- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Can Airbnb’s (ABNB) Expanding Experiences Business Reshape Its Long-Term Growth Trajectory?

Reviewed by Sasha Jovanovic

- Airbnb reported third-quarter 2025 earnings last week, with sales rising to US$4.10 billion and net income reaching US$1.37 billion, alongside incremental improvement in earnings per share compared to the prior year.

- The company’s renewed focus on expanding its ‘Experiences’ and ‘Services’ offerings signals an ongoing push to diversify revenue streams beyond traditional stays.

- We’ll explore how Airbnb’s rising quarterly sales and product diversification efforts may influence its longer-term investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Airbnb Investment Narrative Recap

To be an Airbnb shareholder today, you need to believe that the company's platform can capture ongoing growth in alternative accommodations and adjacent services, even as major urban markets mature and regulatory scrutiny increases. The latest earnings report showed a healthy rise in quarterly sales, but net income and EPS only edged up slightly, which does not significantly alter the near-term catalyst of diversified growth through new offerings, nor does it diminish ongoing risks tied to tightening regulations or softness in bookings growth.

The company’s ongoing share repurchase program stands out, with 7,000,000 shares bought back for US$900.9 million in Q3 2025. While this capital return is relevant, particularly as a sign of balance sheet strength and management’s confidence in future performance, it does not materially shift the primary focus away from evolving market risks and growth drivers discussed above.

But despite the company’s recent financial strength, investors should not overlook shifting regulatory winds in key cities, as...

Read the full narrative on Airbnb (it's free!)

Airbnb's narrative projects $15.4 billion in revenue and $3.7 billion in earnings by 2028. This requires 10.0% yearly revenue growth and a $1.1 billion increase in earnings from $2.6 billion today.

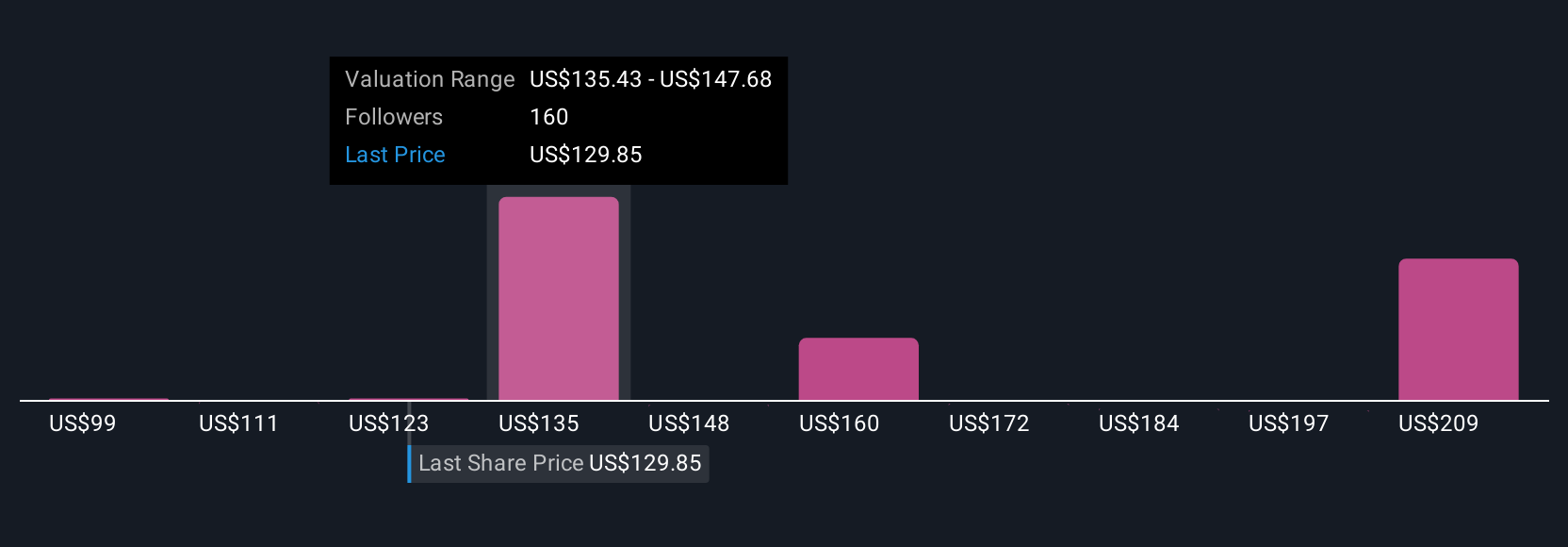

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 15% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts saw international growth and new products driving Airbnb’s annual revenue to US$16.5 billion and earnings to US$4.3 billion by 2028, expecting faster and broader outperformance than consensus. That outlook highlights how much investor views can diverge, especially as new information challenges earlier assumptions and invites you to compare your own expectations.

Explore 27 other fair value estimates on Airbnb - why the stock might be worth as much as 80% more than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives