- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger Stock Climbs 18% Amid Delivery Expansion: Is Its Value Forecast Too Low?

Reviewed by Bailey Pemberton

- Curious if Kroger's stock is a good deal right now? You are not alone, especially as investors hunt for value in today's market.

- Shares have climbed 3.6% in the last week and are up a solid 18.3% over the past year, showing both short-term momentum and long-term strength.

- Recent headlines highlight Kroger's ongoing efforts to streamline operations and expand its digital initiatives, a move that has caught the attention of both investors and rivals. News around strategic partnerships and an increased focus on delivery services adds important context to these recent price changes.

- For those watching the numbers, Kroger earns a 5 out of 6 on our value checks. This is impressive, but let's see how the numbers add up using several different valuation approaches, and keep an eye out for an even better way to cut through the noise at the end of the article.

Approach 1: Kroger Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those numbers back to the present using a required rate of return. This approach helps investors assess what a business is fundamentally worth today, based on expected future performance.

For Kroger, the latest available Free Cash Flow (FCF) stands at approximately $2.2 billion. Looking ahead, analyst estimates plus conservative extrapolations project Kroger’s FCF to steadily increase, potentially reaching roughly $3.2 billion by 2030. Most detailed analyst projections cover the next five years, while Simply Wall St extends the outlook through to 2035 using reasonable growth assumptions.

Applying the DCF model calculations to these projections, the result is a fair value estimate of $87.87 per share. That figure implies Kroger’s stock is currently trading at a 23.3% discount to its intrinsic value, suggesting meaningful undervaluation in the current market.

The data points to a strong upside for patient investors willing to rely on Kroger’s steady cash generation and growth potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kroger is undervalued by 23.3%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

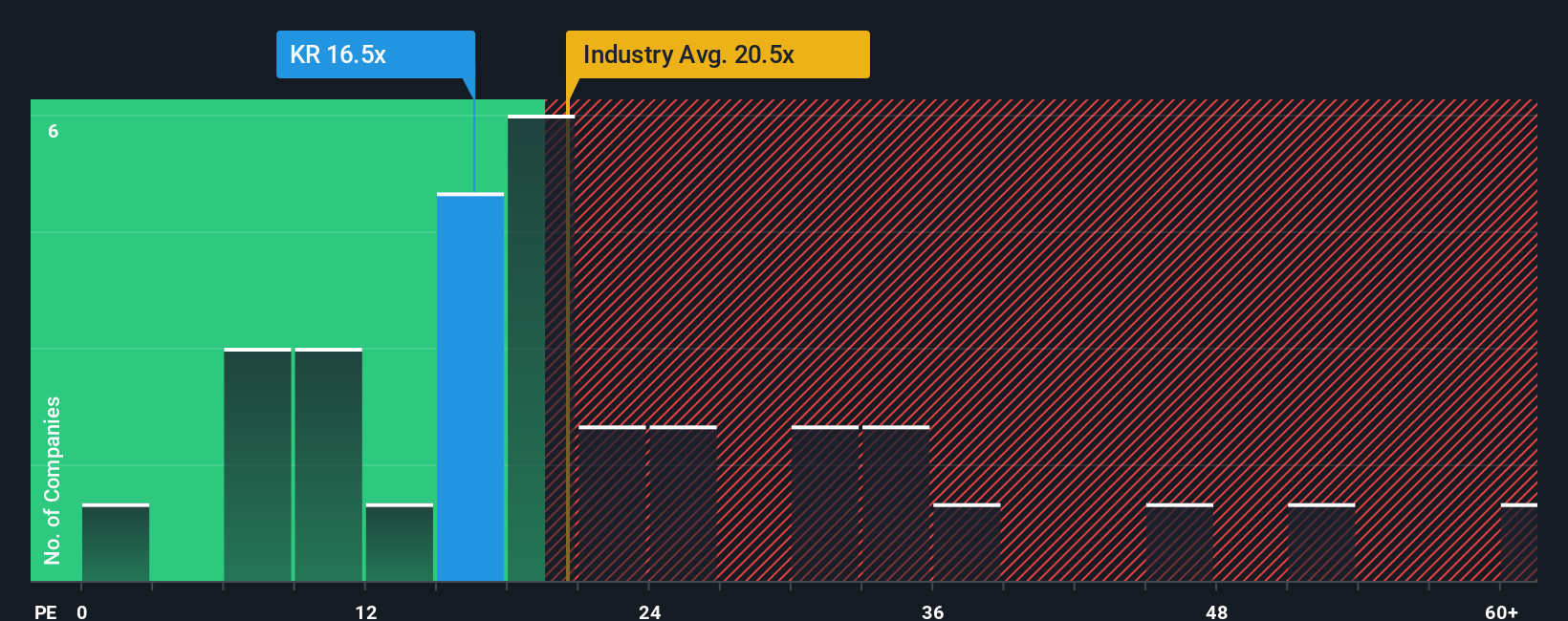

Approach 2: Kroger Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Kroger, because it relates a company’s share price to its earnings. For investors, the PE ratio offers a quick snapshot of how much you are paying for each dollar of profits. This can be a useful lens for assessing value in established businesses with consistent earnings streams like Kroger.

What constitutes a “normal” or “fair” PE ratio depends on several factors, including expected earnings growth and the perceived risk of a company. Businesses with higher growth prospects or lower risk typically command higher PE ratios, while slower-growth or riskier firms typically trade at a discount to the market.

Kroger is currently trading at a PE ratio of 16.5x. This is well below the average for its Consumer Retailing industry, which stands at 20.7x, and also below its peers’ average of 20.5x. This might initially suggest Kroger is undervalued relative to others in its sector. However, Simply Wall St’s “Fair Ratio” goes a step further by factoring in not just earnings, but Kroger’s specific growth rates, risk profile, profit margins, market cap, and its place within the industry. For Kroger, the calculated Fair Ratio is 22.2x.

The Fair Ratio is more comprehensive than a plain comparison with industry or peers because it captures the unique characteristics and future prospects of the company. In Kroger’s case, its actual PE ratio of 16.5x sits well below the Fair Ratio of 22.2x, signaling that the stock appears undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1420 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kroger Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives: a powerful tool that goes beyond just crunching numbers by giving you the story behind the figures.

A Narrative is your way to connect a company’s journey, outlook, and unique events to a financial forecast and, ultimately, a fair value. This approach ties real business changes directly to your investing decisions.

Simply Wall St’s Narratives, available and used by millions on the Community page, let you write or follow perspectives that spell out where you think Kroger’s revenue, profit margins, and earnings are headed based on what is happening in the real world, not just what the models say.

By drawing a clear link between a company’s story and numbers, Narratives help you see whether it is time to buy or sell by comparing your own view of Fair Value to today’s share price. They also automatically stay current as earnings or news come in.

For example, one analyst believes Kroger could be worth as much as $85.00 per share thanks to digital growth and premium product expansion. Another sees challenging competition and wage increases justifying a lower $63.00 target. These are two valid narratives from the same set of facts.

Do you think there's more to the story for Kroger? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives