- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Airbnb (NasdaqGS:ABNB) Experiences 10% Stock Increase Over Past Week

Reviewed by Simply Wall St

Airbnb (NasdaqGS:ABNB) experienced a notable increase of 10% over the past week. Although there were no specific pivotal events directly linked to Airbnb during this period, the rise coincided with broader market trends. The Dow Jones and S&P 500 posted gains as investors showed confidence following strong earnings reports, while optimism about potential tariff ease added a positive tone. This general market uplift likely supported Airbnb's stock performance, aligning with the overall market buoyancy observed during the week. As a result, Airbnb's stock movement reflects the broader trends rather than being driven by internal company-specific developments.

Find companies with promising cash flow potential yet trading below their fair value.

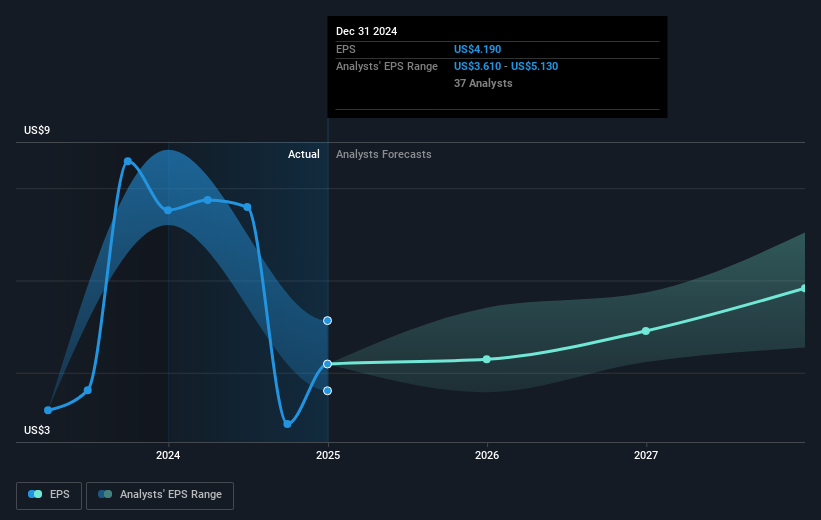

The recent uptick in Airbnb's stock price, aligned with broader market optimism, suggests increased investor confidence, despite a lack of company-specific events driving this movement. This positive momentum, coupled with market trends, might influence future revenue and earnings forecasts as investor sentiment generally supports growth prospects. Enhanced platform technology and AI developments are expected to bolster operational efficiency, expanding Airbnb's offerings and possibly improving net margins, reinforcing the positive outlook.

Over the past three years, Airbnb's total return, including dividends, was a decline of 19.30%. This longer-term performance highlights challenges the company has faced compared to its recent short-term gains. Compared to the US market's 7.7% return over the past year, Airbnb underperformed. In contrast to the US Hospitality industry's 3.4% return, Airbnb similarly lagged. This context emphasizes the fluctuating nature of its market position.

With a consensus analyst price target of US$147.15 and a current share price of US$114.91, the stock trades at a 19% discount, suggesting that bullish sentiment may regard the stock as undervalued. However, differing analyst opinions result in a wide range of price targets, requiring careful consideration of different projections. As the company's shares adjust to current market trends and internal developments, both upside and downside potential may shape future returns and investor decisions.

Upon reviewing our latest valuation report, Airbnb's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives