- United States

- /

- Food and Staples Retail

- /

- NYSE:WMK

Did Rising Sales but Lower Profits Just Shift Weis Markets’ (WMK) Investment Narrative?

Reviewed by Sasha Jovanovic

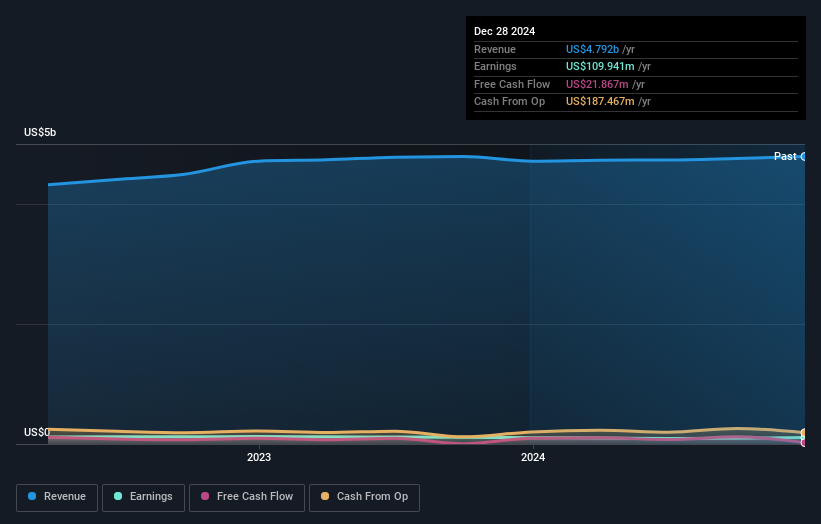

- Weis Markets recently announced its third quarter 2025 results, reporting sales of US$1.24 billion and net income of US$18.23 million, alongside an affirmed quarterly dividend of US$0.34 per share.

- While sales increased compared to the year prior, the company saw a drop in profitability, indicating higher costs or margin pressure despite top-line growth.

- We'll explore how rising sales but declining net income shape the investment narrative for Weis Markets moving forward.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Weis Markets' Investment Narrative?

For Weis Markets, the core thesis rests on steady market share in regional grocery retail and resilience through economic cycles, with consistent sales growth as a bedrock. The latest quarterly results reinforce this, sales increased to nearly US$1.24 billion, but the notable decline in net income to US$18.23 million points to intensifying cost and margin pressures. This shift is important since it could influence the narrative around the company’s ability to grow profits even as revenues tick higher. Additionally, the affirmed US$0.34 dividend signals management’s commitment to shareholder returns, though long-term dividend sustainability is not fully covered by free cash flow, which may figure more into risk discussions now. Overall, recent results put increased attention on whether core profitability can bounce back or if margin challenges will continue to temper catalysts like sales growth.

On the other hand, margin risk looks more pressing after these latest results, something investors should watch closely. Weis Markets' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Weis Markets - why the stock might be worth as much as $64.42!

Build Your Own Weis Markets Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weis Markets research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Weis Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weis Markets' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weis Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMK

Weis Markets

Engages in the retail sale of food through a chain of supermarkets in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives