- United States

- /

- Food and Staples Retail

- /

- NYSE:ACI

How Investors Are Reacting To Albertsons Companies (ACI) Expanding Pharmacy Discounts Through Visory Health Partnership

Reviewed by Sasha Jovanovic

- Visory Health recently announced a new collaboration with Albertsons Companies to expand prescription medication discounts at Albertsons’ extensive network of pharmacy locations, addressing widespread affordability challenges for millions of Americans.

- This partnership not only supports healthcare access but also aligns with Albertsons’ broader health and wellness expansion in pharmacy services, further supported by the company’s recent US$1.5 billion in senior note debt refinancing to restructure its capital profile.

- Let’s explore how Albertsons’ partnership to improve pharmacy affordability could influence the company’s future growth and investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Albertsons Companies Investment Narrative Recap

To be a shareholder in Albertsons Companies, you’ll need to believe in the company’s ability to drive growth through health and wellness expansion, digital investments, and competitive pricing amid an ongoing push for efficiency in a tough grocery market. The new Visory Health partnership expands pharmacy access and could gradually enhance customer loyalty, but it does not materially shift the biggest near-term catalyst, digital and e-commerce growth, or solve the most immediate risk from rising labor costs and industry competition.

Among recent announcements, Albertsons’ US$1.5 billion senior note refinancing stands out as most relevant here, since it directly supports financial flexibility needed to fund growth initiatives like enhanced pharmacy offerings and digital upgrades. This added liquidity may equip Albertsons to focus more resources on its evolving health and wellness model, though near-term margin pressures from competition and union negotiations remain in focus.

However, investors should be aware that persistent upward pressure on labor expenses could still impact profitability if...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies' outlook anticipates $86.1 billion in revenue and $1.1 billion in earnings by 2028. This scenario implies a 2.1% annual revenue growth rate and a $145.7 million increase in earnings from the current $954.3 million level.

Uncover how Albertsons Companies' forecasts yield a $23.62 fair value, a 28% upside to its current price.

Exploring Other Perspectives

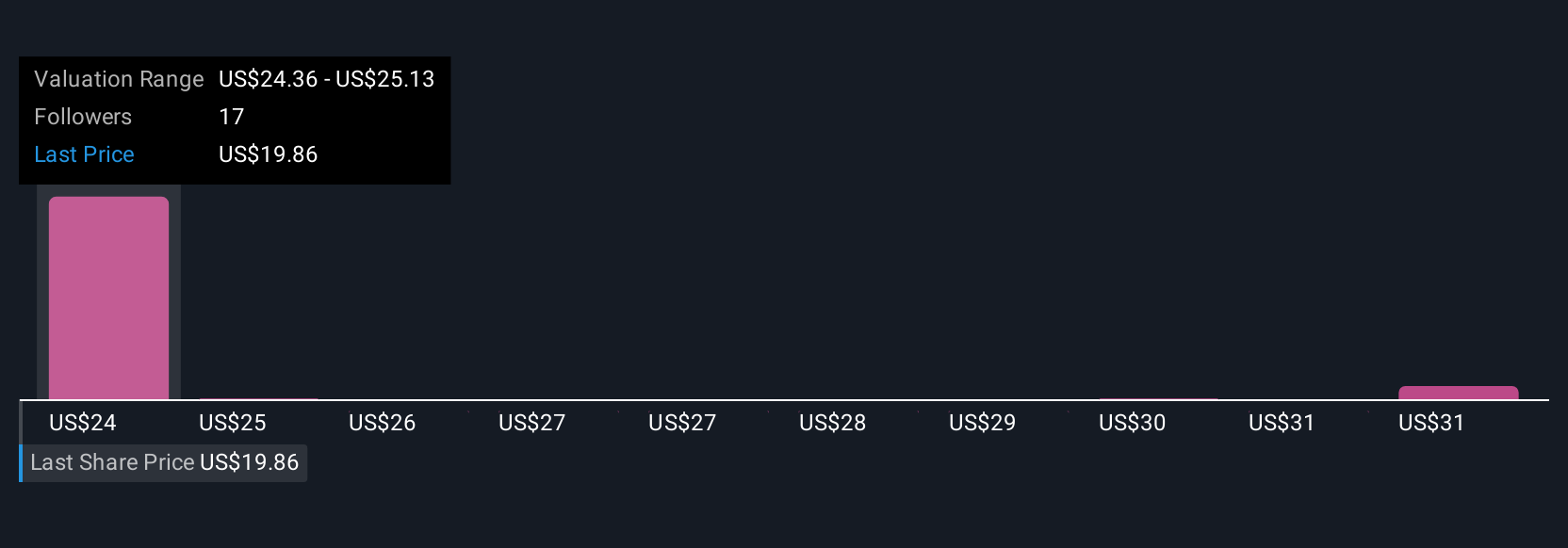

The Simply Wall St Community’s five fair value estimates for Albertsons range from US$19.77 to US$39.34 per share. While many see opportunity, ongoing cost pressures and shifting industry dynamics remain central to how future performance is viewed, explore a variety of opinions to shape your outlook.

Explore 5 other fair value estimates on Albertsons Companies - why the stock might be worth just $19.77!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

No Opportunity In Albertsons Companies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACI

Albertsons Companies

Through its subsidiaries, operates in the food and drug retail industry in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives