- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

Could Community Partnerships Like BJ’s (BJ) Latest Tennessee Expansion Strengthen Its Local Market Position?

Reviewed by Sasha Jovanovic

- BJ's Wholesale Club announced that its Sevierville, Tennessee location opened on November 14, adding its fifth club in the state, with the on-site gas station beginning operations October 29 and offering savings through the Fuel Savers Program.

- An important element of this opening is BJ’s partnership with Second Harvest Food Bank of East Tennessee, marked by a US$75,000 grant to enhance food distribution in the local community.

- We’ll explore how this latest club and community initiative supports BJ’s growth in new markets and reinforces its membership appeal.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

BJ's Wholesale Club Holdings Investment Narrative Recap

To own BJ’s Wholesale Club Holdings, investors need confidence in the membership warehouse model’s appeal in new and underpenetrated markets, steady membership growth, and the company’s ability to balance expanding its physical footprint with managing costs. The Sevierville, Tennessee club opening signals continued progress on footprint expansion, but does not meaningfully change concerns over rising operational expenses or the competitive margin pressures that remain the most important near-term risk for BJ’s business.

One of the company’s most relevant recent announcements is its guidance for 2.0%–3.5% comparable club sales growth for fiscal 2026, which closely aligns with the rationale behind new club openings like Sevierville. This guidance, however, remains subject to ongoing risks from macroeconomic volatility and persistent pricing competition in warehouse retail, both of which could affect the impact of new stores as near-term catalysts.

However, with rising costs from new store launches and the potential for margin erosion, investors should be aware of the increased risk of...

Read the full narrative on BJ's Wholesale Club Holdings (it's free!)

BJ's Wholesale Club Holdings is projected to achieve $25.2 billion in revenue and $683.1 million in earnings by 2028. This outlook assumes annual revenue growth of 6.5% and an increase in earnings of $104.2 million from the current level of $578.9 million.

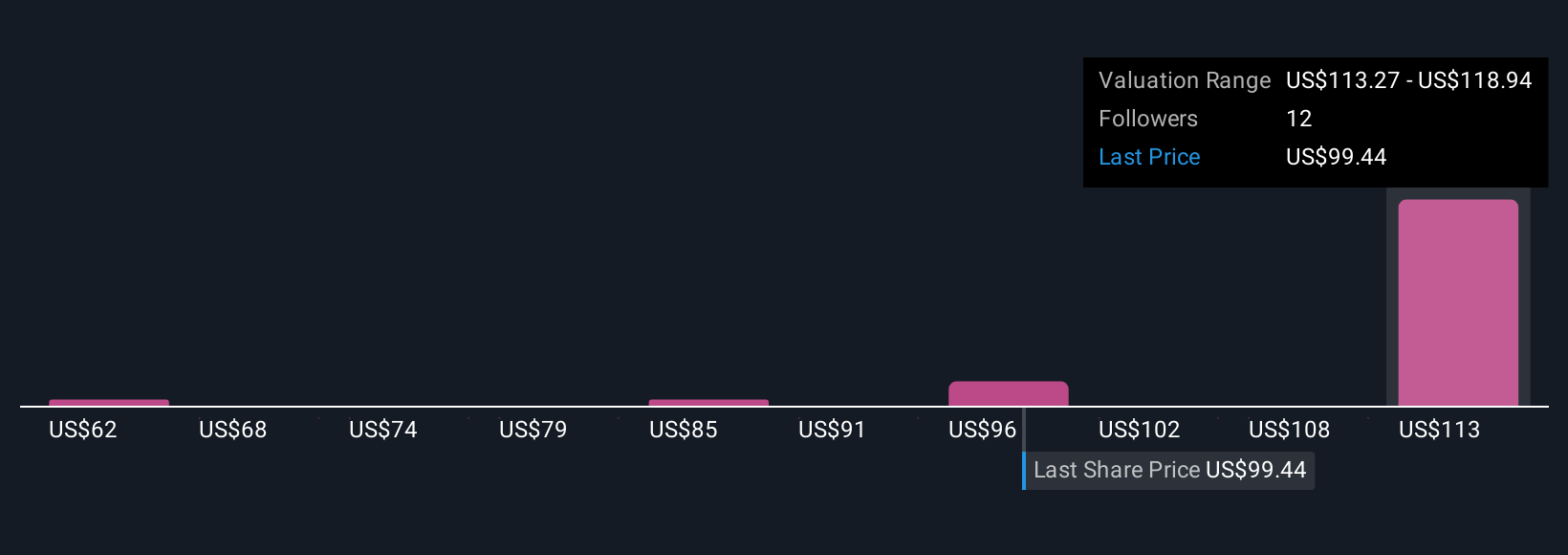

Uncover how BJ's Wholesale Club Holdings' forecasts yield a $115.63 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Eight Simply Wall St Community members placed fair value estimates for BJ’s between US$54.73 and US$144.70, illustrating wide-ranging outlooks. Rising operational and labor costs make cost management a key area to watch across all expectations for future performance.

Explore 8 other fair value estimates on BJ's Wholesale Club Holdings - why the stock might be worth as much as 61% more than the current price!

Build Your Own BJ's Wholesale Club Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BJ's Wholesale Club Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BJ's Wholesale Club Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives