- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

US Foods Holding (USFD): Assessing Valuation After Recent Share Price Momentum Cools

Reviewed by Simply Wall St

US Foods Holding (USFD) shares have shown some movement lately, catching the attention of investors. While the recent changes are not tied to a major event, the stock’s performance offers an interesting case for those watching the consumer goods sector.

See our latest analysis for US Foods Holding.

US Foods Holding's share price has edged down over the past three months but is still up 8.7% for the year to date. While recent momentum has eased, long-term holders have enjoyed robust compounding, with a one-year total shareholder return of 18.8% and an impressive 214.7% over five years.

If you’re looking for your next opportunity, now is a great time to broaden your investment lens and discover fast growing stocks with high insider ownership

With US Foods Holding trading nearly 26% below the average analyst price target and up significantly over five years, investors are left to wonder whether the stock still has room to run or if future growth is already reflected in today’s price.

Most Popular Narrative: 20.7% Undervalued

US Foods Holding's current share price sits well below the narrative's fair value, raising questions about what drives this optimistic gap. The following excerpt provides a glimpse into a core argument behind this valuation.

US Foods' accelerated investment in digital platforms and supply chain automation, such as the MOXe platform and Descartes routing, has driven record operational efficiency, reduced costs, and enabled best-in-class customer experiences. This approach is setting the stage for sustained net margin expansion and higher long-term profitability.

What’s the secret sauce behind this bullish price target? Quantitative forecasts for margin expansion, earnings momentum, and strategic digital advances are fueling the story. Curious about the actual numbers and how future growth expectations shape the narrative fair value? See what drives the analysts’ confidence and what could surprise the market next.

Result: Fair Value of $92.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in dining trends or higher regulatory costs could slow momentum and challenge US Foods’ ability to meet analyst growth expectations in the coming years.

Find out about the key risks to this US Foods Holding narrative.

Another View: Multiples Demand Caution

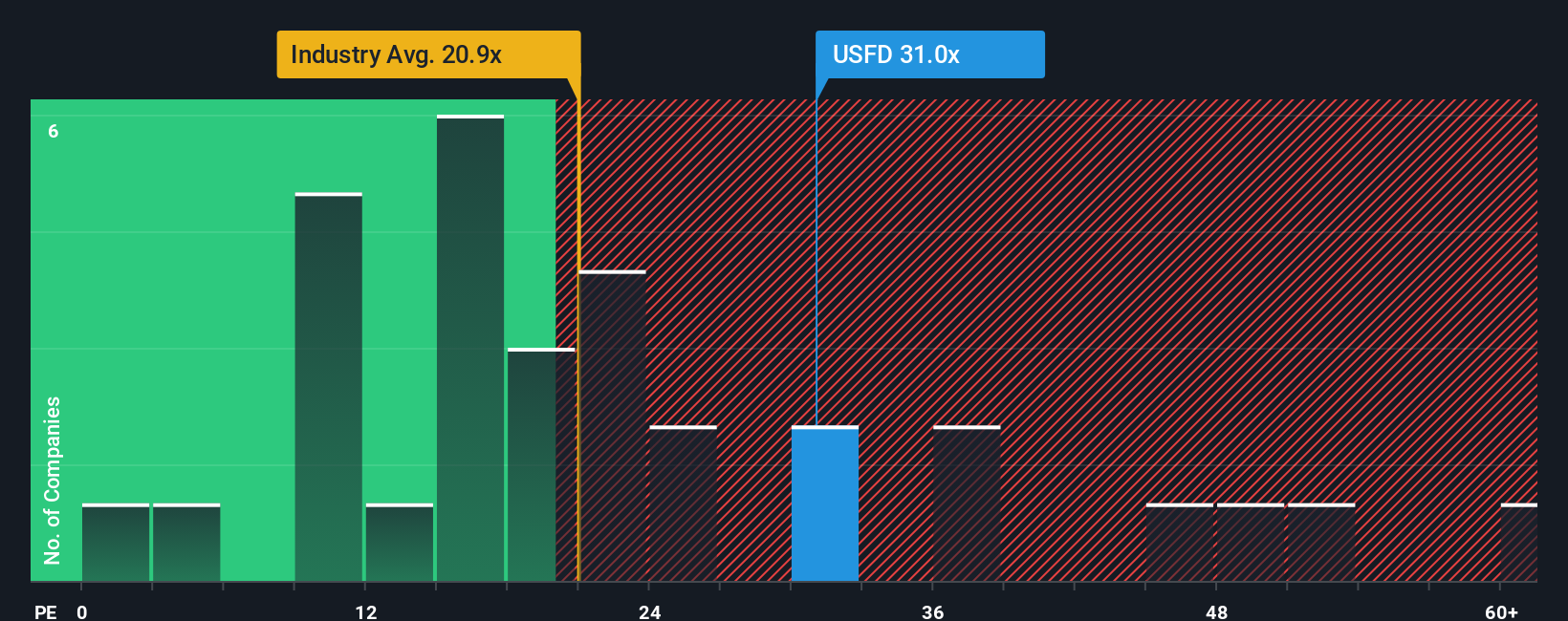

While analyst consensus paints US Foods Holding as undervalued, a closer look at its price-to-earnings ratio tells a different story. The company trades at 29.8 times earnings, higher than both the industry average (20.4x) and peers (29.2x), as well as above the fair ratio of 25.3x. This premium suggests that much of the expected growth may already be factored into the price, raising the question: Are investors paying up for optimism, or is there still value to be found?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own US Foods Holding Narrative

If you see things differently, or want to dig deeper into the numbers yourself, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your US Foods Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop relying on old habits and give yourself an edge by tapping into fresh opportunities that others might overlook. The right screen can help uncover your next big win.

- Accelerate your portfolio’s income growth and check out high-yield potential with these 24 dividend stocks with yields > 3%, which delivers consistent payouts above market averages.

- Tap into future breakthroughs by investigating these 28 quantum computing stocks, where innovation in cutting-edge computing is driving remarkable returns and industry disruption.

- Fuel your strategy with undervalued picks by seizing the chance to outperform through these 831 undervalued stocks based on cash flows before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives