- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

A Look at Atour Lifestyle Holdings (NasdaqGS:ATAT) Valuation Following Analyst Upgrades and Board Appointment

Reviewed by Simply Wall St

Atour Lifestyle Holdings (NasdaqGS:ATAT) is drawing fresh attention as recent board changes and improved outlook from analysts signal a period of transition for the company. Investors are watching closely as Atour welcomes Mr. Yingchun Song, a leader in the retail space, to its board.

See our latest analysis for Atour Lifestyle Holdings.

Even with a brief dip this past week, Atour Lifestyle Holdings has seen momentum build over the year, with its year-to-date share price return at 37.3% and an impressive 44.9% total shareholder return for the past twelve months. Recent board changes and earnings optimism have helped fuel investor interest and could signal further growth ahead.

If you're interested in exploring what's next in dynamic markets, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the share price still showing a meaningful discount to analyst targets and consensus estimates rising, investors now face a key question: Is Atour Lifestyle Holdings undervalued, or is the market already pricing in the company’s future potential?

Most Popular Narrative: 15.3% Undervalued

With the most widely followed narrative estimating a fair value of $43.77, Atour Lifestyle Holdings trades at a notable discount to its assessed worth, closing last at $37.09. This gap is drawing close attention as market optimism around growth and innovation builds.

"Significant hotel network expansion in Tier 2 and 3 Chinese cities (with 239 hotels opened in H1, 500 targeted for FY2025, and 816 more in the pipeline) positions Atour to capitalize on continuing urbanization and infrastructural improvements. This expansion may support long-term revenue and occupancy growth as domestic travel demand rises."

Curious how rapid network expansion and shifting consumer habits fuel this bullish scenario? The driving force behind this valuation could be surprising profit margins and a future earnings multiple that breaks with sector norms. Discover the full financial story that is causing analysts to price in a premium well ahead of market trends.

Result: Fair Value of $43.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition and an overreliance on core sleep products could slow Atour’s growth or challenge the bullish outlook that is taking shape among analysts.

Find out about the key risks to this Atour Lifestyle Holdings narrative.

Another View: Valuation Through Market Ratios

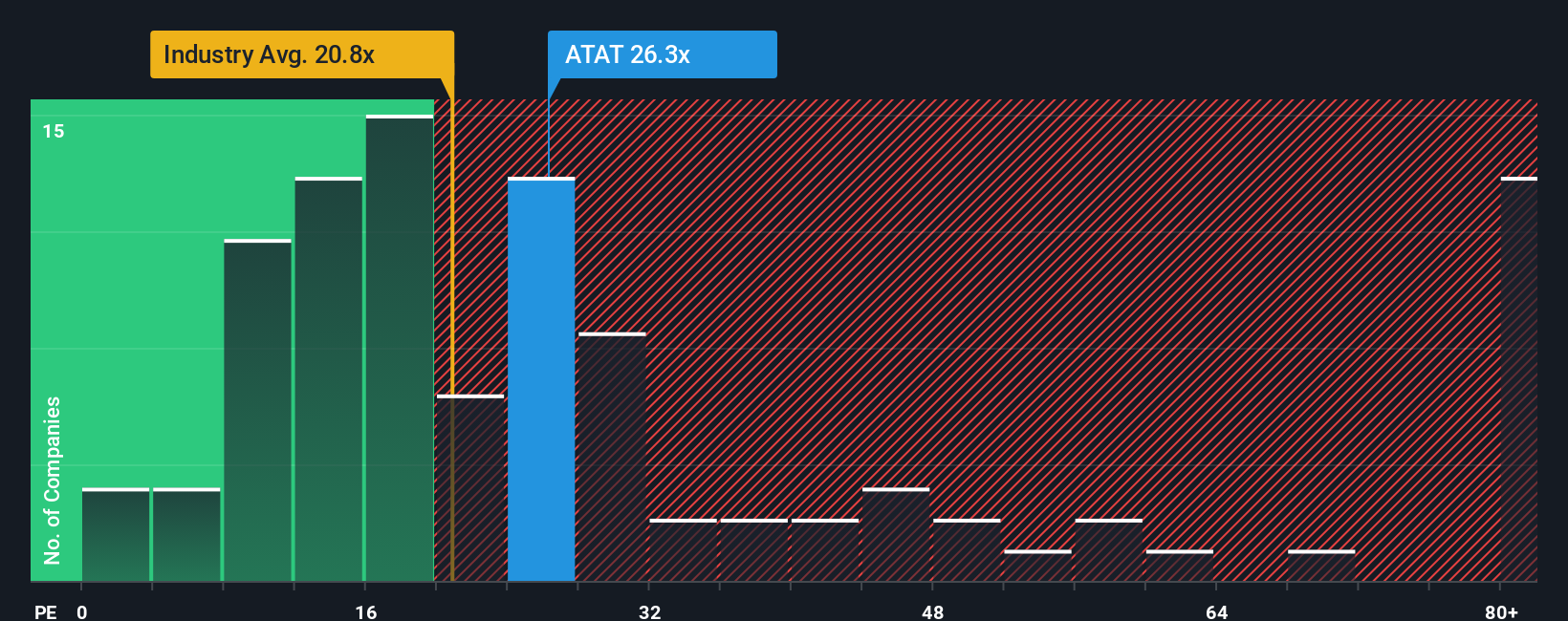

Looking from a different angle, Atour Lifestyle Holdings is currently trading at a price-to-earnings ratio of 26.3x. This is higher than the US Hospitality industry average of 20.8x but lower than its peer average of 33x. Interestingly, the company’s ratio sits just below its fair ratio of 26.9x, a level the market could trend toward in the future. This mix of premiums and discounts highlights both temptation and caution for investors. Does the stock’s current price offer a bargain or does it carry more risk than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atour Lifestyle Holdings Narrative

If you have your own perspective or want to interpret the numbers differently, it only takes a few minutes to shape your own view and Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Atour Lifestyle Holdings.

Looking for more investment ideas?

Don't let opportunity pass you by. Expand your horizons now and find companies primed for tomorrow’s innovation using these powerful Simply Wall St tools:

- Tap into tomorrow’s potential by scanning these 927 undervalued stocks based on cash flows that analysts believe are trading below their real worth and could provide compelling upside.

- Uncover the next breakthroughs in medicine by using these 30 healthcare AI stocks which is changing patient care through revolutionary technology and AI-driven solutions.

- Supercharge your income strategy by selecting these 15 dividend stocks with yields > 3% for consistent yields above 3 percent with strong financial backing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives