- United States

- /

- Food and Staples Retail

- /

- NYSE:ACI

How Albertsons Companies’ (ACI) $1.25 Billion Senior Notes Offering Has Altered Its Capital Allocation Story

Reviewed by Sasha Jovanovic

- Albertsons Companies announced in October 2025 that it plans to issue US$1.25 billion in new senior unsecured notes maturing in 2031 and 2034, with proceeds aimed at refinancing existing debt, repaying some credit borrowings, and covering related expenses.

- This move follows a series of positive shareholder return initiatives, including an increased buyback authorization, continued share repurchases, and updated earnings guidance, highlighting proactive capital management and ongoing focus on financial flexibility.

- We’ll examine how Albertsons’ refinancing with new senior notes could influence its investment case and capital allocation outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Albertsons Companies Investment Narrative Recap

To own Albertsons Companies shares, you need to believe the company can use its large store presence and loyalty ecosystem to deliver steady growth despite heavy competition and rising costs. The recent US$1.25 billion debt refinancing is designed to lower interest expense and extend maturity, but does not materially change the most important short-term catalyst, which is continued margin improvement through e-commerce and digital execution. The biggest risk remains elevated labor costs and contract negotiations, which could pressure margins if not managed well.

Albertsons recently increased its share buyback authorization to US$2.75 billion, underscoring its commitment to shareholder returns. While this move is relevant for capital allocation, persistent margin risks tied to wage growth and union agreements could influence future buyback capacity if costs climb faster than expected.

On the other hand, ongoing labor contract talks could still pose unanticipated cost pressures that investors should be aware of...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies is projected to achieve $86.1 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 2.1% and an earnings increase of about $146 million from current earnings of $954.3 million.

Uncover how Albertsons Companies' forecasts yield a $23.62 fair value, a 22% upside to its current price.

Exploring Other Perspectives

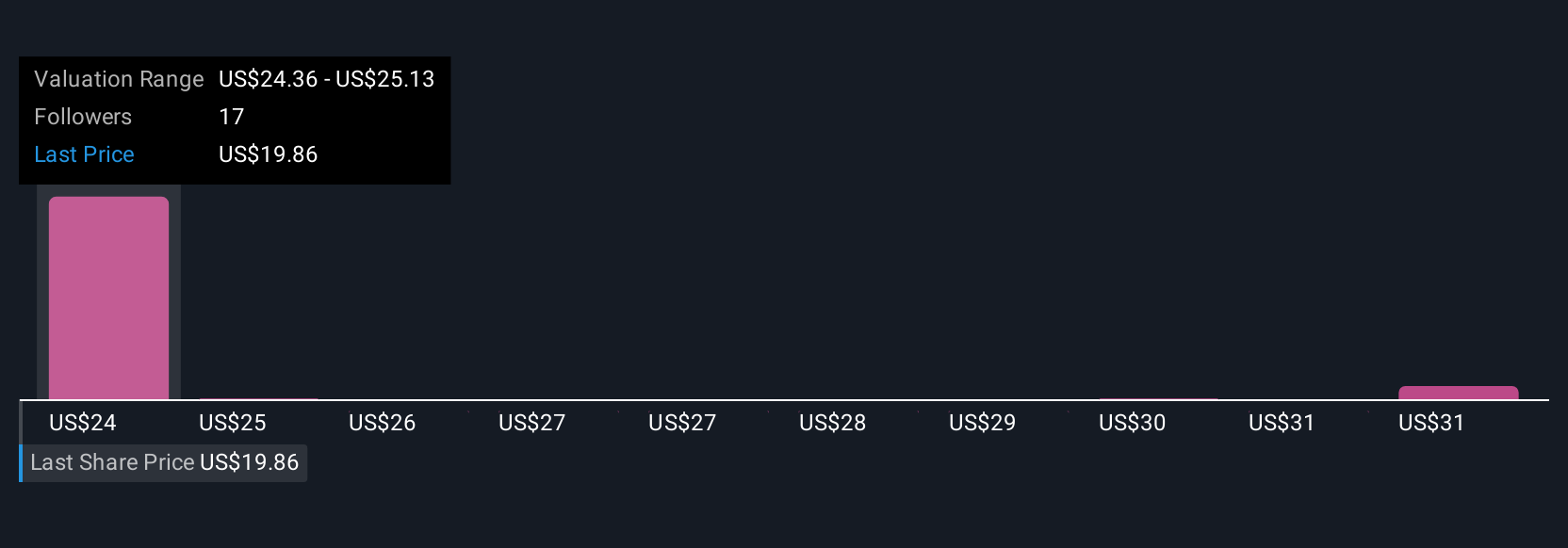

Five members of the Simply Wall St Community estimate Albertsons’ fair value between US$19.77 and US$40.07 per share. Despite broad agreement among professional analysts, elevated labor expenses remain top of mind and could weigh on future profitability, so compare views to see how different investors analyze these scenarios.

Explore 5 other fair value estimates on Albertsons Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACI

Albertsons Companies

Through its subsidiaries, operates in the food and drug retail industry in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives