- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:WBA

Walgreens Boots Alliance, Inc. (NasdaqGS:WBA) is an Attractive Dividend Opportunity After the Latest Pullback

Walgreens Boots Alliance , Inc. ( NasdaqGS:WBA ) recently came under the pressure, falling almost 16% within days.

Regardless of reporting strong earnings, this event shows that the market is not immune to Covid19 fears – this time quoting the falling vaccination numbers. Yet, given the results, buying this stock for the yield and a post-pandemic turnaround does make sense.

Looking Beyond Vaccinations

Walgreens reported stellar earnings , beating the estimates by US$530m with revenue of US$34.04b and earnings-per-share of US$1.27 (beat by 0.36). The revenue alone increased 12.1% year-over-year that provides for a strong turnaround story.

Looking beyond the vaccinations, WBA is investing heavily in automated micro-fulfillment centers, looking to bring the number up to 1,000 locations. Furthermore, by introducing the VillageMD clinics , they are in alignment with Biden's Administration, pursuing for cost-effective healthcare.

Last but not least, they are expanding into advertising in brick-and-mortar stores and introducing debit and credit cards .

Going Ex-Dividend Within a Month

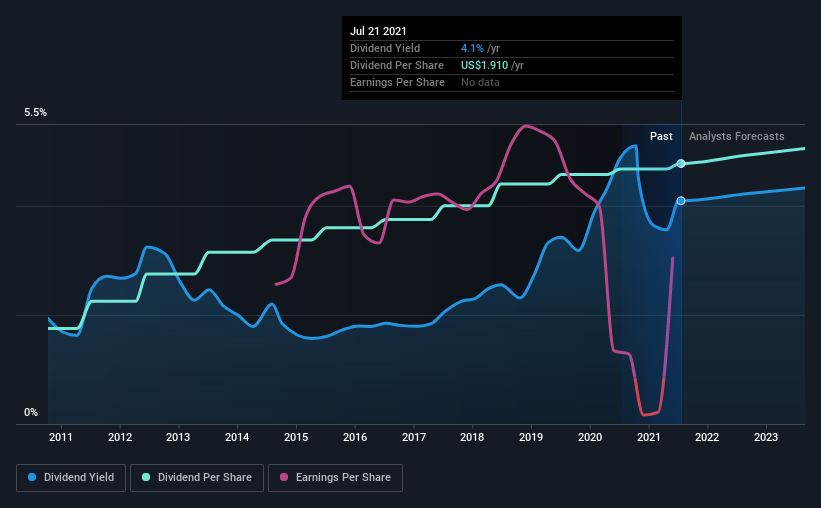

Could Walgreens Boots Alliance be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting dividends. Walgreens is currently yielding 4.1% and going Ex-Dividend on August 19th.

A high yield and a long history of paying dividends is an appealing combination for Walgreens Boots Alliance.We'd guess that plenty of investors have purchased it for the income.The company also bought back stock during the year, equivalent to approximately 0.7% of the company's market capitalization at the time.Some simple research can evaluate the risk of buying Walgreens Boots Alliance for its dividend.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation.In the last year, Walgreens Boots Alliance paid out 72% of its profit as dividends.A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

Another important check is to see if the free cash flow generated is sufficient.The free cash flow it generated last year, Walgreens Boots Alliance paid out 34% as dividends, suggesting the dividend is affordable.It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Walgreens Boots Alliance every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point in buying a stock if its dividend is regularly cut or is not reliable.During the last decade, the dividend has been stable, which could imply the business could have relatively consistent earnings power.During the past 10-year period, the first annual payment was US$0.7 in 2011, compared to US$1.9 last year.This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice to grow earnings per share (EPS). This is essential to maintaining the dividend's purchasing power over the long term.Over the past five years, it looks as though Walgreens Boots Alliance's EPS have declined at around 2.3% a year.If earnings continue to decline, the dividend may come under pressure. Every investor should assess whether the company is taking steps to stabilize the situation.

Conclusion

When we look at a dividend stock, we need to judge whether the dividend will grow, if the company can maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable.First, we think Walgreens Boots Alliance has an acceptable payout ratio, and its dividend is well covered by cash flow.It's not great to see earnings per share shrinking, but the company seems to be turning around after a crash of 2020.

The yield itself (4.1%) outperforms the industry (1.6%), so as long as the company remains reasonably valued, it provides an opportunity for yield-seeking investors.

Investors generally tend to favor companies with a consistent, stable dividend policy instead of operating an irregular one.Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Walgreens Boots Alliance that investors should know about before committing capital to this stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Valuation is complex, but we're here to simplify it.

Discover if Walgreens Boots Alliance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:WBA

Walgreens Boots Alliance

Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success