- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

How Walmart's Upgraded Sales Outlook and Strong Quarter May Impact WMT Investors

Reviewed by Sasha Jovanovic

- Walmart reported strong third-quarter results with US$177.77 billion in sales and raised its full-year and fourth-quarter guidance for both sales and operating income, reflecting confidence in continued market share gains heading into the holiday season.

- Management's optimistic outlook is supported by growth across U.S., international, and Sam's Club divisions, as well as robust early holiday promotional activity both online and in stores.

- We will now explore how Walmart's upgraded guidance and solid quarterly performance may influence its longer-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Walmart Investment Narrative Recap

To be a Walmart shareholder, you need confidence in the company's ability to grow through omni-channel retail, efficiency gains, and further expansion in high-margin segments like advertising, even as competition heats up and costs rise. Recent news about Walmart's robust third-quarter sales and upgraded guidance reinforces this narrative for the holiday quarter, though it does not materially change the biggest near-term catalyst, holiday season sales growth, or the major risk: persistent pressure on margins from rising costs in logistics and lower-margin essentials.

Among recent announcements, Walmart’s launch of Grinch-themed holiday décor and early Black Friday promotions are particularly relevant as they reflect the company’s focus on driving traffic and online engagement during a critical sales window. These events align closely with the holiday season as a key earnings driver, but they also put a spotlight on how Walmart must continually invest in assortment and price competitiveness to support both revenue and market share.

However, it's important for investors to be mindful that, despite strong sales, Walmart is still exposed to rising labor and logistics costs that may cap operating leverage...

Read the full narrative on Walmart (it's free!)

Walmart's outlook forecasts $789.9 billion in revenue and $27.4 billion in earnings by 2028. This is based on a 4.5% annual revenue growth rate and an increase in earnings of $6.1 billion from the current $21.3 billion.

Uncover how Walmart's forecasts yield a $118.38 fair value, a 7% upside to its current price.

Exploring Other Perspectives

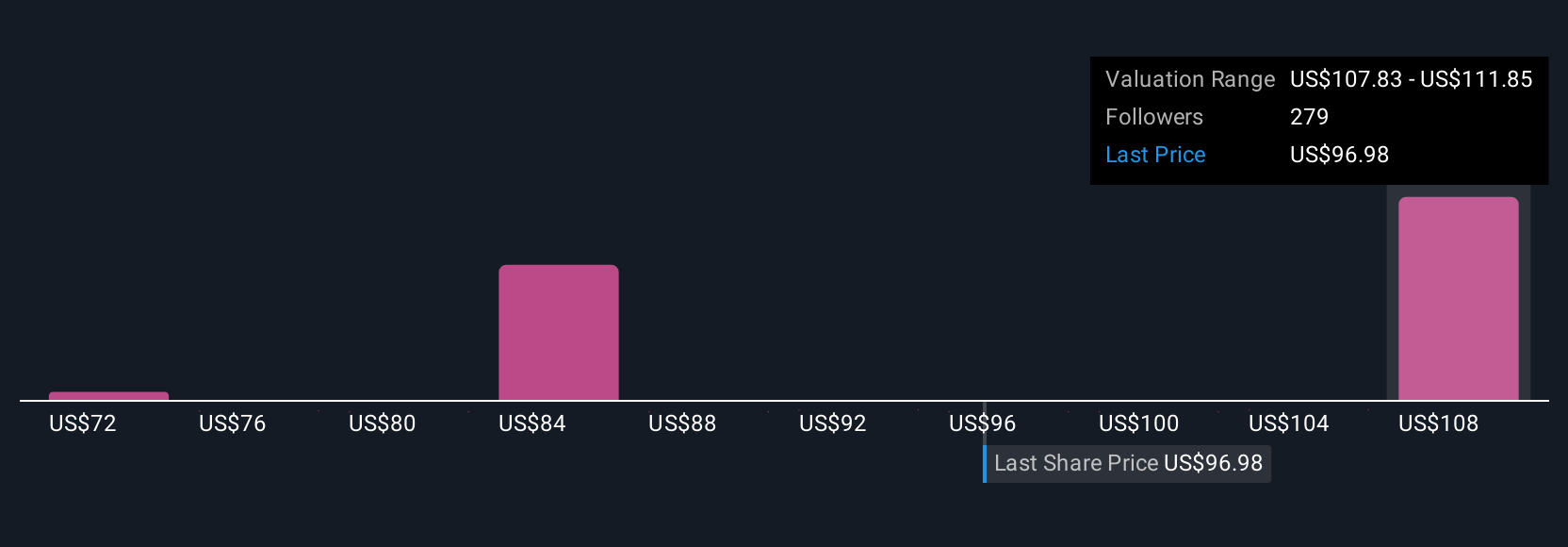

Seventeen fair value estimates from the Simply Wall St Community place Walmart’s worth between US$91.38 and US$118.38 per share. While you see plenty of confidence in Walmart’s omni-channel push, the risk of margin pressure from rising delivery and labor costs means investors in this space should always consider several viewpoints.

Explore 17 other fair value estimates on Walmart - why the stock might be worth as much as 7% more than the current price!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026