- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

BJ’s Wholesale Club (BJ): Evaluating Valuation as Expansion and Community Initiatives Signal Growth Potential

Reviewed by Simply Wall St

BJ's Wholesale Club (NYSE:BJ) is opening its fifth Tennessee location in Sevierville, accompanied by a new on-site gas station this November. This expansion pairs retail growth with deeper community engagement and support initiatives.

See our latest analysis for BJ's Wholesale Club Holdings.

These latest openings come as BJ's Wholesale Club rides a steady wave of long-term performance, with a 9.75% total shareholder return over the last year and a striking 138.66% five-year total return. While the 6% year-to-date share price return shows momentum has cooled in the short run, recent expansion moves point to the company's focus on maintaining growth and strengthening its value proposition.

If you want to explore other retailers with exciting growth stories and leadership alignment, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near recent highs and continued expansion fueling optimistic forecasts, the question stands: Is BJ's Wholesale Club undervalued at today's levels, or has the market already factored in the next leg of its growth?

Most Popular Narrative: 19% Undervalued

With the narrative's fair value set at $115.63, which is well above the last closing price of $93.65, analysts are betting on continued growth, fueled by robust membership momentum and expanding digital engagement.

Accelerating membership growth, particularly in higher-tier memberships and underpenetrated secondary markets, is likely to boost recurring revenues and expand BJ's addressable market. This provides a strong base for future earnings growth. Expansion of BJ's physical footprint, with 25 to 30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage. This helps drive margin expansion.

What fuels this bullish outlook? It is not just expansion, but a bold set of financial forecasts and margin assumptions that paint a picture of future earnings strength. Want to see how recurring revenue, membership upgrades, and digital adoption combine to deliver this high fair value? Dive into the narrative and discover the key drivers behind the estimate.

Result: Fair Value of $115.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if ongoing macro uncertainty dampens consumer spending or if margin pressures from rising costs undermine BJ's earnings outlook.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another View: What Do Market Multiples Say?

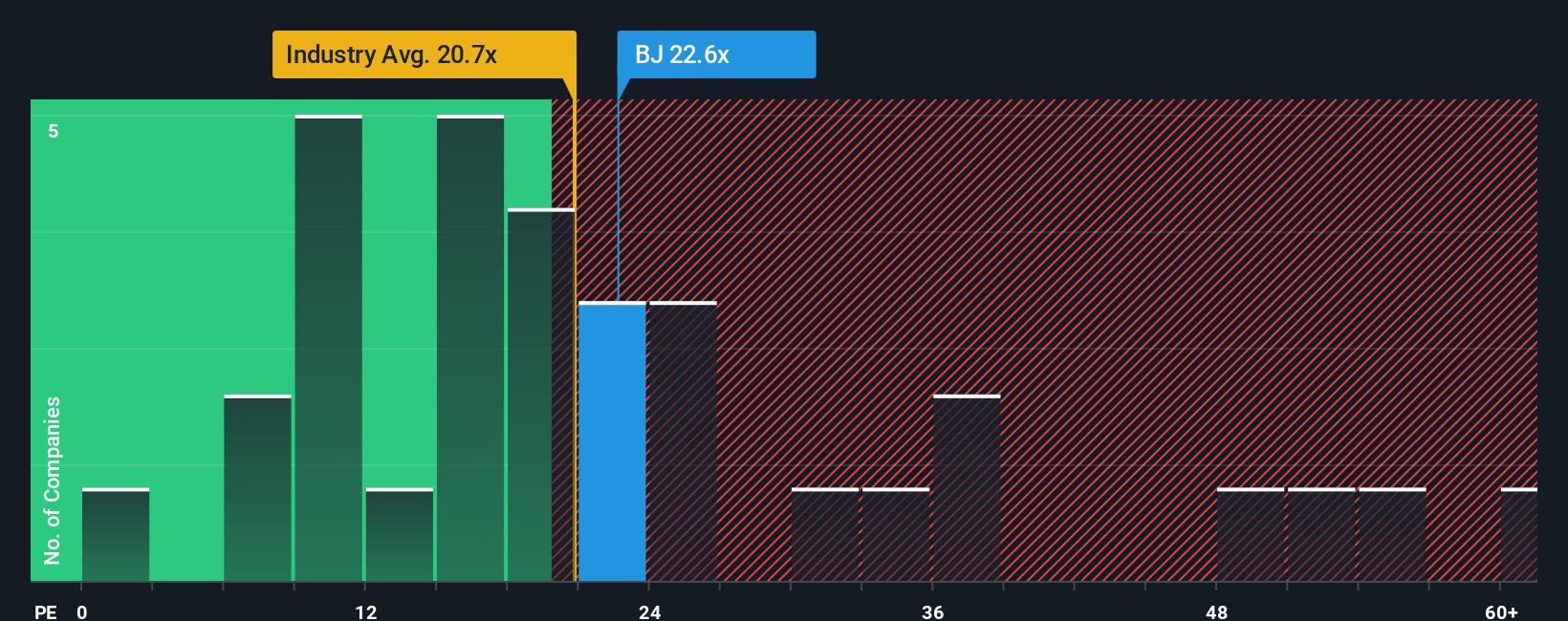

Looking at the stock through its price-to-earnings ratio, BJ's trades at 21.3x, which is higher than its peer average of 18.7x and the industry average of 20.6x. It also sits above its fair ratio of 19.1x. This suggests investors are paying a premium, raising questions about how much upside is left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you see things differently or want to follow your own investing logic, you can explore the data and build your own view in just a few minutes. Do it your way

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and take action before the next big trend takes off. The right stock could be just a click away, so do not let opportunity slip by.

- Uncover tomorrow’s market leaders by jumping into these 870 undervalued stocks based on cash flows, which delivers growth potential that current prices may not reflect.

- Target income for your portfolio by accessing these 19 dividend stocks with yields > 3%, filled with companies boasting reliable yields greater than 3%.

- Tap into groundbreaking breakthroughs and advancements by checking out these 80 cryptocurrency and blockchain stocks, featuring innovators in digital finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives