- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Atour Lifestyle Holdings (NasdaqGS:ATAT): Assessing Valuation After Strong Results, Dividend Boost, and Raised Guidance

Reviewed by Simply Wall St

Atour Lifestyle Holdings (NasdaqGS:ATAT) just released its third quarter results, reporting higher revenue and net income compared to last year. The company also raised its full-year outlook and declared a second cash dividend.

See our latest analysis for Atour Lifestyle Holdings.

After climbing on the back of upbeat earnings, a dividend announcement, and plans for accelerated expansion, Atour Lifestyle Holdings has attracted plenty of market attention. The latest share price closed at $40.43, delivering a robust year-to-date share price return of nearly 50% and an impressive 57.7% total shareholder return over the past year. In short, the stock’s momentum is building as growth initiatives and shareholder rewards catch investors’ eyes.

If these moves have you scanning for the next opportunity, now is a great time to broaden your options and discover fast growing stocks with high insider ownership

Yet with the stock advancing nearly 50% this year and full-year growth forecasts now public, the critical question for investors is whether Atour shares still offer real value or if future gains are already reflected in the price.

Most Popular Narrative: 13.2% Undervalued

The most widely followed narrative suggests Atour’s fair value sits notably above its latest closing price, drawing attention to the gap and stirring debate over the growth fueling such optimism.

The company’s focus on differentiated, high-quality lifestyle and experiential brands (such as SAVHE and Atour Light), alongside strong product innovation, aligns with shifting consumer preferences toward experiential and themed stays. This supports premium pricing, higher RevPAR, and brand loyalty, directly enhancing top-line revenue and margins.

Want a glimpse into the financial assumptions shaping this bold upside? The narrative hinges on fast-rising margins and a premium pricing playbook. Discover exactly which aggressive growth factors analysts are betting on to justify this value gap.

Result: Fair Value of $46.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, possible missteps in rapid hotel expansion or quality control across franchisees could undermine growth and put recent margin gains at risk.

Find out about the key risks to this Atour Lifestyle Holdings narrative.

Another View: What Do Earnings Ratios Suggest?

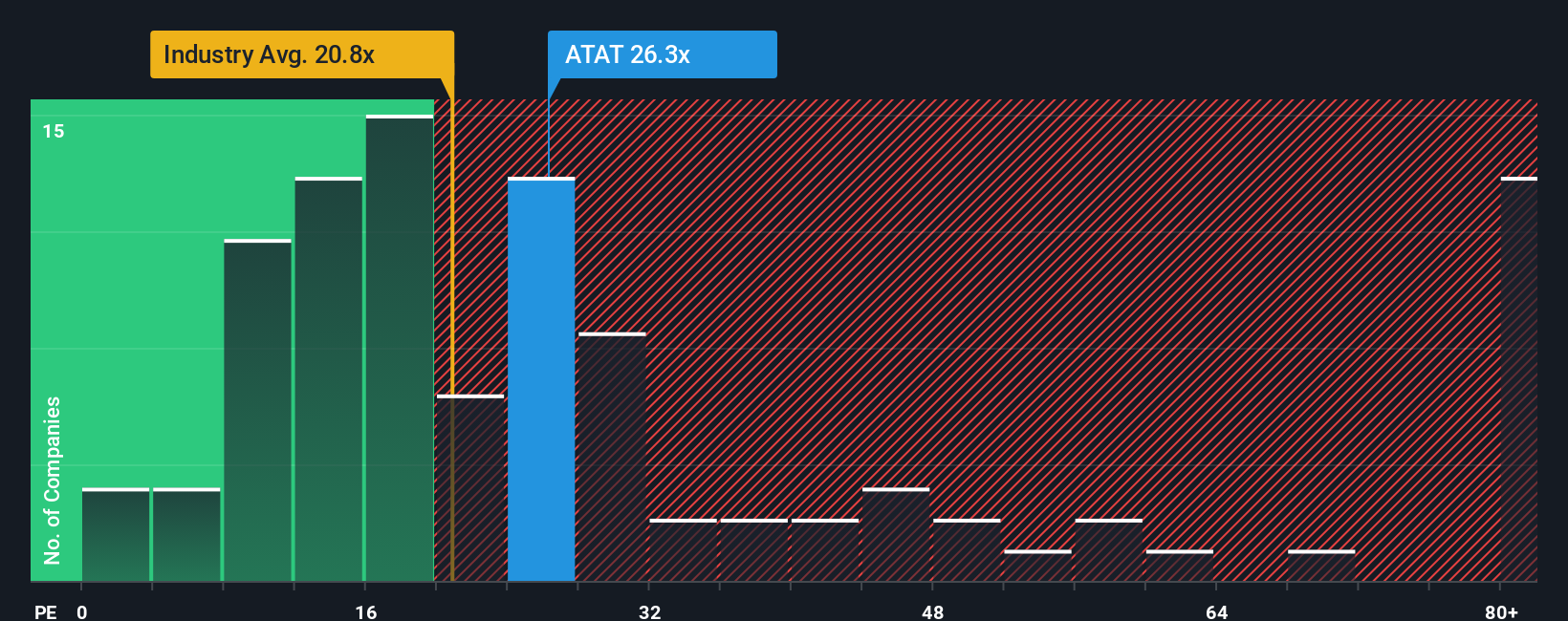

Looking at the valuation through an earnings lens, Atour Lifestyle trades at 26.7 times earnings. This is higher than the US hospitality industry average of 21.3 times, but below peer averages at 32.5 times. While this premium suggests investor optimism, it also highlights valuation risk if growth expectations are not met. What will happen if market sentiment or industry trends shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atour Lifestyle Holdings Narrative

If the current analysis does not align with your perspective, you can quickly explore Atour’s data to build your own view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Atour Lifestyle Holdings.

Looking for More Standout Opportunities?

Expand your investing toolkit and tap into fresh growth prospects with stock ideas you might not have considered. This is your chance to stay ahead of the crowd.

- Maximize potential returns by tapping into these 928 undervalued stocks based on cash flows that the market has overlooked but show strong fundamentals and upside.

- Secure reliable income streams with these 14 dividend stocks with yields > 3% offering consistent yields above 3%, ideal if you want both growth and stability.

- Ride the wave of innovation by targeting these 25 AI penny stocks powering tomorrow’s breakthroughs across industries through cutting-edge artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026