- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

How Does Target’s Price Stack Up After Employee Survey Reveals Doubts About Company Direction?

Reviewed by Bailey Pemberton

If you are staring at Target's current share price and wondering whether it is time to buy, hold, or pass, you are not alone. It's been a bumpy ride lately, and you want to feel confident about whichever direction you choose. In the last week alone, shares managed to bounce up by 2.7%, suggesting there is still life in the stock despite deeper losses over the past year. Longer-term performance tells a tougher story: down 3.2% for the month, and a steep drop of almost 38% in the past year. That sort of drawdown has left many investors anxious, but also potentially opened up a window of opportunity for anyone who believes in a turnaround story.

So, why the volatility? Part of the picture comes from shifting company news. The recent employee survey revealing that a significant chunk of Target’s staff is worried about the company's long-term direction may have raised concerns about management’s grip on morale and strategy. Meanwhile, the move to end its popular price-matching policy likely sent ripples through consumer sentiment, sparking debates about Target’s competitiveness as rivals, such as Walmart, amp up their own employee perks. It is a whirlwind of change that can feel destabilizing, or like a chance to buy low if you see value where others see risk.

On that note, the numbers surrounding valuation have gotten more appealing. On a scale that gives one point for every “undervalued” signal in six key checks, Target lands a score of 5. That means undervalued flags are blinking in nearly all the usual places. Next, let’s break down exactly which valuation approaches paint Target as a buy. Keep your eyes open, because by the end of this article, you’ll have a smarter, more nuanced view of what valuation really means for this stock.

Why Target is lagging behind its peers

Approach 1: Target Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate what a business is worth today by forecasting its future cash flows and then discounting those amounts back to their present value. This approach considers how much cash the company is expected to generate over time, adjusting for the fact that cash now is worth more than the same amount in the future.

For Target, the latest reported Free Cash Flow stands at $2.26 Billion. Analyst forecasts project that annual Free Cash Flow will rise to $3.49 Billion by 2030. While analysts provided estimates for the first five years, further projections are extrapolated by Simply Wall St, offering a complete ten-year picture of future growth. This steady increase in cash flow underpins the company’s optimistic long-term valuation.

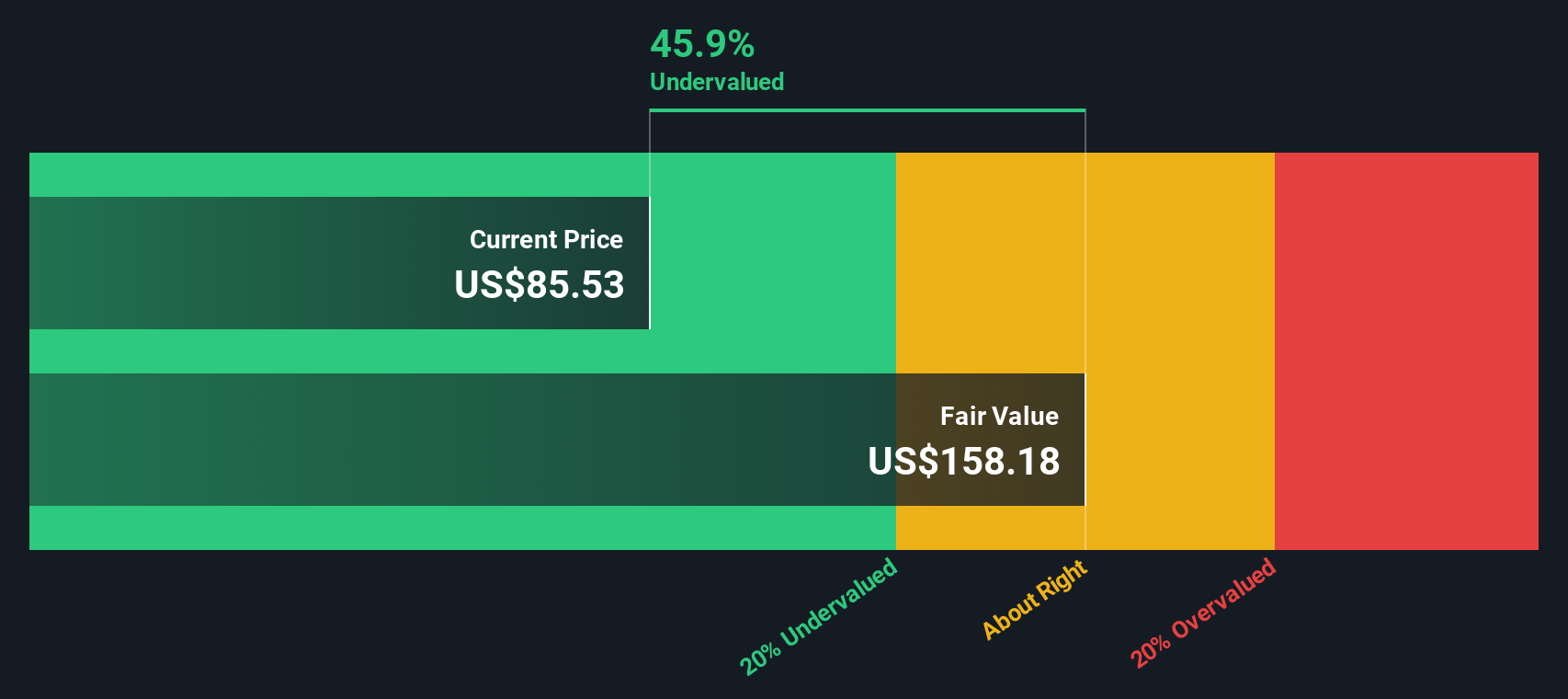

Based on this model, Target's intrinsic value is calculated at $158.90 per share. Compared to recent market prices, this implies a hefty discount of 43.7 percent, suggesting Target shares are currently well below their DCF-based fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Target is undervalued by 43.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Target Price vs Earnings

The Price-to-Earnings (PE) ratio is a particularly useful tool for evaluating established, profitable companies like Target. This metric measures how much investors are willing to pay today for every dollar of current earnings, making it a clear and straightforward way to gauge relative valuation. Generally, companies with stronger growth prospects, lower risk profiles, or higher profitability can justify higher PE ratios. In contrast, riskier or slower-growing businesses tend to trade at lower multiples.

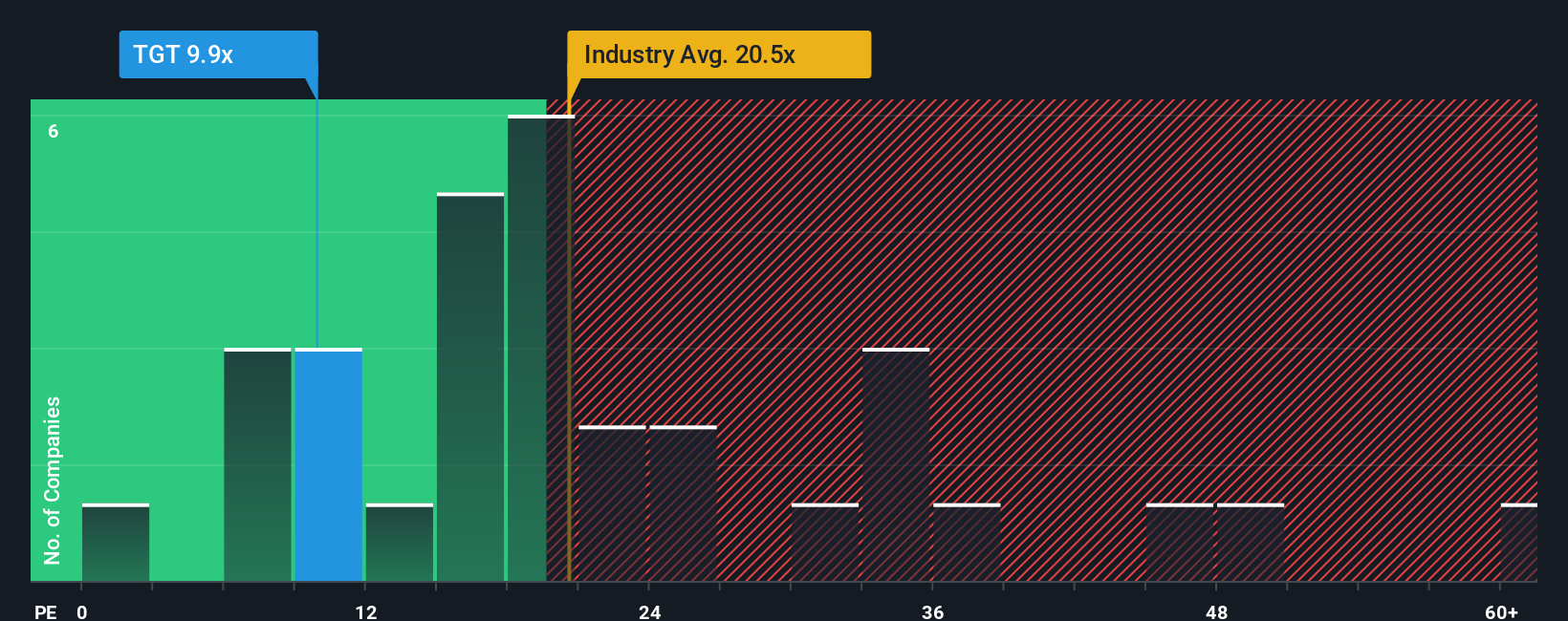

Currently, Target has a PE ratio of 10.35x. For context, the average PE ratio across the Consumer Retailing industry is 20.93x, and Target’s peer group sits even higher at 26.58x. Both of these benchmarks are well above where Target currently trades, which might hint at undervaluation.

