- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Will Walmart’s (WMT) Holiday AI Push and Membership Discount Redefine Its Retail Investment Narrative?

Reviewed by Sasha Jovanovic

- Walmart has launched a major holiday promotion by halving the annual Walmart Plus membership fee to US$49 and introduced five new AI-driven shopping tools, accessible through its app and website, to enhance customer convenience and experience during the important holiday season. This initiative is coupled with expanded collaborations on AI and digital features, underlining Walmart’s ongoing commitment to blending technology and value to attract shoppers amid economic uncertainty.

- The integration of artificial intelligence addresses both operational efficiency and customer engagement, illustrating how Walmart leverages technology innovations not just to drive sales but also to adapt its workforce and retail model for the future.

- We'll now examine how Walmart's aggressive membership discounting and AI innovations could influence its evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Walmart Investment Narrative Recap

To be a Walmart shareholder today, you need confidence in its ability to drive digital transformation through AI and logistics advances, while leveraging scale to offset margin risks from e-commerce, international expansion, and competition. The latest holiday membership discount and launch of new AI shopping tools are timely moves but do not materially alter Walmart’s near-term outlook; the biggest short-term catalyst remains Q3 earnings, and the main risk is ongoing margin pressure from rising costs and possible tariff impacts.

Walmart’s expansion of last-mile logistics through its newly announced GOFO partnership is particularly relevant as it supports ongoing efforts to improve delivery speed and cost efficiency, a direct response to rising online order volumes and competitive intensity. Efficient execution in these areas could prove crucial as Walmart aims to balance customer satisfaction with sustainable margin improvement across its core retail and marketplace businesses.

However, investors should also be aware that, in contrast, persistent inefficiencies or continued cost pressure in Walmart’s global e-commerce operations could...

Read the full narrative on Walmart (it's free!)

Walmart's narrative projects $789.9 billion in revenue and $27.4 billion in earnings by 2028. This requires 4.5% yearly revenue growth and a $6.1 billion earnings increase from the current $21.3 billion.

Uncover how Walmart's forecasts yield a $113.78 fair value, a 10% upside to its current price.

Exploring Other Perspectives

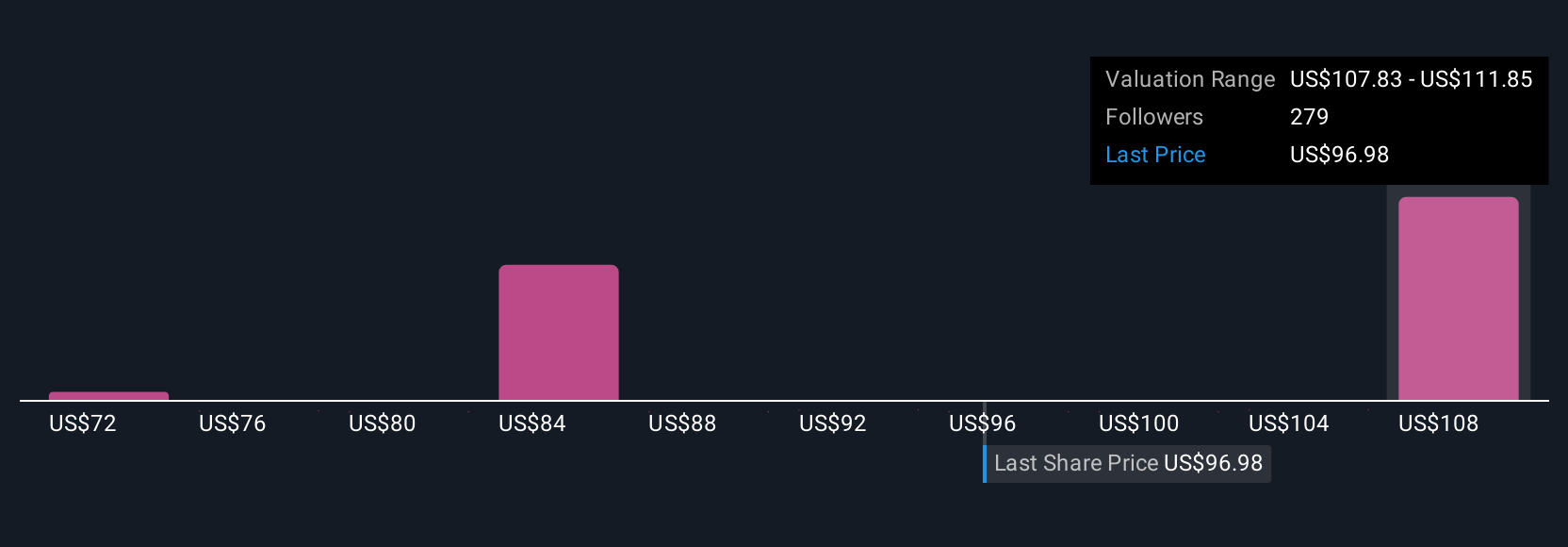

Fair value estimates from 17 Simply Wall St Community members for Walmart range from US$87.15 to US$113.78. With such variety in outlooks, consider how Walmart’s ongoing investments in digital and last-mile logistics may influence long-term profitability and the views of other holders.

Explore 17 other fair value estimates on Walmart - why the stock might be worth as much as 10% more than the current price!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

No Opportunity In Walmart?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives