- United States

- /

- Consumer Services

- /

- OTCPK:ASPU

The CFO & Director of Aspen Group, Inc. (NASDAQ:ASPU), Frank Cotroneo, Just Sold 50% Of Their Holding

We'd be surprised if Aspen Group, Inc. (NASDAQ:ASPU) shareholders haven't noticed that the CFO & Director, Frank Cotroneo, recently sold US$243k worth of stock at US$10.78 per share. In particular, we note that the sale equated to a 50% reduction in their position size, which doesn't exactly instill confidence.

See our latest analysis for Aspen Group

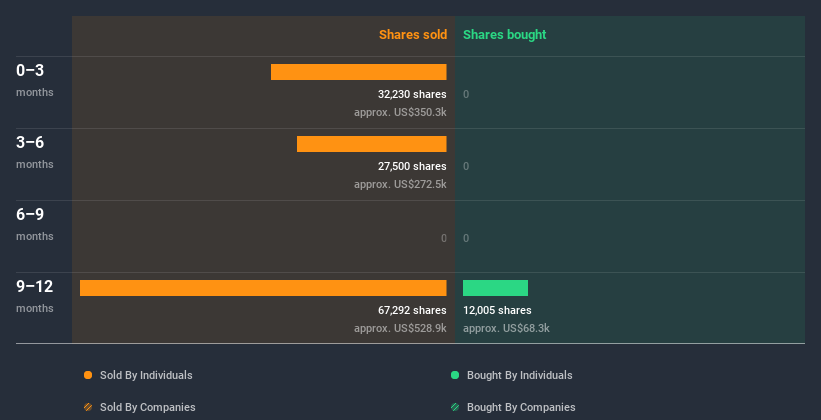

Aspen Group Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Independent Director, C. Jensen, for US$536k worth of shares, at about US$8.03 per share. That means that an insider was selling shares at slightly below the current price (US$10.84). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 29% of C. Jensen's holding.

Over the last year we saw more insider selling of Aspen Group shares, than buying. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 16% of Aspen Group shares, worth about US$43m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Aspen Group Insider Transactions Indicate?

Insiders sold stock recently, but they haven't been buying. Zooming out, the longer term picture doesn't give us much comfort. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Aspen Group. For example - Aspen Group has 2 warning signs we think you should be aware of.

Of course Aspen Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Aspen Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:ASPU

Aspen Group

An education technology company, provides online higher education services in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success