- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

Dollar General’s (DG) Raised 2025 Guidance Shifts The Investment Narrative - What Should Investors Watch Now

- Dollar General reported first-quarter sales of US$10.44 billion and net income of US$391.93 million, with earnings per share rising to US$1.78, and raised its full-year sales and EPS guidance for fiscal year 2025 due to higher spending per customer and market share gains.

- The company is expanding its customer base into middle- and upper-income demographics, launching home delivery, and prioritizing store expansion and remodels, while actively developing plans to manage potential tariff impacts.

- We'll examine how Dollar General's raised full-year outlook, driven by strong first-quarter results, reshapes the company's investment narrative.

Dollar General Investment Narrative Recap

For anyone considering Dollar General, the core belief is in its ability to keep growing sales by attracting new customers and extending its value proposition, even as it faces industry headwinds. The upgraded full-year guidance following strong first-quarter numbers brings new attention to near-term sales execution as a key catalyst, while rising tariff costs remain a significant risk for margins. For now, these latest announcements are materially relevant to both factors.

Among recent developments, Dollar General’s raised sales and earnings outlook stands out, closely tied to better-than-expected first-quarter results and ongoing efforts to broaden its customer base. This updated guidance reinforces the current catalyst, stronger spending trends, but also highlights why investors are monitoring operational performance so closely as the retailer expands and consumer behaviors evolve.

But while optimism about sales momentum is growing, investors should also consider the unresolved questions about tariff impacts that could ...

Read the full narrative on Dollar General (it's free!)

Exploring Other Perspectives

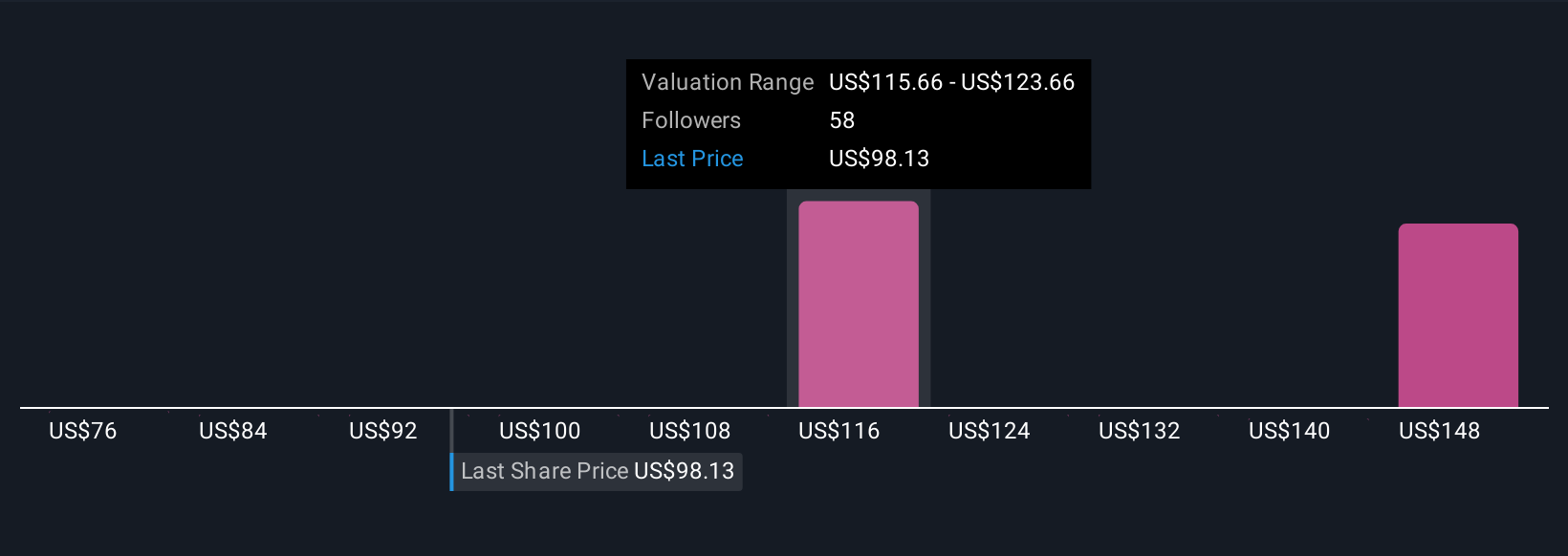

Simply Wall St Community members have published 12 independent fair value estimates on Dollar General, stretching from US$54.85 to US$274.34 per share. With recent guidance shifts emphasizing sales momentum as a catalyst, these sharply varied opinions reveal just how wide expectations are, and underscore the value of comparing several distinct viewpoints.

Build Your Own Dollar General Narrative

Disagree with existing narratives? Create your own in under 3 minutes, extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollar General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar General's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here, pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives