- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

How Might Atour Lifestyle Holdings (ATAT) Board Changes Shape Its Growth and Execution Strategy?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Atour Lifestyle Holdings Limited announced that Mr. Cong Lin resigned from his roles as director and key board committee member for personal reasons, with Mr. Yingchun Song, founder of Today Convenience Store and a leader in China’s retail chain sector, appointed as his successor on the same day.

- Mr. Song’s deep experience in supply chain management and brand operations could introduce new perspectives to Atour’s board at a time of rapid expansion and evolving market strategy.

- We’ll explore how Mr. Song’s appointment and leadership expertise could impact Atour’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Atour Lifestyle Holdings Investment Narrative Recap

For investors considering Atour Lifestyle Holdings, the core thesis is centered on the company’s ability to deliver high-quality, innovation-led experiences as it scales rapidly across China’s hospitality and retail sectors. While the appointment of Mr. Yingchun Song adds valuable retail and supply chain expertise to the board, this change is not expected to materially alter the immediate growth catalyst, namely, Atour’s aggressive hotel network expansion, and does little to mitigate the main risk of intensifying competition in both hotels and retail.

The recently announced 30% year-on-year revenue growth guidance for 2025 remains the most pertinent update, reinforcing the company's positive outlook despite the board changes. Progress on this growth target continues to be the key area for investors to monitor, especially as the incoming director’s retail background may eventually influence Atour’s evolving retail segment performance.

However, with more rivals targeting Atour’s customer experience strengths, investors should be aware that...

Read the full narrative on Atour Lifestyle Holdings (it's free!)

Atour Lifestyle Holdings is forecast to reach CN¥15.4 billion in revenue and CN¥2.8 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 22.5% and an earnings increase of CN¥1.4 billion from current earnings of CN¥1.4 billion.

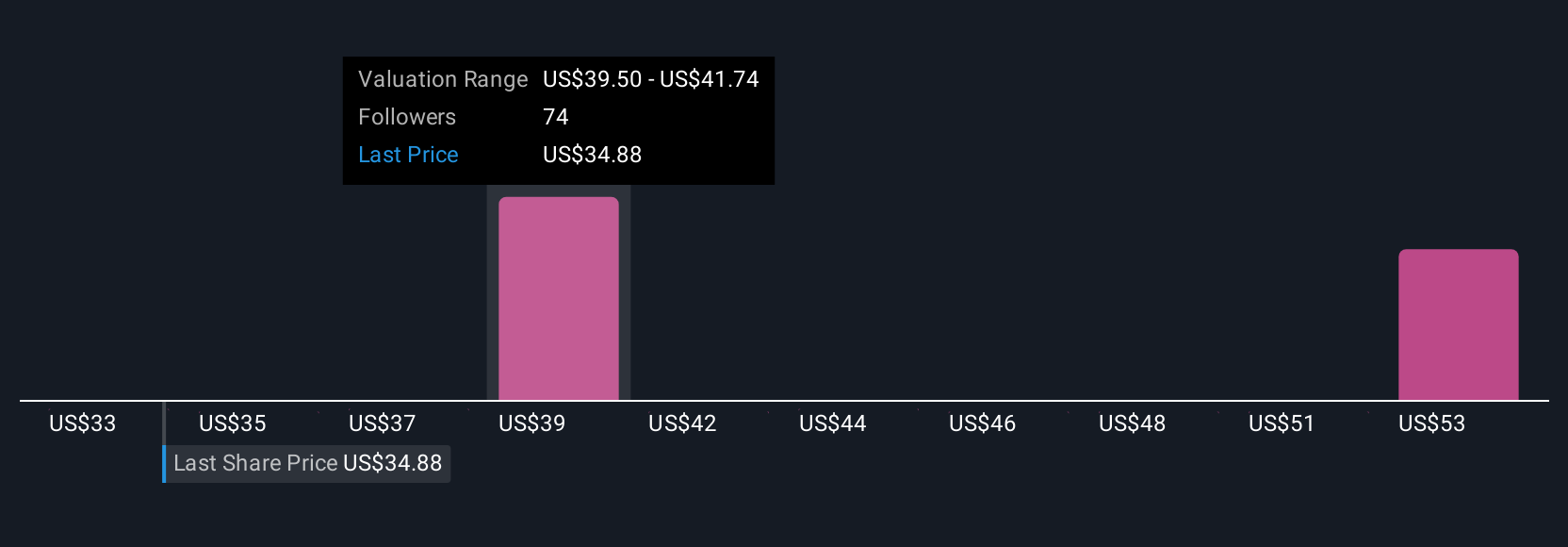

Uncover how Atour Lifestyle Holdings' forecasts yield a $43.77 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community estimate Atour’s fair value between US$37.92 and US$58.69, showing wide differences in expectations. Several highlight sustained network expansion as a reason for optimism, though many point to the risks posed by rising competition and operating standards.

Explore 8 other fair value estimates on Atour Lifestyle Holdings - why the stock might be worth as much as 43% more than the current price!

Build Your Own Atour Lifestyle Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atour Lifestyle Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Atour Lifestyle Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atour Lifestyle Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives