- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Farmers Market (SFM): Exploring Current Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Sprouts Farmers Market (SFM) stock has been catching some attention as investors look for signals amid shifting trends in the grocery sector. The company’s performance over the past month highlights ongoing volatility in the retail space.

See our latest analysis for Sprouts Farmers Market.

After a tough run recently, Sprouts Farmers Market has seen its momentum shift sharply to the downside, with the share price down 29% over the past month and 41.9% year-to-date. While this short-term volatility stands out, long-term investors still sit on a robust 281.6% five-year total shareholder return. This highlights how quickly sentiment can swing, even for companies with strong track records.

If you’re rethinking your watchlist after these dramatic moves, it may be the perfect time to explore fast growing stocks with high insider ownership.

With shares now trading nearly 24 percent below the average analyst price target and the fundamentals showing consistent growth, the real question is whether Sprouts Farmers Market is undervalued or if the market has already considered all potential upside.

Most Popular Narrative: 56.8% Undervalued

Sprouts Farmers Market's widely followed narrative sets its fair value substantially above the last close, signaling meaningful upside versus current trading levels.

Expansion into underpenetrated regions, particularly the Midwest, Mid-Atlantic, and Northeast, combined with the pipeline of 130+ new locations and robust new store performance, is expected to meaningfully increase Sprouts' addressable market and overall revenue base over the next several years.

This narrative hinges on aggressive store rollout plans and a surge in new markets. Want to uncover the assumptions powering this bold fair value? The full narrative reveals the growth metrics and margin forecasts that analysts believe could radically reshape Sprouts' financial landscape. Don't miss the details that could change your investment perspective.

Result: Fair Value of $178.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, healthy food trends alone may not shield Sprouts, as intensifying competition and rising supply chain costs could challenge its optimistic growth outlook.

Find out about the key risks to this Sprouts Farmers Market narrative.

Another View: What Do Market Ratios Say?

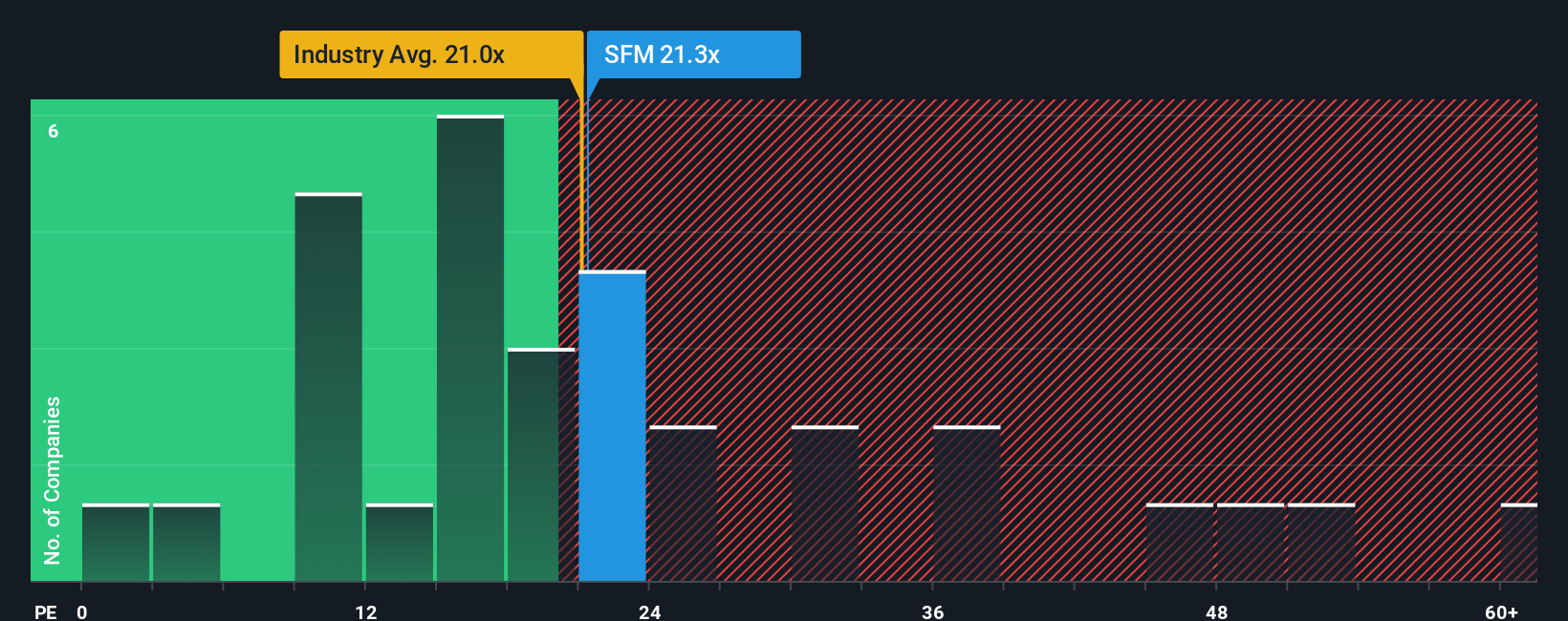

Looking at valuation through market ratios paints a different picture. Sprouts' price-to-earnings ratio of 21.1x is above both the industry average (20.4x) and the peer group (20.3x), and just above its fair ratio of 20.6x. This suggests the market prices in some added risk or less upside here. But does this mean investors are overpaying for potential growth, or is the market expecting more profitability ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sprouts Farmers Market Narrative

If you see things differently or want to dive into the data on your own terms, you can quickly build your own narrative in just a few minutes. Do it your way

A great starting point for your Sprouts Farmers Market research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors do not stop at just one idea. Take control of your financial future by putting your capital to work in stocks with unique potential built on deep analysis.

- Tap into emerging megatrends and spot future leaders by searching through these 26 AI penny stocks, which are transforming artificial intelligence.

- Unlock stable income and growth with these 22 dividend stocks with yields > 3%, which reward shareholders and have yields over 3 percent.

- Seize undervalued gems before the market catches on by targeting these 854 undervalued stocks based on cash flows, fueled by strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives