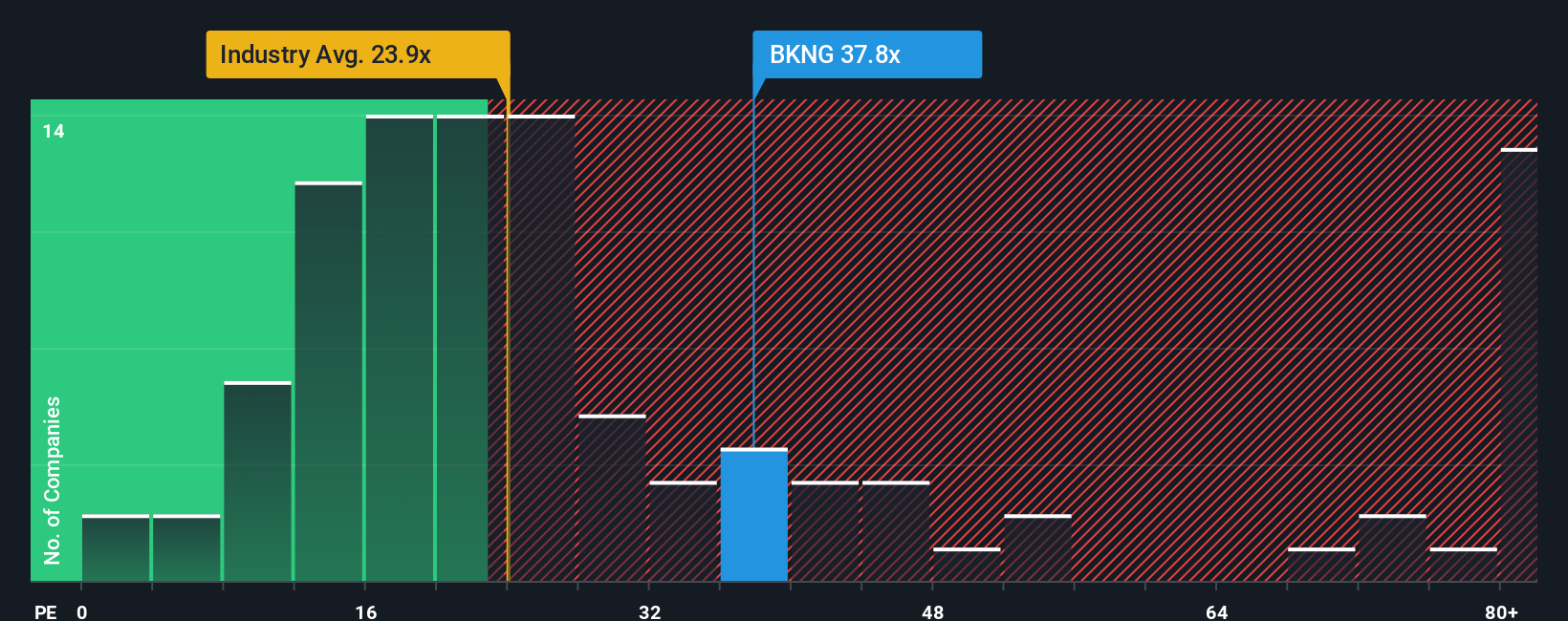

Another View: Price Ratios Send a Caution Signal

Looking at price ratios, Booking Holdings is trading at 30 times earnings, notably higher than both the US Hospitality industry average of 20.7x and the peer average of 27.5x. While the fair ratio is 37x, these gaps suggest investors are already paying a premium and may face downside risk if future growth does not deliver. Could this premium be justified, or is market optimism overextended?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Booking Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can explore the data and build your own perspective in under three minutes. Do it your way

A great starting point for your Booking Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let your research stop here. The best opportunities can pass by unnoticed unless you act now, so expand your horizons with these expert-backed screens:

- Tap into future tech potential and uncover emerging leaders among these 26 AI penny stocks who are positioned to benefit from the rapidly growing artificial intelligence sector.

- Accelerate your portfolio’s growth by targeting income-generating strategies, starting with these 15 dividend stocks with yields > 3% that consistently deliver strong yields above 3%.

- Capture hidden value that others often overlook by jumping into these 897 undervalued stocks based on cash flows identified through cash flow analysis and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives