- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

How Dollar General's (DG) New COO and Leadership Changes Have Shifted Its Investment Narrative

Reviewed by Sasha Jovanovic

- Dollar General recently announced a series of executive leadership changes, most notably appointing Emily C. Taylor as Chief Operating Officer effective November 16, 2025, along with the promotion of key leaders in merchandising and the elimination of the EVP of strategy and development role following Steve Deckard's departure.

- These moves draw attention to the company's continued investment in experienced, long-serving talent and suggest a potential shift in focus for leadership priorities and operational direction.

- We'll examine how Emily Taylor's appointment as COO and the associated leadership restructuring shape Dollar General's ongoing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dollar General Investment Narrative Recap

Dollar General’s investment narrative hinges on the company’s ability to maintain profitable growth in rural and suburban markets, underpinned by effective execution of store expansion and digital initiatives. The latest leadership changes, featuring the appointment of Emily Taylor as Chief Operating Officer, are unlikely to materially affect the key near-term catalysts, continued store rollouts and digital partnerships remain central, while over-expansion remains the most pressing risk as Dollar General pushes into already well-penetrated regions. Among recent announcements, Taylor’s elevation to COO stands out, given her pivotal role driving merchandising, private label expansion, and the launch of pOpshelf®. Her wide-ranging experience, particularly in enhancing in-store experience and leading category innovation, directly support Dollar General’s ongoing drive to boost non-consumable sales, a critical piece for improving margins and offsetting mounting competitive pressures. However, investors should also keep in mind that, despite these leadership moves, concerns about over-expansion and potential store saturation in core U.S. markets remain...

Read the full narrative on Dollar General (it's free!)

Dollar General's outlook anticipates $46.9 billion in revenue and $1.7 billion in earnings by 2028. This is based on analysts forecasting 4.1% annual revenue growth and a $0.5 billion increase in earnings from the current $1.2 billion.

Uncover how Dollar General's forecasts yield a $120.11 fair value, a 18% upside to its current price.

Exploring Other Perspectives

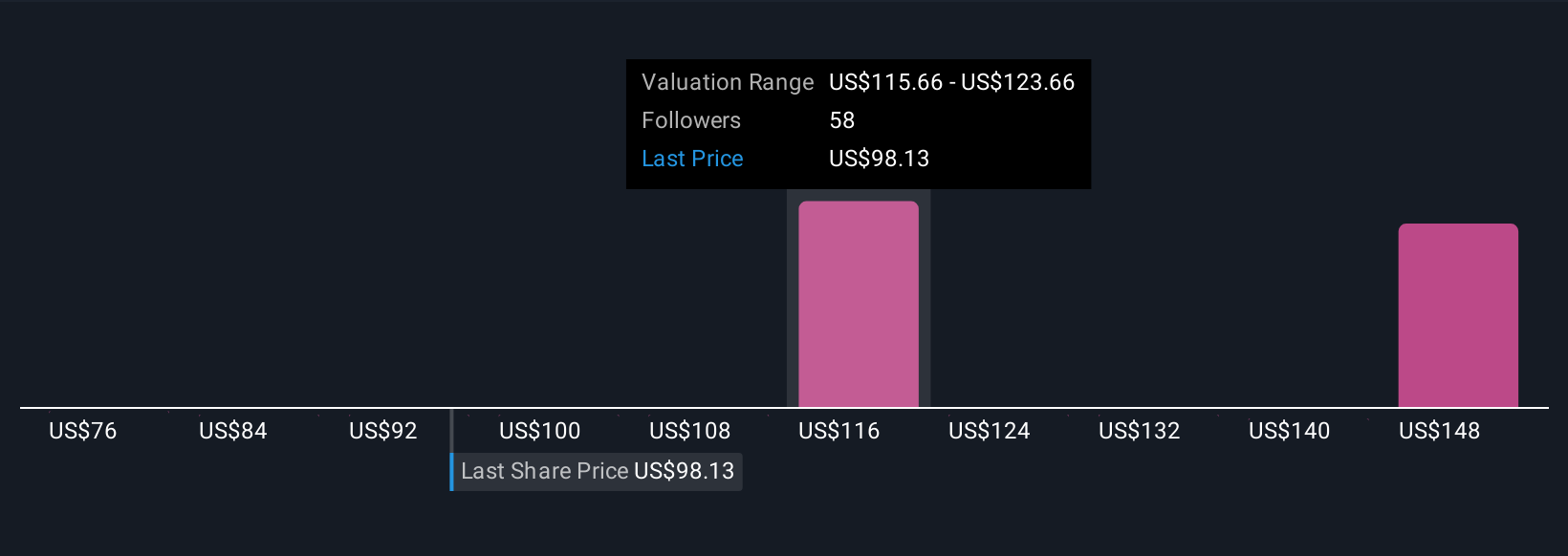

Six Simply Wall St Community members estimate Dollar General’s fair value between US$93.54 and US$157.64, showcasing broad disagreement around the company’s prospects. Setting this diversity alongside persistent risks of over-expansion highlights why your outlook may differ, there are several perspectives you should consider before making a decision.

Explore 6 other fair value estimates on Dollar General - why the stock might be worth 8% less than the current price!

Build Your Own Dollar General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollar General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar General's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives