- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

Sysco (SYY) Completes Buyback, Reports Earnings Drop and Predicts Future Sales Growth

Reviewed by Simply Wall St

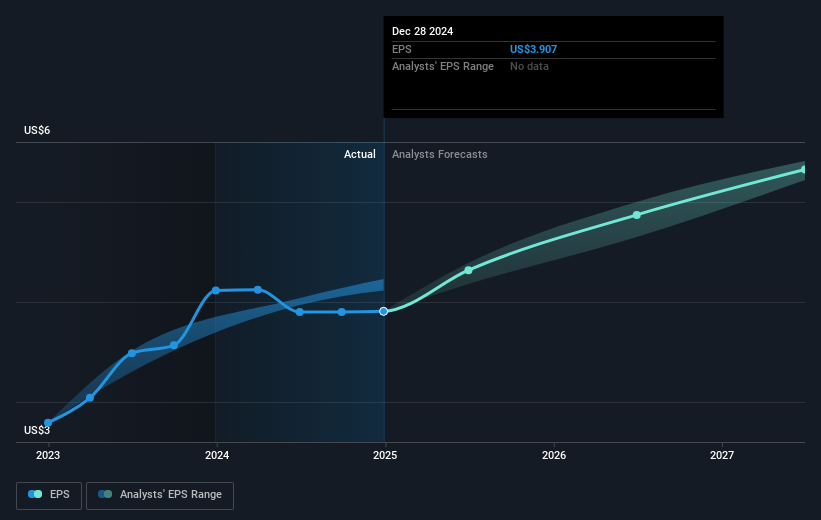

Sysco (SYY) recently updated its share buyback program, completing a significant repurchase, and reported fiscal year-end earnings that showed increased sales but a decline in net income and EPS. The company's corporate guidance for a 3% to 5% growth in fiscal 2026 sales also added context to their strategic direction. During a quarter with a 9.78% increase in share price, this likely aligned with broader market optimism around corporate earnings, as evidenced by similar trends in the S&P 500 and Nasdaq indices. These updates could have supported Sysco's gains against the backdrop of a generally positive market environment.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Sysco's recent share buyback and updated fiscal guidance underscore its intent to navigate market challenges while enhancing shareholder value. Despite a near 10% quarterly share price rise, Sysco's five-year total return, including dividends, amounted to 64.84%. This longer-term return highlights considerable growth and shareholder gains, affirming Sysco's resilience amidst market fluctuations. Over the past year, however, Sysco underperformed both the US market and its industry, highlighting potential areas for improvement despite solid longer-term performance.

The company's recent strategic moves, including buybacks and guidance, might positively influence revenue and earnings forecasts. Enhanced workforce productivity and expanded facilities could drive future revenue growth, although economic uncertainties and weather-related disruptions could pose risks. With a price target of US$84.31 and a current share price of US$78.38, there's a modest discount to the target. This could reflect cautious optimism about Sysco's ability to meet analyst expectations and achieve projected growth amidst evolving industry conditions.

Review our historical performance report to gain insights into Sysco's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives