- United States

- /

- Consumer Services

- /

- NasdaqGS:ARCE

If You Had Bought Arco Platform's (NASDAQ:ARCE) Shares A Year Ago You Would Be Down 13%

Arco Platform Limited (NASDAQ:ARCE) shareholders should be happy to see the share price up 11% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 13% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for Arco Platform

Arco Platform isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Arco Platform increased its revenue by 85%. That's well above most other pre-profit companies. The share price drop of 13% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

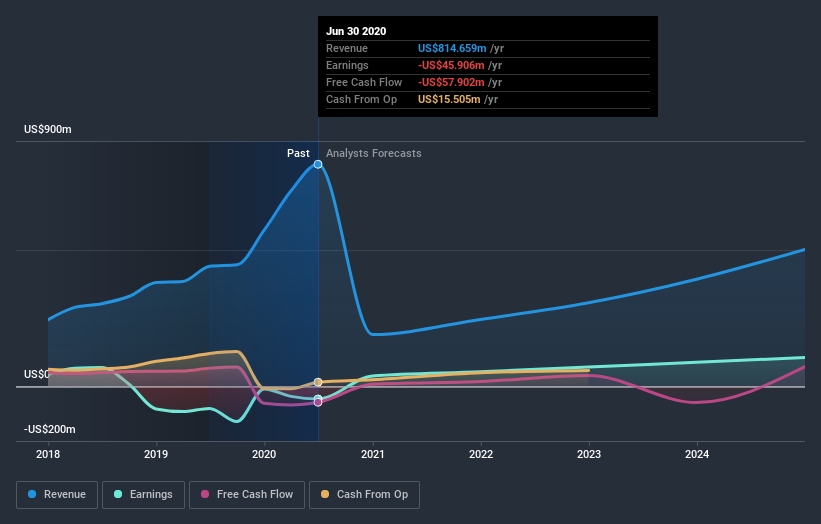

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Arco Platform shareholders are down 13% for the year, the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 22% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Arco Platform you should know about.

But note: Arco Platform may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Arco Platform, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ARCE

Arco Platform

Arco Platform Limited, a technology company in the education sector, provides a pedagogical system with technology-enabled features to deliver educational content to private schools in Brazil.

High growth potential and slightly overvalued.

Market Insights

Community Narratives