- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT) Expands Product Range with A-GAME Sports Drinks on Marketplace

Reviewed by Simply Wall St

A-GAME Beverages Inc. has expanded its market presence by launching sports drinks on the Walmart Marketplace, positioning them to tap into one of the fastest-growing e-commerce platforms. This partnership could help Walmart (WMT) bolster its product offerings, contributing to the stock's recent 1.4% gain. Meanwhile, Dollar Shave Club's new College Razor Handles release could further increase Walmart's customer engagement, adding weight against broader market trends. Despite general market declines due to tariff-related uncertainties and weak job data, these product launches on Walmart's platforms might have played a role in buoying the company's stock performance amidst a volatile market environment.

We've discovered 2 warning signs for Walmart that you should be aware of before investing here.

While A-GAME Beverages Inc.'s partnership with Walmart could enhance market positioning by leveraging Walmart's expanding e-commerce platform, this move also factors into the broader narrative of Walmart's ongoing efforts to ramp up operational efficiency and profitability. This expansion aligns with Walmart's focus on high-margin ventures, which could potentially boost revenue growth. Over the past five years, Walmart's total shareholder return was 144.04%, indicative of strong investor confidence despite recent challenges. In comparison to the broader US Consumer Retailing industry, Walmart's one-year return outperformed the industry average, reflecting its resilience in a competitive market.

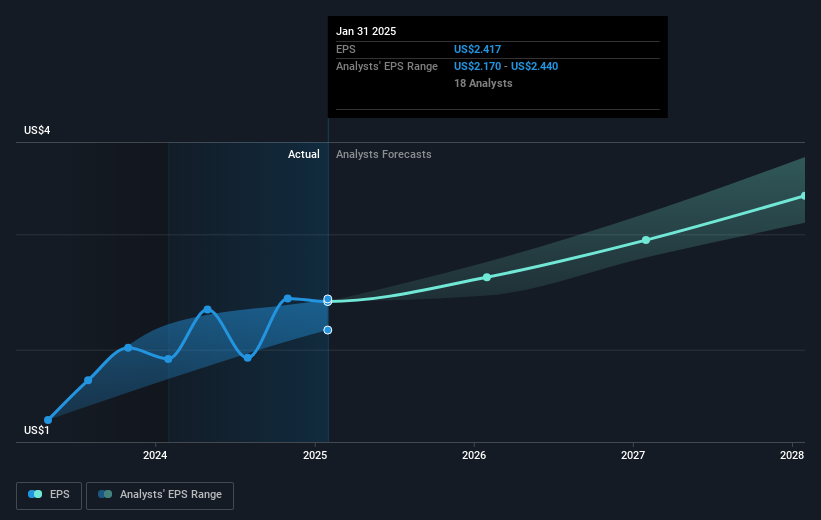

The introduction of high-margin products and streamlined distribution could have a positive impact on future revenue and earnings forecasts. Despite facing market-wide economic pressures, Walmart's strategic initiatives might position it well for future growth. The current share price of US$97.98 suggests a discount to the analyst price target of US$109.54, indicating a potential upside. This discount could represent an opportunity for investors who believe in Walmart's growth prospects and efficiency gains, evidenced by its recent actions and historical performance. Such developments may also foster a more favorable outlook among analysts, reinforcing Walmart's commitment to expanding its market leadership.

Understand Walmart's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives