- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:WMT

Is Walmart (WMT) Still Undervalued After Its Recent Share Price Rally?

Reviewed by Simply Wall St

Walmart (WMT) has quietly kept shareholders happy this year, with the stock up about 27% year to date and roughly 12% over the past 3 months, outpacing many big-box retail peers.

See our latest analysis for Walmart.

At around $114 per share, Walmart’s 1 month share price return of 13.67% and year to date share price return of 27.07% signal strengthening momentum, while its 5 year total shareholder return above 150% shows that long term holders have been well rewarded.

If Walmart’s steady climb has you thinking more broadly about resilient consumer names, you might also want to explore fast growing stocks with high insider ownership for other interesting ideas.

With shares hovering just below Wall Street targets and trading only slightly under some intrinsic value estimates, investors face a key question: Is Walmart still a bargain, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 4.3% Undervalued

With Walmart last closing at $114.36, the most widely followed narrative pegs fair value modestly higher at about $119, framing the stock as slightly mispriced rather than deeply discounted.

Expansion of high margin business streams Walmart Connect (advertising, up 31 46% globally), marketplace, and Walmart+ memberships (global advertising up 46%, membership income up 15%) is diversifying Walmart's income base beyond retail. This is gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Want to see why a mature retailer is being modeled more like a growth compounder? The narrative leans on expanding margins, disciplined buybacks, and a future earnings multiple usually reserved for market darlings. Curious which revenue streams and profit forecasts are doing the heavy lifting in that equation? Read on to unpack the full playbook behind this fair value call.

Result: Fair Value of $119 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained wage inflation and tougher online competition could squeeze margins, challenging assumptions about steady earnings growth and the premium valuation already reflected in the share price.

Find out about the key risks to this Walmart narrative.

Another View: Rich Multiples, Thin Margin of Safety

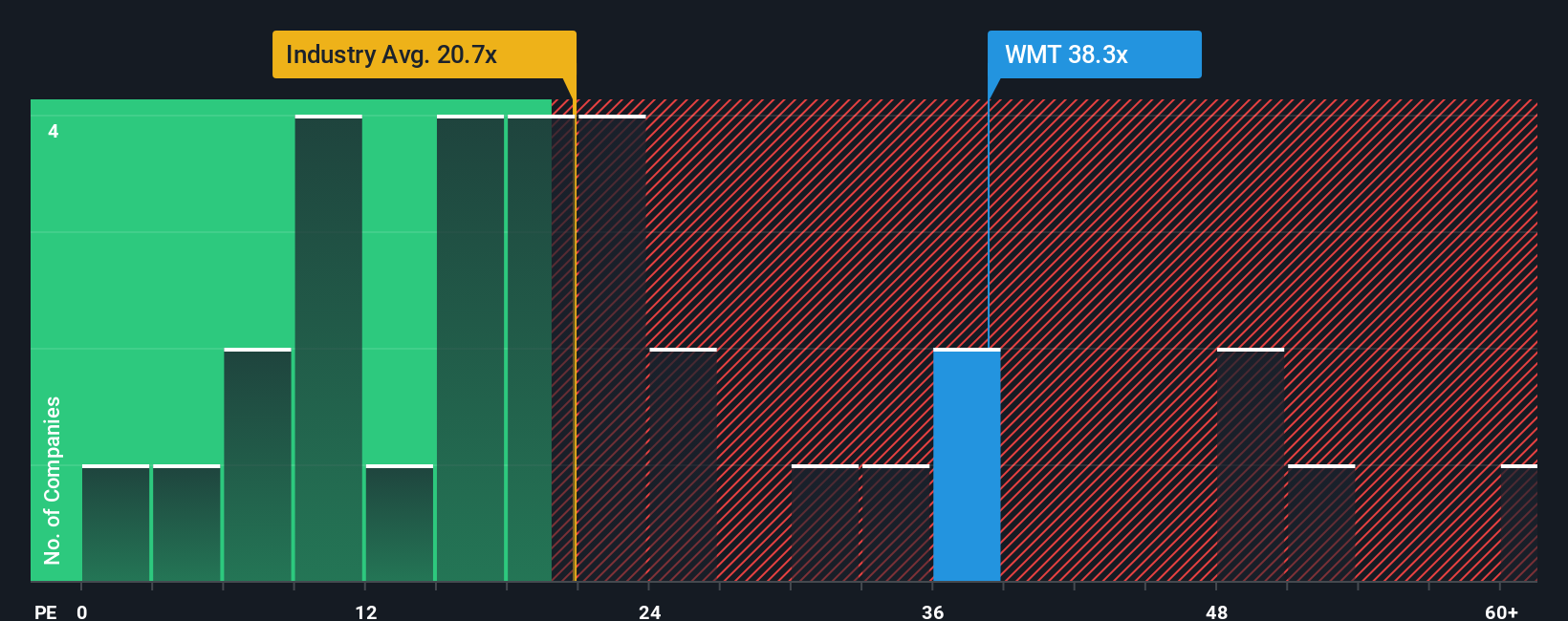

While the narrative and fair value work suggest Walmart is modestly undervalued, its 39.8x earnings multiple paints a tougher picture. That is well above the US consumer retailing industry at 21.8x, the peer average at 26x, and even our 36.9x fair ratio. This leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If you see things differently or prefer to dig into the numbers yourself, you can build a personalized view of Walmart in just minutes: Do it your way.

A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to sharpen your watchlist beyond Walmart? Use the Simply Wall St Screener to pinpoint fresh opportunities before the crowd catches on and the upside narrows.

- Capitalize on mispriced businesses by scanning these 913 undervalued stocks based on cash flows that show strong cash flow support for their current share prices.

- Ride powerful income trends by zeroing in on these 13 dividend stocks with yields > 3% that can boost your portfolio’s yield without abandoning quality.

- Position for the next wave of digital disruption with these 79 cryptocurrency and blockchain stocks that are building real businesses around blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion