- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT) Introduces ScentMatch Wax Melts In-Store Starting At US$4

Reviewed by Simply Wall St

Walmart (WMT) recently introduced ScentMatch in its stores, a strategic move to penetrate the luxury home fragrance market while capitalizing on current trends among younger consumers. During the last quarter, Walmart’s stock experienced a modest price move of approximately 2%. In a period marked by mixed market performances and larger macroeconomic factors such as inflation and financial institution earnings, Walmart's steady price move aligns with broader market trends. The company's initiatives, including product launches and new collaborations, likely provided additional support to its overall performance, complementing broader market stability.

Be aware that Walmart is showing 2 risks in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

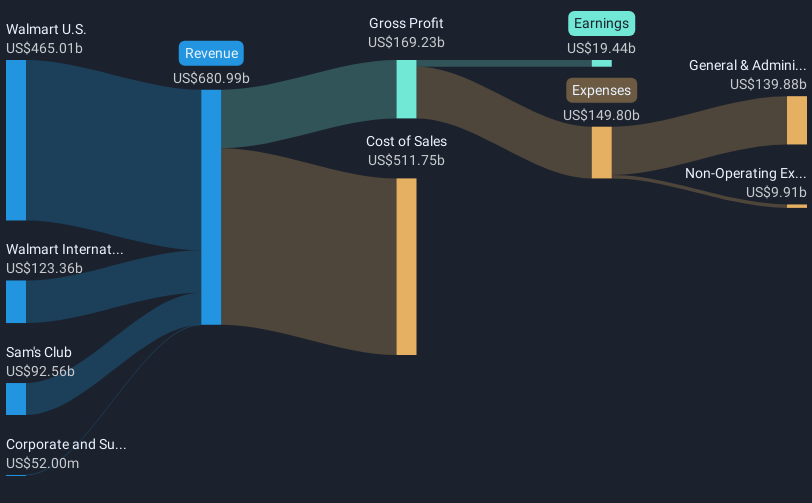

Walmart’s foray into the luxury home fragrance market with ScentMatch may significantly bolster its revenue streams by aligning with consumer trends favoring premium products. This initiative, part of broader efforts to enhance profitability through high-margin ventures like membership and advertising, could positively influence the company’s earnings forecasts. Analysts expect Walmart’s earnings to grow to US$25.8 billion by May 2028, a trajectory expected to support future top-line growth.

Over the longer-term, Walmart’s total shareholder return amounted to 134.71% over five years, indicating a robust performance. This return surpasses the recent 11.4% gain of the US market over the past year, highlighting Walmart’s capacity for sustained growth.

Despite a modest price movement of around 2% last quarter, Walmart’s current share price of US$95.78 remains below the consensus analyst price target of US$109.32. This suggests potential undervaluation, with continued investments and initiatives like ScentMatch possibly aiding in closing this gap. Nevertheless, challenges such as currency fluctuations and the cost of e-commerce transitions remain critical considerations impacting revenue and profit margins.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives