- United States

- /

- Hospitality

- /

- OTCPK:BFIC.Q

Little Excitement Around BurgerFi International, Inc.'s (NASDAQ:BFI) Revenues As Shares Take 26% Pounding

BurgerFi International, Inc. (NASDAQ:BFI) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

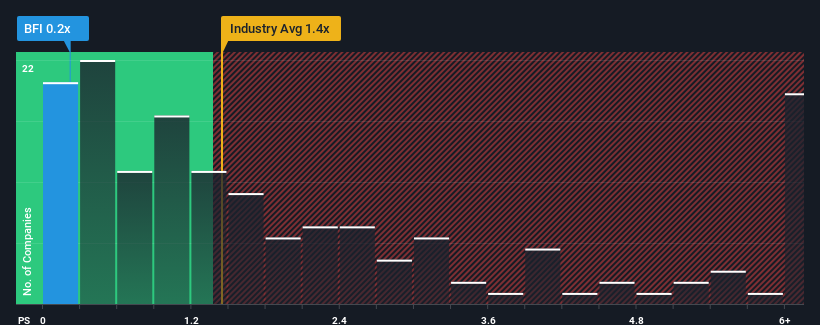

Since its price has dipped substantially, given about half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider BurgerFi International as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for BurgerFi International

What Does BurgerFi International's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, BurgerFi International has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BurgerFi International.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, BurgerFi International would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow revenue by 263% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.7% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

In light of this, it's understandable that BurgerFi International's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does BurgerFi International's P/S Mean For Investors?

BurgerFi International's recently weak share price has pulled its P/S back below other Hospitality companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that BurgerFi International maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for BurgerFi International (1 is a bit concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BurgerFi International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:BFIC.Q

BurgerFi International

Owns and franchises fast-casual and premium-casual dining restaurants under BurgerFi and Anthony’s brand name in the United States.

Low and slightly overvalued.

Market Insights

Community Narratives