- United States

- /

- Food and Staples Retail

- /

- NYSE:WMK

Weis Markets (WMK): Assessing Valuation Following Mixed Q3 Earnings and Profit Decline

Reviewed by Simply Wall St

Weis Markets (WMK) just released its third quarter and nine-month earnings, drawing investor attention. Sales and revenue increased compared to the same period last year, but net income and earnings per share decreased from last year's results.

See our latest analysis for Weis Markets.

Weis Markets shares recently saw a small boost following its earnings release, but this momentum hasn’t reversed the broader trend. The stock’s 1-year total shareholder return is down 5.2%, and its longer-term 3-year return sits even lower at -17.7%. While short-term price gains reflect some positive sentiment around higher sales, the drop in profitability keeps the outlook cautious for now.

If you’re rethinking your approach after recent grocery retail updates, it might be the perfect time to widen your search and discover fast growing stocks with high insider ownership

With shares lagging even as revenue ticks higher, some investors may wonder if Weis Markets is trading at a bargain or if the market has already factored in any hopes of future growth.

Price-to-Earnings of 16.5x: Is it justified?

Weis Markets currently trades on a price-to-earnings (P/E) ratio of 16.5x, slightly below the US market average of 18.2x but more expensive than its peer group average of 15x. With the latest close at $66.7 per share, the P/E ratio offers mixed signals on whether the stock is fairly priced or trading at a premium relative to competitors.

The P/E ratio is important because it measures how much investors are paying for each dollar of the company’s earnings. It is a key metric in consumer retail, where profit margins and sales consistency matter. A higher P/E may signal optimism for future earnings, while a lower one can suggest undervaluation or market skepticism.

While Weis Markets is cheaper than the broader US market, it still comes in higher than the average within its own industry. This could mean investors see earnings growth potential or a quality premium, but it also raises questions about whether its earnings profile and industry standing warrant this premium. If the fair value ratio becomes available, the market could use it as a benchmark for further shifts in valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.5x (ABOUT RIGHT)

However, ongoing weak share performance and a lack of clear earnings growth remain risks that could shift sentiment further if these issues are not improved soon.

Find out about the key risks to this Weis Markets narrative.

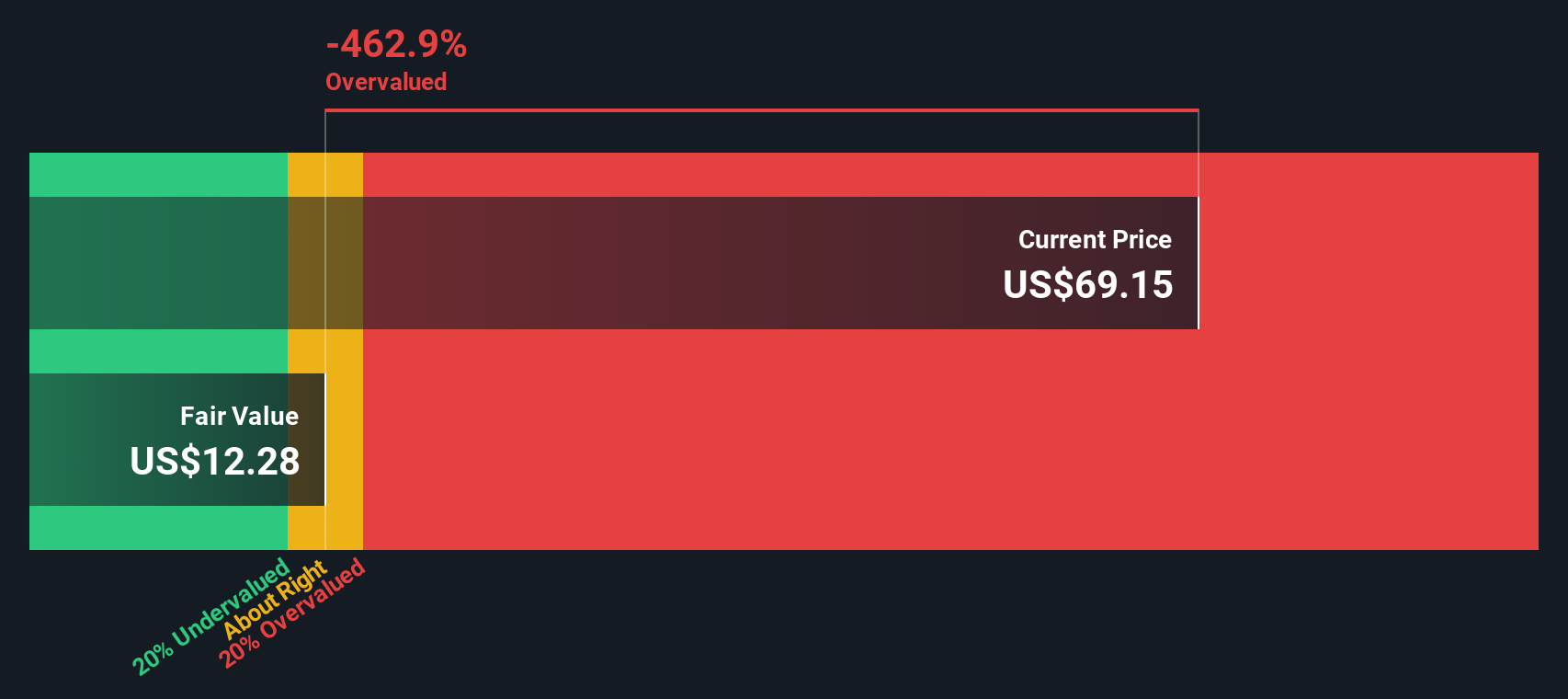

Another View: Discounted Cash Flow Tells a Different Story

Looking at Weis Markets through the lens of the SWS DCF model shows a more cautious picture. The model estimates the fair value at just $11.54 per share, which is well below the current price. This suggests the stock could actually be overvalued, even though the earnings ratio implies otherwise. How does this factor change your outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Weis Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Weis Markets Narrative

If you want to reach your own verdict or dig into the data on your terms, it only takes a few minutes to shape your own perspective, so why not Do it your way

A great starting point for your Weis Markets research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to give your portfolio a powerful edge. The market never waits, and fresh opportunities are one smart move away. Don’t let another day pass without checking these out.

- Tap into high yield by reviewing these 16 dividend stocks with yields > 3%, which features companies offering robust income streams and attractive payout histories.

- Catch the innovation wave with these 25 AI penny stocks, a collection of businesses at the forefront of artificial intelligence transforming entire industries.

- Ride the momentum of digital finance by exploring these 82 cryptocurrency and blockchain stocks, where top emerging players are shaping blockchain and cryptocurrency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weis Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMK

Weis Markets

Engages in the retail sale of food through a chain of supermarkets in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives