- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

Sysco (SYY): Evaluating Valuation Following Strong Sales Growth and Upbeat Management Guidance

Reviewed by Simply Wall St

Sysco (SYY) recently reported quarterly results that drew attention with a solid uptick in sales across U.S. Foodservice, International, and SYGMA, even as net income saw only a slight shift. Management’s decision to reiterate full-year sales and earnings growth guidance for fiscal 2026 signals ongoing confidence and was well received by investors.

See our latest analysis for Sysco.

Sysco’s steady operational improvements and recent MICHELIN Guide partnership have sparked renewed interest among investors, reflected in its 1-day share price gain of 3.11%. However, its 1-year total shareholder return is virtually flat at -0.19%, which signals that long-term momentum has yet to fully materialize even as the business shows incremental progress.

If positive sales trends in food distribution have your attention, you might find it rewarding to broaden your search and discover fast growing stocks with high insider ownership

This recent combination of steady sales momentum and upbeat management guidance raises a key question: Is Sysco’s current share price leaving room for further upside, or are investors already factoring in all the expected growth?

Most Popular Narrative: 13.5% Undervalued

Sysco’s current share price of $75.18 sits well below the most widely followed narrative’s fair value estimate of $86.94. The narrative’s valuation is based on the expectation that operational and strategic improvements will drive stronger earnings over the next several years.

Sysco is focused on improving its sales consultant workforce. New hires are becoming more productive, and a strategic shift in the compensation model is expected to enhance revenue and earnings starting in fiscal 2026.

The company is expanding its fulfillment capacity with new facilities in Florida and internationally in Sweden and Ireland, which is expected to boost its storage and distribution ability to capture profitable revenue growth in key markets.

Curious what foundational assumptions lead to this valuation gap? The underlying story involves a planned surge of sales and profit, reordered incentives, and an international footprint intended to reshape future financial results. Want to see exactly what numbers drive expectations of a higher share price? The details might surprise you.

Result: Fair Value of $86.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic challenges and persistent sales consultant turnover could slow revenue growth and delay Sysco’s return to sustained outperformance.

Find out about the key risks to this Sysco narrative.

Another View: Market Multiple Signals Opportunity

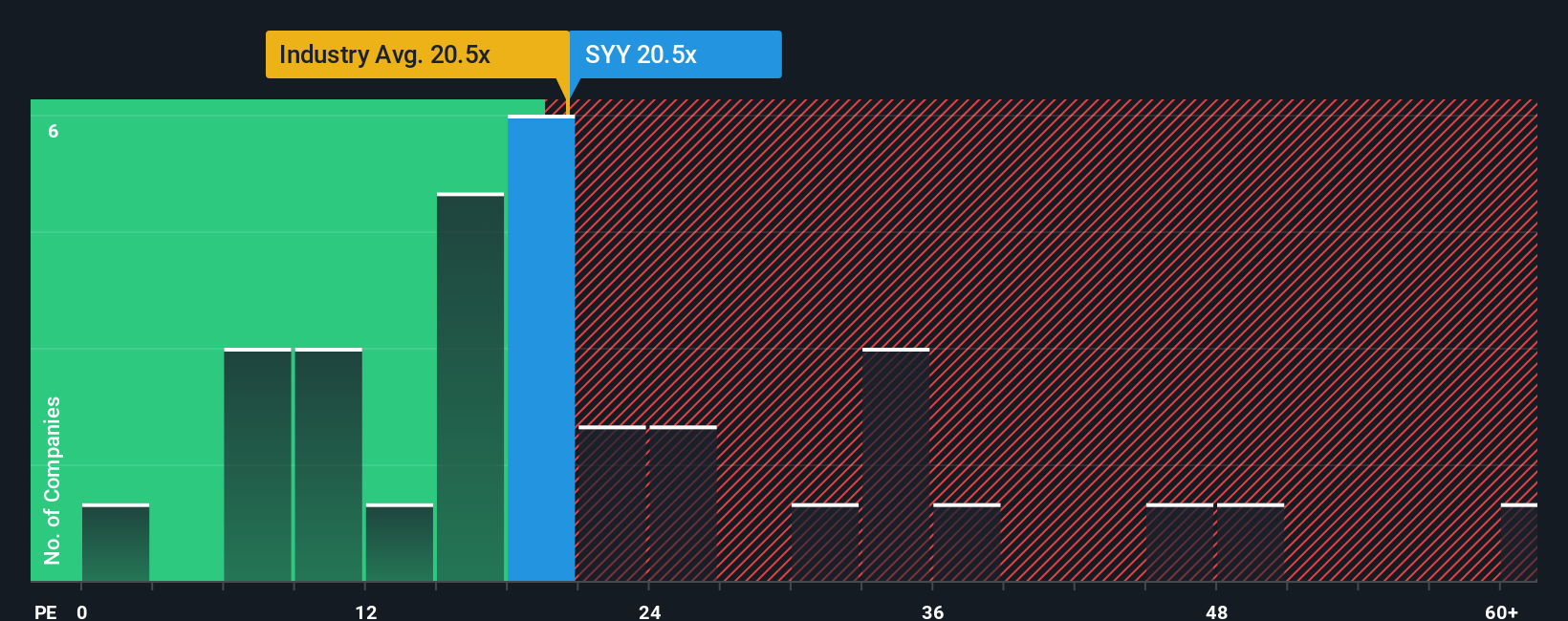

Looking at valuation through earnings multiples tells a nuanced story. Sysco's price-to-earnings ratio stands at 19.8x, which is more expensive than both the US Consumer Retailing industry average of 19.4x and its own net profit is lower year over year. However, when compared to the peer average of 33.5x and a fair ratio of 24.3x, where the market may gravitate over time, Sysco appears attractively priced. Does this signal a margin of safety or hint at market caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sysco Narrative

If you want to dig deeper, you can sift through the data and build your own Sysco outlook in just a few minutes. Do it your way

A great starting point for your Sysco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Now is the time to step up your investing game by finding stocks others might overlook. Uncover emerging opportunities beyond Sysco with just a few clicks.

- Grow your passive income with attractive yields by checking out these 16 dividend stocks with yields > 3%, which offers reliable dividends and robust financial performance.

- Tap into the future of medicine by searching these 32 healthcare AI stocks, which leads innovation in healthcare with breakthrough artificial intelligence solutions.

- Seize the potential in cutting-edge cryptocurrencies by reviewing these 82 cryptocurrency and blockchain stocks, which is changing how markets think about digital assets and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives