- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

How Investors Are Reacting To Sysco (SYY) Labor Strike Authorization at Key West Coast Facilities

Reviewed by Sasha Jovanovic

- In the past week, over 400 Teamsters at Sysco’s San Francisco facility and more than 270 in Portland voted to authorize strike action, seeking improved wages, benefits, and working conditions as contract negotiations with the company continue.

- This unified labor stance, now involving nearly 800 workers across major West Coast operations, follows recent union gains at key Sysco competitors and places significant pressure on Sysco to resolve labor disputes to avoid operational disruptions.

- Next, we'll examine how the prospect of a large-scale strike raises questions about Sysco's ability to deliver on its earnings growth plans.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sysco Investment Narrative Recap

Sysco’s long-term thesis relies on its scale, efficiency, and steady demand for foodservice distribution, but any investor will want confidence in its ability to deliver consistent earnings growth while managing costs. The recent strike authorizations among nearly 800 West Coast Teamsters introduce a meaningful short-term operational risk, as labor disruptions could impact Sysco’s near-term ability to hit sales and profitability targets; for shareholders, this risk now outweighs typical external headwinds like economic conditions or industry trends.

Looking at company announcements, Sysco’s most relevant recent move is its implementation of a new compensation model and workforce development strategy for sales consultants, aimed at supporting revenue and earnings improvement from fiscal 2026. With these labor challenges unfolding, the timing and execution of such internal productivity improvements become even more critical to the near-term growth outlook, and to maintaining investor confidence in Sysco’s ability to offset disruption and rebuild sales momentum.

However, with labor action risks now in play, investors should be aware that...

Read the full narrative on Sysco (it's free!)

Sysco's outlook forecasts $91.9 billion in revenue and $2.6 billion in earnings by 2028. This is based on yearly revenue growth of 4.2% and a $0.8 billion increase in earnings from the current $1.8 billion.

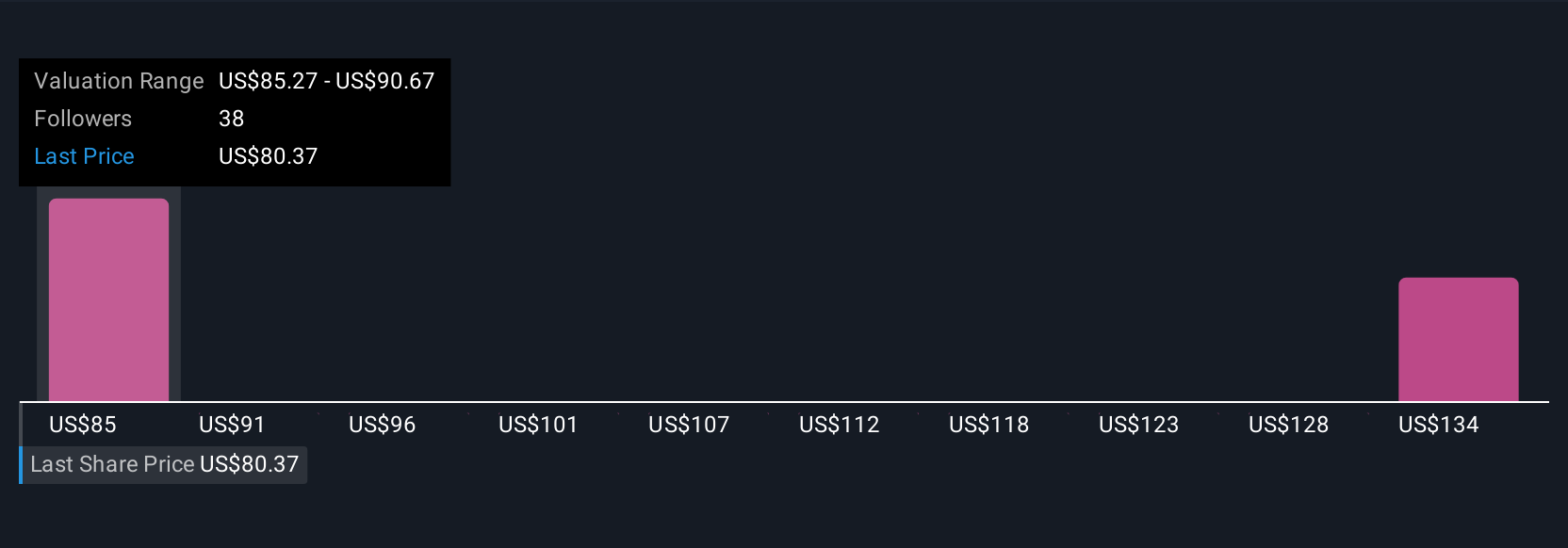

Uncover how Sysco's forecasts yield a $85.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published fair value estimates for Sysco ranging from US$85.60 to US$144.46, drawing on two distinct forecasts. Against this backdrop, the threat of widespread labor disruption could be a major swing factor for future company performance, inviting you to compare these views for yourself.

Explore 2 other fair value estimates on Sysco - why the stock might be worth just $85.60!

Build Your Own Sysco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sysco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sysco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sysco's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion