- United States

- /

- Consumer Services

- /

- NasdaqGS:ARCE

These 4 Measures Indicate That Arco Platform (NASDAQ:ARCE) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Arco Platform Limited (NASDAQ:ARCE) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Arco Platform

How Much Debt Does Arco Platform Carry?

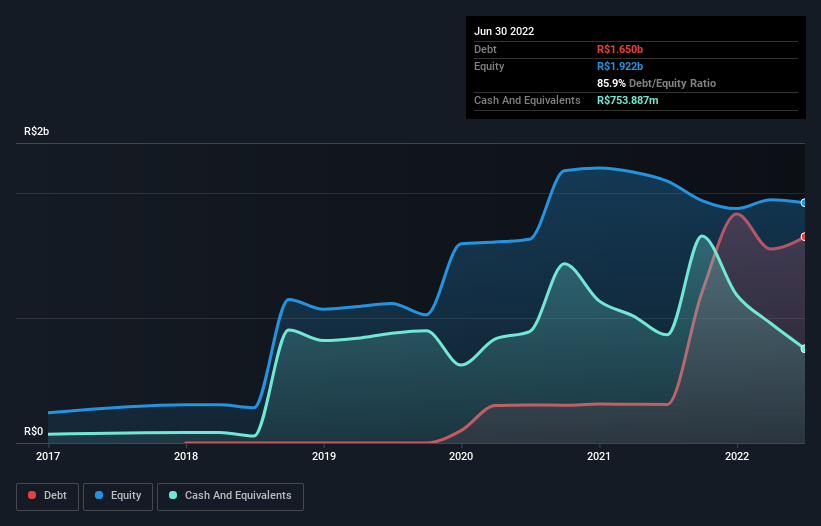

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Arco Platform had R$1.65b of debt, an increase on R$308.7m, over one year. However, it also had R$753.9m in cash, and so its net debt is R$896.5m.

How Strong Is Arco Platform's Balance Sheet?

According to the last reported balance sheet, Arco Platform had liabilities of R$1.26b due within 12 months, and liabilities of R$2.41b due beyond 12 months. Offsetting this, it had R$753.9m in cash and R$646.9m in receivables that were due within 12 months. So its liabilities total R$2.27b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of R$3.45b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Arco Platform's net debt to EBITDA ratio of 2.8, we think its super-low interest cover of 0.76 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. The good news is that Arco Platform grew its EBIT a smooth 47% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Arco Platform's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Arco Platform burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Arco Platform's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Arco Platform stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Even though Arco Platform lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARCE

Arco Platform

Arco Platform Limited, a technology company in the education sector, provides a pedagogical system with technology-enabled features to deliver educational content to private schools in Brazil.

High growth potential and slightly overvalued.

Market Insights

Community Narratives