However, relying solely on generic industry or peer averages can be misleading. Simply Wall St's Fair Ratio considers a mix of relevant factors such as Target’s earnings growth, industry positioning, profit margins, scale, and risk characteristics to determine a more tailored, “true” multiple. Target’s Fair Ratio is calculated at 20.80x, nearly double its current multiple. Since this fair value explicitly accounts for what matters most to Target’s outlook, it gives a more informed baseline for assessment than a one-size-fits-all comparison.

With the company’s PE ratio far below its Fair Ratio, the evidence suggests Target is undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Target Narrative

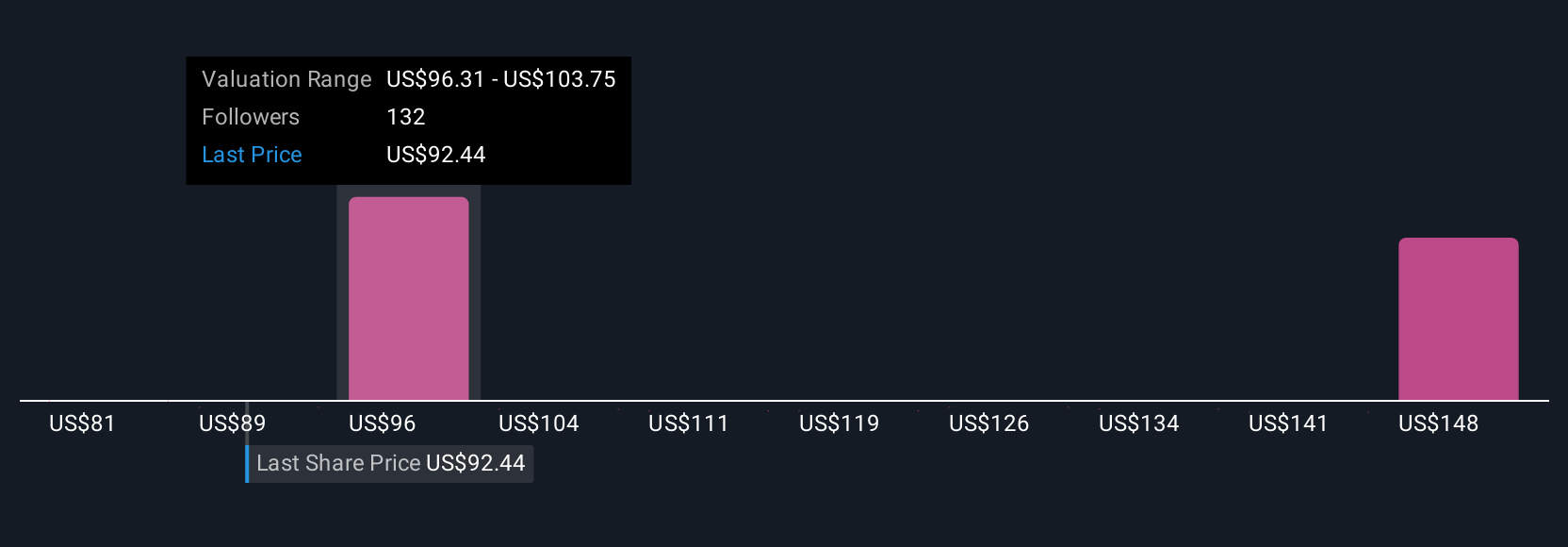

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, where you connect the dots between what you think will happen operationally, such as future revenue, earnings, and profit margins, and what the stock is actually worth today. Narratives take the numbers from traditional valuation models (like DCF and PE) and layer on your perspective about the business’s future, transforming raw data into a living, breathing investment case.

On Simply Wall St’s Community page, Narratives make this process easy for all investors. You can build and adjust your own narrative, see others’ perspectives, and instantly see what fair value that story supports. When the facts change, such as big news, earnings, or analyst updates, Narratives update automatically, helping you stay one step ahead. This way, you can quickly compare your calculated fair value to the current share price, giving you a dynamic indicator for when to buy, hold, or sell.

For example, among recent Narratives about Target, some investors expect strong gains from private label brands and digital sales, justifying optimistic price targets around $135. Others focus on tough competition and margin pressures, leading them to set bearish values near $82. This highlights how your conviction and research can directly shape your investment view, giving you control over your own decision-making process.

Do you think there's more to the story for Target? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success