- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Stock Slides 20% in 2025 Is There Value in the Recent Drop

Reviewed by Bailey Pemberton

Thinking about what to do with your Sprouts Farmers Market shares, or mulling over whether to finally buy in? You're not alone. Over the past few months, Sprouts has been one of those stocks that keep popping up in investor discussions, with its price swinging noticeably. After a roaring multiyear run, up a remarkable 458% over the last five years and 258% in three, things have cooled off lately. In just the past week, the stock slipped by 5%, extending a 3% drop over the past month and a year-to-date tumble of more than 20%.

A lot of this movement comes as Wall Street reassesses grocery stocks in light of shifts in consumer trends and high-profile mergers in the space. Most recently, industry chatter has centered around heightened competition from both traditional players and upscale grocery chains, which has driven investors to scrutinize Sprouts’ unique format and growth prospects more closely. This broader market mood helps explain the changing risk perception around the company, even as Sprouts maintains its focus on fresh, healthier food and strategic expansion.

So, is Sprouts undervalued right now? Based on our valuation scorecard, the company scores a 3 out of 6 for undervaluation. That means it checked the boxes in half the key areas typically used to find a bargain, not bad, but not a slam-dunk either. Of course, the way we assess valuation can make all the difference. Next, we will break down those classic valuation lenses and, before we finish, explore a more insightful approach for understanding the real value story here.

Why Sprouts Farmers Market is lagging behind its peers

Approach 1: Sprouts Farmers Market Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach is a well-established method for valuing businesses. It works by projecting a company’s future cash flows and then discounting them back to today’s value. This process gives investors an estimate of what the business is really worth right now based on expected performance.

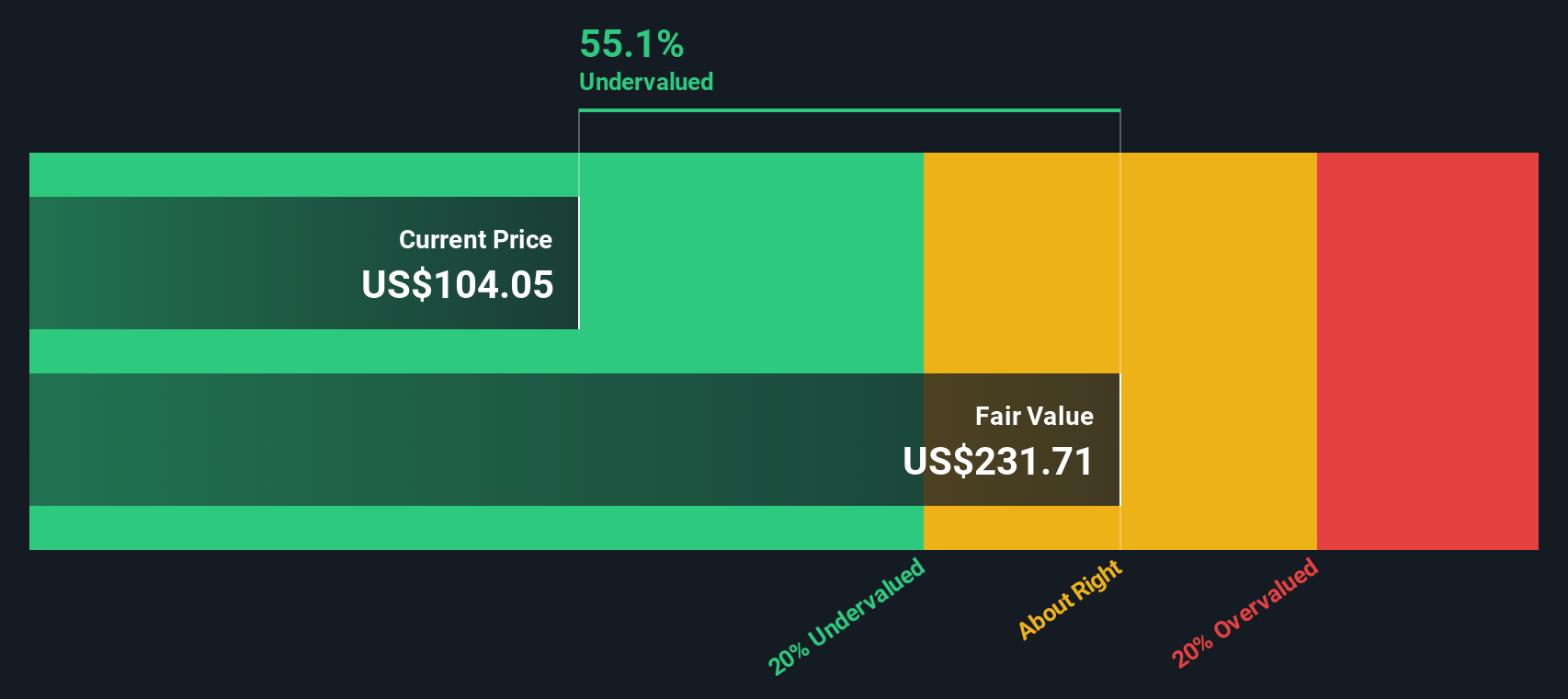

For Sprouts Farmers Market, the most recent twelve-month Free Cash Flow is $499.6 Million. Analysts forecast growth in annual Free Cash Flow over the next several years, with projections reaching about $898.2 Million in 2029. After five years, further estimates are extrapolated by Simply Wall St, indicating a steady upward trend in cash generation into the next decade.

According to these cash flow projections, the estimated fair value of Sprouts Farmers Market shares is $225.79. This figure suggests the stock is trading at a 52.9% discount to its intrinsic value, which may indicate shares are significantly undervalued based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sprouts Farmers Market is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sprouts Farmers Market Price vs Earnings

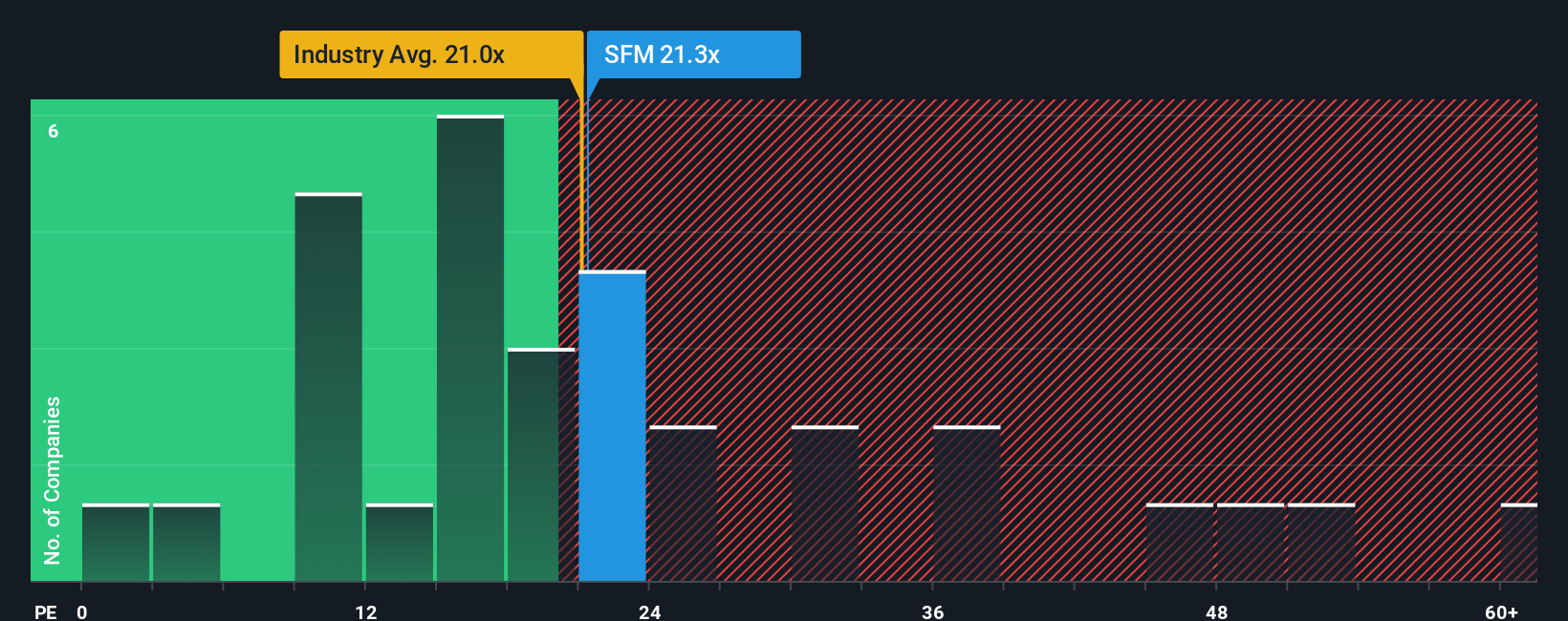

Price-to-Earnings (PE) is the go-to valuation tool for profitable companies like Sprouts Farmers Market, because it links what investors are paying to the company’s actual profit. For businesses that consistently generate earnings, PE ratios allow for straightforward comparisons to peers, the wider industry, and historical norms.

However, what counts as a “normal” or “fair” PE ratio depends on expectations for future growth and how risky investors consider the business compared to others. Higher growth prospects or less perceived risk often justify a higher ratio. In contrast, slower growth or greater uncertainty tend to pull ratios lower.

Sprouts currently trades at a PE of 21.4x. That is slightly above both the Consumer Retailing industry average of 20.6x and its peer group average of 20.6x. To really gauge fair value, we use the Simply Wall St Fair Ratio, which integrates not just industry context but also the company’s profit margins, growth outlook, risk factors, and market size. For Sprouts, the Fair Ratio comes in at 20.6x.

Because the actual PE and the Fair Ratio are nearly identical, our analysis suggests Sprouts Farmers Market stock is valued about right on this measure, even after considering its above-average performance and changing growth outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sprouts Farmers Market Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a more powerful investing tool that connects a company’s story to your financial forecast and then directly to a personalized fair value. Narratives let you frame your own perspective on Sprouts Farmers Market by considering not just the numbers, but also the underlying drivers like future revenue, profit margins, and market opportunities, all in one interactive view. Available to millions of investors through the Simply Wall St Community page, Narratives make it easy to see how your take stacks up; you can quickly compare your estimate of fair value to the current share price and decide if you think Sprouts is a buy or a sell. Because Narratives update dynamically with every new company announcement or earnings report, your view always reflects the latest facts. For example, some investors believe Sprouts’ growth-focused strategy and expanding organic market justify a high fair value, while others are more cautious, focusing on risks from fierce competition and setting much lower fair value targets. This means you can easily spot if your outlook differs from the crowd and ensure every decision is based on a story you believe in, not just a single metric.

Do you think there's more to the story for Sprouts Farmers Market? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives