- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

Is United Natural Foods Still a Bargain After 76% Gain and New Partnerships in 2025?

Reviewed by Bailey Pemberton

- Curious if United Natural Foods is undervalued or poised for more gains? Let’s dig into what the numbers and recent trends reveal.

- The stock has caught plenty of attention after climbing 33.2% year-to-date and racking up a 76.4% return over the last year. However, it recently dipped 5.2% in the past week.

- Recent headlines highlight United Natural Foods’ expanding distribution partnerships and strategic moves in the organic and health food space. These developments have fueled optimism among both investors and analysts, helping to explain the stock’s recent momentum despite market fluctuations.

- Currently, United Natural Foods holds a valuation score of 5 out of 6, reflecting its standing across multiple valuation checks. We’ll break down how traditional valuation methods stack up next and look at why there might be an even smarter way to assess if UNFI is a true value opportunity.

Approach 1: United Natural Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its expected future cash flows and discounting them back to today’s dollars. This approach is widely used because it focuses on the core of a business: the cash it generates now and what analysts expect it to generate in the future.

For United Natural Foods, the current Free Cash Flow (FCF) stands at $162.8 million. Analyst estimates predict that annual FCF will rise to $385.2 million by 2026 and continue climbing, with projections of $542 million in the year 2030. It is important to note that while the first several years of projections are based on analyst forecasts, later years are extrapolated by Simply Wall St’s model. These growth expectations reflect optimism about United Natural Foods’ ability to increase cash generation over the next decade.

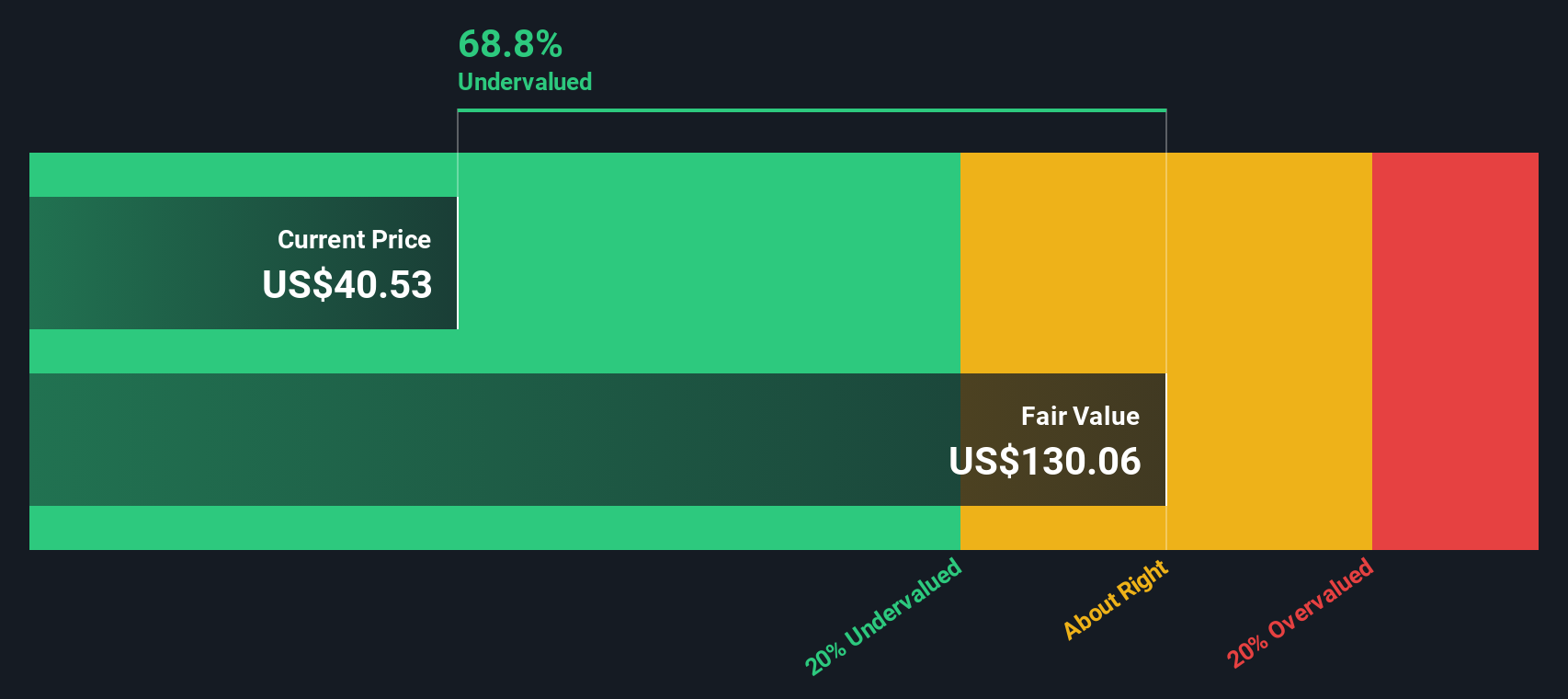

Based on these cash flow projections, the DCF model calculates an intrinsic value of $128.38 per share. That is roughly 71.4% higher than the stock’s current price, which implies a substantial undervaluation at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Natural Foods is undervalued by 71.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: United Natural Foods Price vs Sales

For United Natural Foods, the Price-to-Sales (P/S) ratio is a suitable valuation metric because it provides a useful gauge of how the market values each dollar of the company’s revenue, regardless of current profitability. This is especially relevant for businesses in the consumer retailing sector, where sales volume can be a clearer indication of the company’s scale and market opportunity than earnings alone.

Growth expectations and risk play a big role in determining the “normal” or “fair” P/S ratio for any business. Companies with strong sales growth and lower operational risks typically command higher P/S multiples, while businesses facing competitive or structural challenges tend to trade at lower multiples.

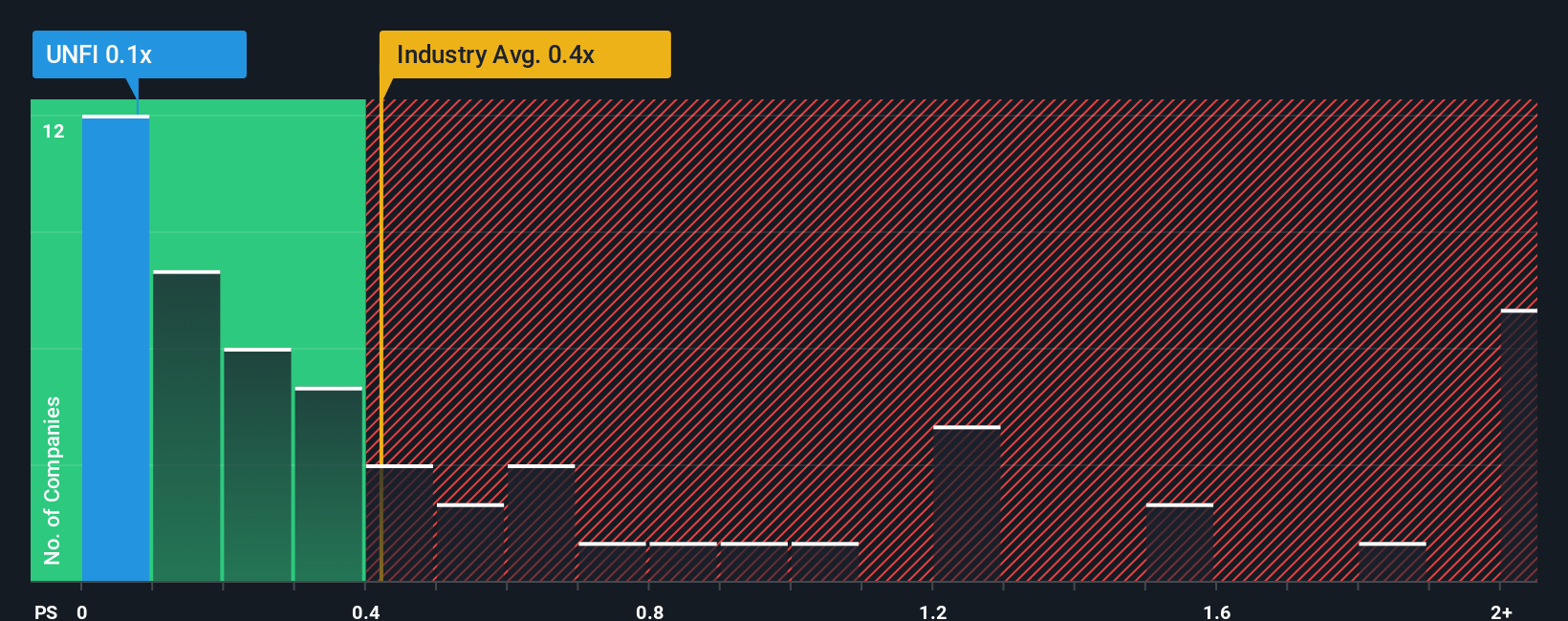

Currently, United Natural Foods trades at a P/S ratio of just 0.07x. This is well below the industry average of 0.43x and the peer average of 0.36x. On first glance, this low multiple might suggest significant undervaluation. However, Simply Wall St’s Fair Ratio model assigns a fair P/S ratio of 0.17x for United Natural Foods, taking into account specific factors like its earnings growth, profit margins, market cap, risk profile, and the dynamics of the consumer retailing industry.

The Fair Ratio is more insightful than a simple peer or industry comparison because it adjusts for the unique strengths and risks of United Natural Foods, rather than assuming one-size-fits-all valuation standards. It allows investors to see where the company truly stands in relation to what the market should be willing to pay based on its fundamentals.

Since United Natural Foods' actual P/S ratio of 0.07x is well below the Fair Ratio of 0.17x, the stock looks undervalued using this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Natural Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, interactive way to capture your own story about a company, including how you see its future revenue, earnings, and margins, connecting that perspective directly to a financial forecast and a personally-derived fair value.

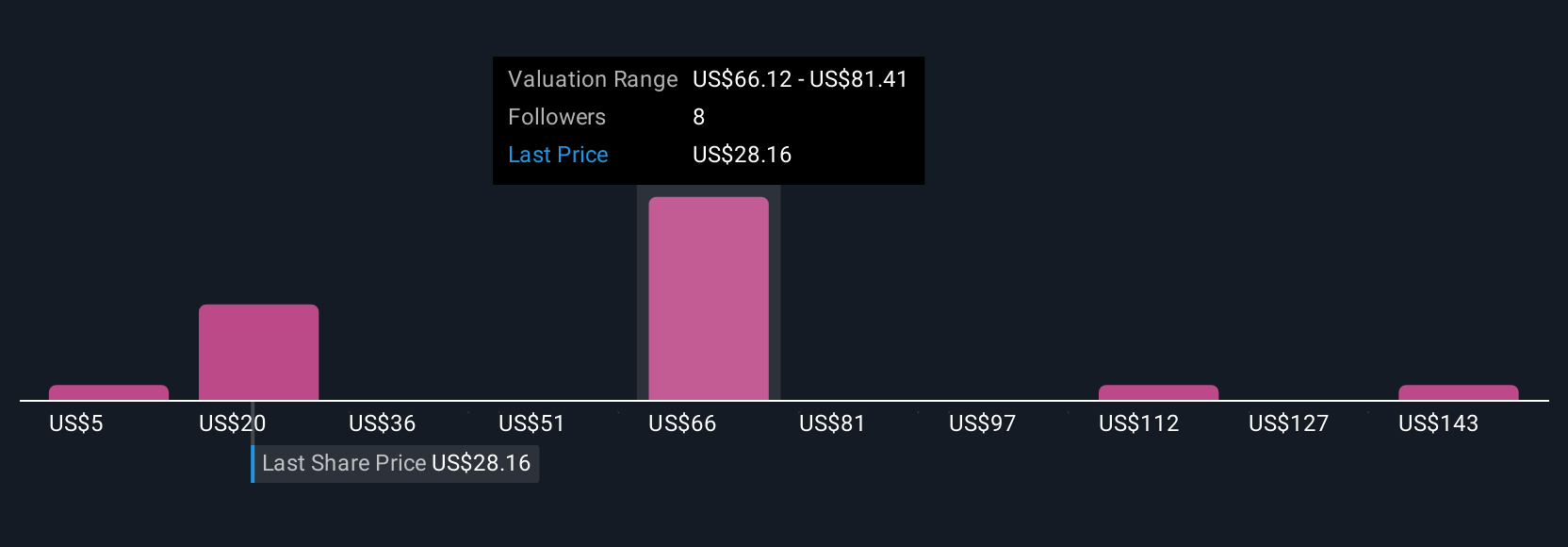

On Simply Wall St’s platform, Narratives are an easy tool available within the Community page, used by millions of investors to share, update, and compare their views. Narratives go beyond static models by letting you incorporate not just the numbers, but your reasoning and expectations behind them. By tracking how your Narrative’s Fair Value compares to the current price, Narratives empower you to decide when a stock is undervalued, fairly priced, or it may be time to take profits.

The best part is that Narratives are dynamically updated as new information such as earnings or major news is released, so your analysis always reflects the latest changes. For example, looking at United Natural Foods, you might see some investors are highly optimistic, expecting a future fair value as high as $42 per share based on robust margin expansion and industry growth. Others are more cautious, with a fair value closer to $24, factoring in competitive pressures and operational risks. Which Narrative aligns with your view? That is the story you can own, test, and adjust as the facts evolve.

Do you think there's more to the story for United Natural Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNFI

United Natural Foods

Engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives